Good heavens, silver’s in a spot of bother! Extreme valuation signals are flashing like a débutante’s tiara at a midnight ball, and the poor dear looks utterly stretched. One simply can’t ignore the risk of a sharp reversion, even after its recent little tantrum.

Silver’s Price Strength? Darling, It’s All Smoke and Mirrors!

That clever chap, Bloomberg Intelligence’s Mike McGlone, took to the social media platform X (formerly known as Twitter, but do keep up!) on Jan. 31 to deliver a prognosis as bleak as a rainy Tuesday in November. He warns that silver’s valuation is as precarious as a tightrope walker in a gale, leaving it vulnerable to a reversion so painful it’d make one long for a dentist’s chair.

“Copper can direct silver’s silliness back toward $60,” McGlone quipped, with all the wit of a Coward quip. He insists that intermetal comparisons are the only way to navigate this madness, as nominal levels are about as reliable as a society hostess’s promises. He added:

“If silver drops to $60 an ounce and copper remains as steady as a butler’s hand, the former could still be the most overpriced trinket since the Taj Mahal.”

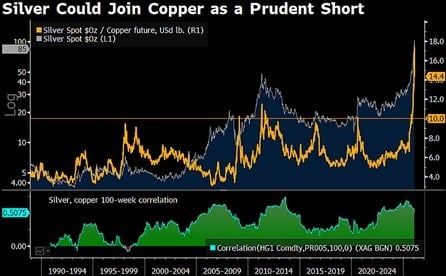

The man’s chart, darling, is a masterpiece of clarity. It shows the silver-to-copper ratio perched higher than a socialite’s hat at Ascot, despite recent volatility. A sharp decline, he insists, would scarcely bring it to fair value when compared to copper’s stoic pricing profile.

The chart, my dear, is a scandal! The ratio hovers above historical peaks like a balloon at a children’s party, even after easing from extremes that approached 19 pounds of copper per ounce of silver. A reference level near 10 is highlighted, while the current reading lingers in the mid-teens-utterly stretched on a logarithmic scale that spans more commodity cycles than one’s had hot dinners. And the 100-week silver-copper correlation? A mere 0.51, darling, signaling a relationship as tenuous as a society marriage.

Silver, poor thing, already suffered a collapse on Jan. 30 that was as dramatic as a diva’s fainting spell. It plummeted over 31% in a single session-its worst performance since 1980. The culprit? President Donald Trump’s nomination of Kevin Warsh as Fed Chair, which sent the dollar and Treasury yields soaring like a soprano’s high note. Prices, which had peaked above $120, crashed toward $84, eventually stabilizing near $78-$80 as forced liquidations and a 36% hike in CME margin requirements crushed its parabolic rally. Quite the spectacle, really.

McGlone, ever the sage, further explained:

“Since 1988, 10 has marked peaks in the silver/copper ratio, with an average of six. Silver above $100 an ounce may be joining the ‘prudent-short’ category, much like a third glass of champagne at lunch.”

Copper, with its industrial demand tied to manufacturing, infrastructure, and electrification, acts as a stabilizing anchor-rather like a dowager at a debutante ball. Silver’s investment-driven volatility, amplified by momentum and monetary expectations, leaves it as vulnerable as a gossip columnist’s reputation. Even a retreat toward $60 would be mere normalization, not capitulation, with relative pricing still as elevated as a society matron’s hat.

FAQ ⏰

- Why does the silver-copper ratio matter, darling?

It highlights relative valuation extremes, signaling when silver is as overextended as a socialite’s credit. - What downside risk did McGlone highlight for silver?

He warned it could fall toward $60 and still be as expensive as a bespoke suit from Savile Row. - How elevated is the current silver-copper ratio?

It’s in the mid-teens, darling, well above the long-term average and historical peaks-simply outrageous! - Why is copper used as a benchmark against silver?

Copper’s industrial demand provides a steadier pricing anchor, unlike silver’s investment-driven volatility, which is as unpredictable as a Coward plot twist.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

2026-02-01 04:17