In the vast and often tumultuous sea of cryptocurrencies, Solana (SOL) stands out once more, drawing the gaze of the weary and the hopeful alike. The air is thick with the scent of institutional money and on-chain activity, both of which are buzzing with an almost palpable energy. The newly minted Solana staking ETF has already set records, and the price of SOL seems to be clinging to a lifeline around the $175 to $180 mark, like a stubborn sailor refusing to let go of his ship’s wheel during a storm. 🌪️

Solana ETF Sees Record Demand

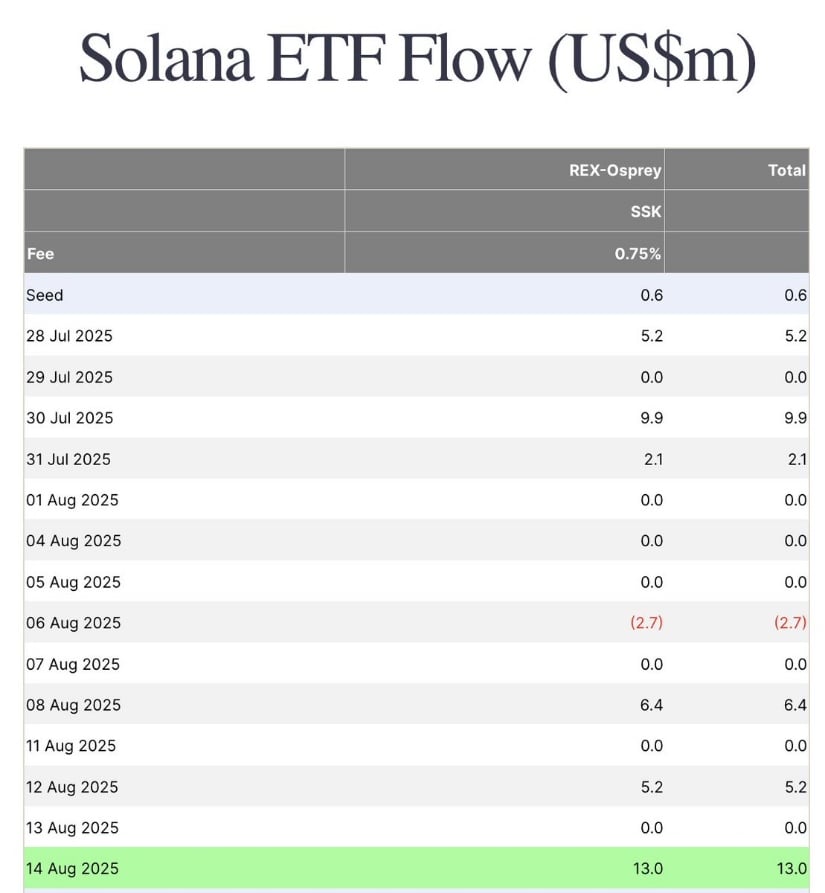

The U.S. Solana staking ETF ($SSK) has had its finest hour, recording a staggering $13 million in fresh inflows and a volume that would make any trader’s heart skip a beat-over $60 million in a single day. This is no small feat; it’s the kind of trading activity that whispers of a new era, where Solana is not just a player but a contender in the regulated financial world. 🏆

Each dip in the market seems to bring more inflows, a sign that the appetite for Solana as a regulated product is growing like a weed after rain. It’s a testament to the resilience of this blockchain, a story of survival and adaptation in a world where only the strong survive. 💪

The ETF’s success mirrors Solana’s broader market performance, a network that continues to attract liquidity and recognition. The strong volume inflows not only validate the ETF’s positioning but also hint at a shift in investor behavior-a move towards a more sophisticated and regulated way of engaging with Solana. 📈

Solana Technical Structure Holds Firm

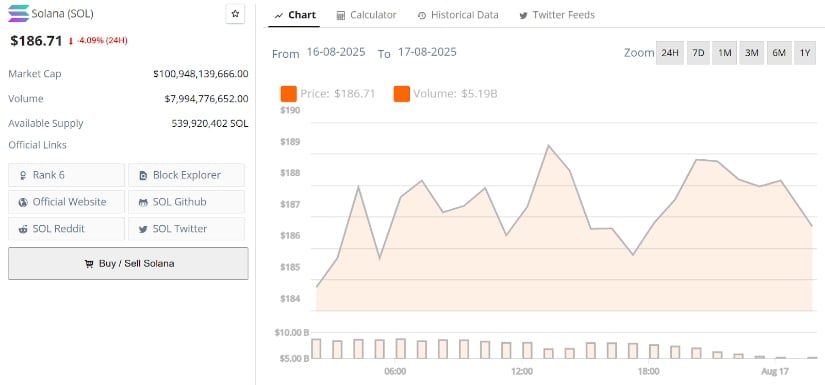

Solana has managed to hold its ground above the $175 demand zone, a clean bounce that speaks volumes about the strength of the buyers. The chart, courtesy of Skull, shows a clear defense of this level, a testament to the network’s ability to accumulate even in the face of adversity. As long as this zone holds, the higher-low structure remains intact, keeping the broader uptrend alive. 🛡️

The $175 to $180 range is now a critical pivot, a point of no return for many market participants. A breakout above $180 would be the key, a signal that the recent consolidation is over and that fresh highs are within reach. The momentum indicators are aligned, suggesting that Solana still has room to grow after a period of cooling off. 🚀

Solana Fundamentals Show Strong Growth

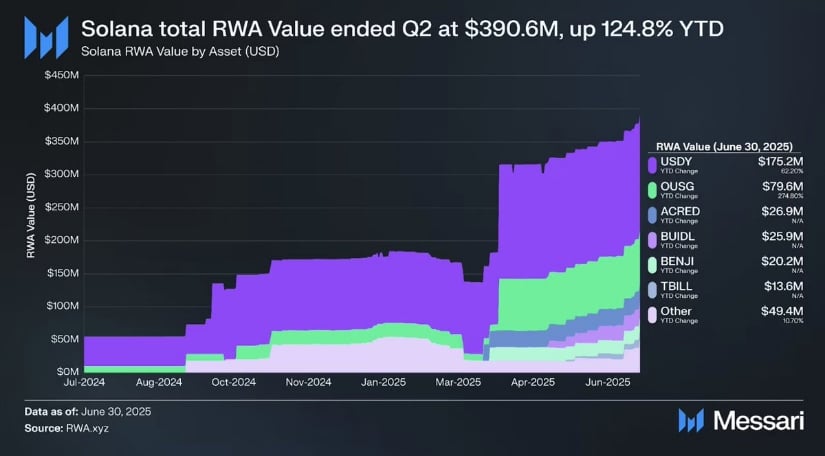

But it’s not just the ETF inflows and technical momentum that are driving Solana forward. The core fundamentals of the network are also showing significant traction. Messari’s Q2 report is a beacon of hope, highlighting a 30.4% jump in DeFi TVL and a 211% surge in app revenue capture ratio. The total Real-World Asset (RWA) value on Solana has climbed to nearly $391M, a clear indication that the network is being used to tokenize and secure real-world assets. 🌐

This aligns with Solana’s vision of not just being a high-performance blockchain but an infrastructure layer capable of supporting scalable, revenue-generating applications. With on-chain adoption and protocol upgrades moving in sync, Solana is entering the next phase of growth, backed by both technical resilience and a broader utility base. 🌱

Solana Technical Outlook: Key Levels in Focus

Analyst Lennaert Snyder offers a glimmer of insight, noting that Solana is showing resilience despite its recent pullback. The $184 zone is now attempting to flip from resistance into support, a crucial test for the bulls. The broader structure remains bullish as long as the $175 level holds, making it a critical anchor for sustaining the uptrend. Snyder emphasizes that reclaiming the $205.54 resistance would be a decisive trigger, setting the stage for a potential rally. 🎯

The chart outlines a series of horizontal levels acting as resistance and take-profit zones. If momentum follows through, the next upside targets lie in the $250 to $260 region, where prior supply clusters converge with Fibonacci extensions. It’s a tantalizing prospect, one that could redefine Solana’s place in the crypto landscape. 🌟

Final Thoughts: Can Solana Extend the Breakout?

Solana’s current narrative is one of resilience, backed by momentum on multiple fronts. ETF inflows are surging, technical structures remain intact above the $175 to $180 zone, and fundamentals such as DeFi growth and real-world asset adoption are showing impressive progress. This mix of regulated demand and on-chain strength suggests that Solana isn’t just riding short-term hype; it’s positioning for a much larger move if buyers can sustain the pressure. 🚀

A clean flip of $184 into support and a decisive reclaim of the $205.54 resistance could shift sentiment toward a stronger continuation phase. Should momentum align, the $250 to $260 region comes into focus as the next logical target range. It’s a story of perseverance and potential, a tale that continues to unfold in the ever-changing world of cryptocurrency. 🌐💡

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin’s Big Breakout: Fed Cuts, Crypto Cash, and a Million BTC Heist 🚀

- USD CNY PREDICTION

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

2025-08-17 00:39