Markets

What to know:

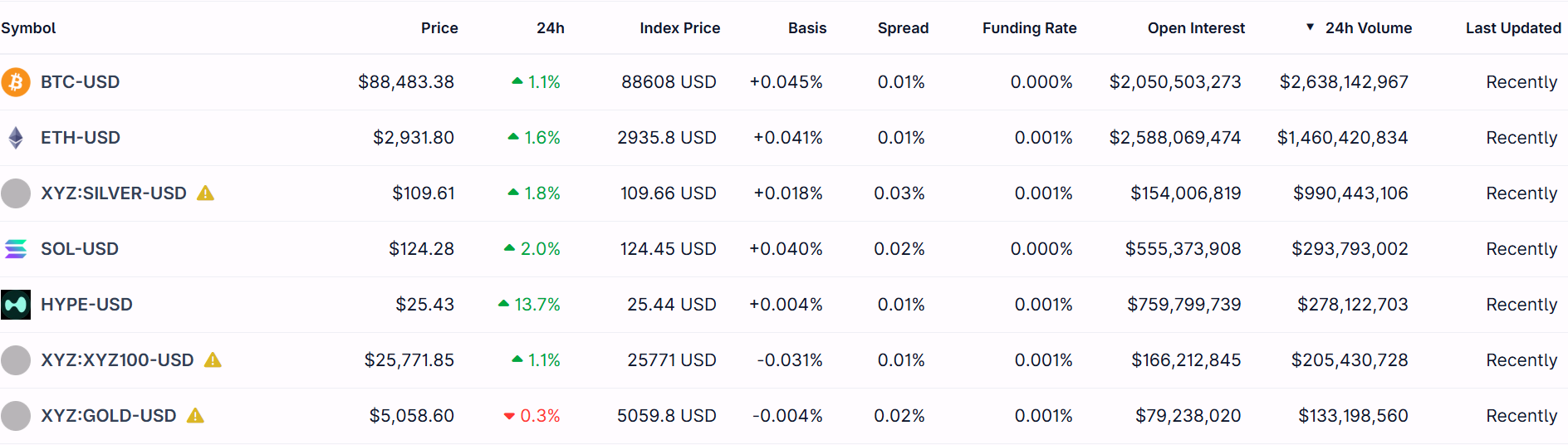

- Silver futures on the Hyperliquid crypto derivatives exchange have become busier than a bee in spring, ranking just behind the ever-glamorous bitcoin and ether in trading volume. Yes, apparently silver is the new hotshot in crypto-land, surprising everyone except maybe those who’ve always thought silver was shiny and overlooked in favor of Bitcoin’s rock-star reputation.

- The SILVER-USDC contract’s sky-high volume, substantial open interest, and slightly negative funding all suggest traders aren’t exactly betting on silver to hit the moon but rather using crypto infrastructure like a hedge trimmer on a hedge fund’s hedge fund-volatile, cautious, and confused, but still busy.

- Meanwhile, Bitcoin is cozying up near $88,000, hanging out in what some fancy folks are calling a “defensive equilibrium.” With ETF inflows cooling off, derivatives showing mixed signals, and traders eager to buy insurance rather than bags of bitcoin, it’s clear that the crypto giant is just playing it safe-like a cautious cat eyeing a puddle.

Silver has stolen the show on Hyperliquid, quietly whispering that crypto derivatives venues are turning into a playground for macro trades rather than just speculative antics. It’s like silver, normally the reliable but dull cousin at family parties, is suddenly the life of the crypto ball, outsizing sums of Bitcoin and Ethereum in the trading frenzy.

The SILVER-USDC contract is trading at around $110 during Asia’s morning coffee break, boasting roughly a cool $994 million in volume over 24 hours-definitely not small potatoes, more like a medium-sized farm. Open interest stands at a hearty $154.5 million, while negative funding hints at a market that’s more about hedges than moonshots. It’s the kind of market where everyone looks busy but no one is betting the farm-more like carefully counting the flock.

And it’s not just that silver’s price is doing its subtle dance, but it’s holding a prominent spot-only slightly behind Bitcoin and Ethereum in trading volume, according to CoinGecko, and confidently leaving other altcoins like SOL and XRP in the dust. Who knew silver could be the crypto equivalent of a dark horse, or perhaps a shiny surprise?

When a commodity contract can rival the volume of major crypto assets on a decentralized exchange, you start to realize that traders are using crypto plumbing like a Swiss Army knife-shifting from the traditional Bitcoin and Ethereum playbooks to macroeconomic whodunits, hedging their bets on everything from inflation to geopolitical intrigue.

This backdrop helps explain why Bitcoin itself is taking a leisurely stroll around $88,000-stuck in what some might call a “defensive stance,” with recent data from Glassnode showing sellers hitting bids more than buyers bidding up prices. It’s the crypto version of “wait and see,” while ETF flows die down and traders hedge rather than chase.

Options skew rising and open interest easing say it all: traders are more interested in protecting against the downside than going all-in on the upside. Bitcoin is like that guy at the party who’s still there but has put on sunglasses-spectator mode, waiting for better days while others gamble recklessly around him. Meanwhile, Ether remains a bit sluggish, like a sluggish cat that’s lost interest in jumping up on the furniture.

So, what’s the takeaway? Bitcoin isn’t being forgotten but rather kept on the sidelines-a bit like an experienced boxer waiting for the perfect punch. And the unexpected rise in silver trading on Hyperliquid? Well, that’s the market’s not-so-subtle way of saying, “Hey, we’re uncertain, and we’re hedging our bets on anything shiny and macro.”

Market Movement

BTC: Bitcoin is lazily hovering around $88,000, like a cat on a sunny windowsill-calm on the surface but packed with energy just waiting for a reason to jump.

ETH: Ether is lounging at around $2,300, quite the laggard compared to Bitcoin, as traders remain cautious and risk-averse-more ‘watch and wait’ than ‘buy and fly.’

Gold: Gold is having one of those “look at me” moments, up about 15% in a month, more than 50% in six months, as everyone rushes to the safe-haven buffet-proof that macro stress isn’t going anywhere, and crypto’s just trying to keep up.

Nikkei 225: Japan’s stock index is playing it safe, hovering near flat, even as U.S.-threatened tariffs keep South Korean auto stocks dancing and regional markets confused, like a dog chasing cars-mostly chaos, little direction.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

2026-01-27 05:31