Solana… SOL, they call it. Currently lounging around $162.5, though the market, as always, seems to have a mischievous glint in its eye. A volatility of 5.6%—a gentle tremor, really, for those of us accustomed to the earth-shattering quakes of modern finance. Market cap? A rather substantial $87.43 billion. Quite a pile of digits, isn’t it? Though digits, naturally, can be rearranged to tell any tale.

It dipped, naturally. For the fifth day running, a descent of 4% bringing it to $166.23, and now teetering where it is. Down 16% from Monday’s momentary ambition of $182. Spooked, they say, by America’s latest economic murmurings. As if the market truly cares for the plight of payrolls.

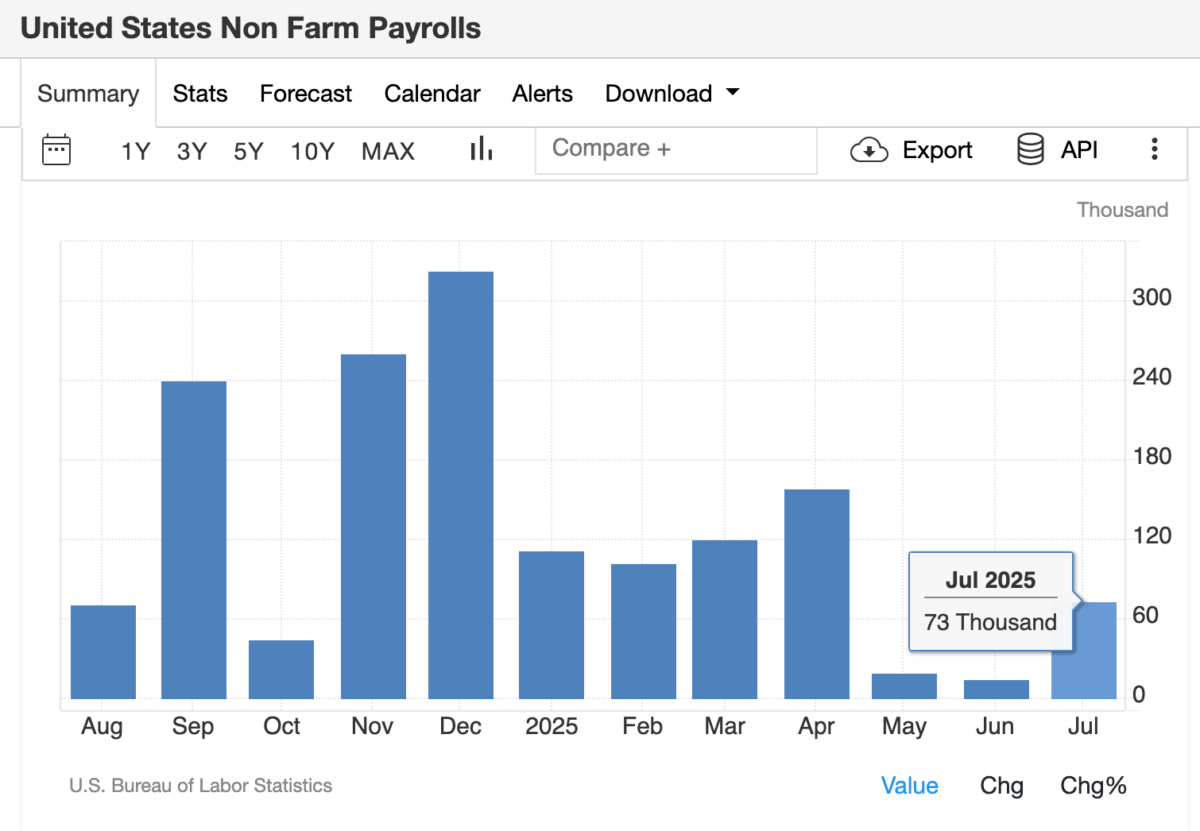

US Non-Farm Payrolls | TradingEconomics, August 1, 2025. A chart. Because everything needs a chart these days. A visual reassurance of… something.

Ah, the jobs data. A mere 73,000 added – a paltry sum in the grand scheme of things. Revised downwards too, those earlier figures. A subtle rewriting of history. The Fed, no doubt, will ponder this… or simply do whatever it was planning to do all along. Such is the nature of power.

But Solana’s innards, its very soul, remain robust, they claim. A staggering $87 million in network revenue in July. Tenth month running, apparently. Leading the pack. Ethereum trails, a respectable $55 million, and Bitcoin’s DeFi offerings… a mere $16 million. A triumph, perhaps? Or simply a demonstration of where the current whims of the crowd lie? 🤷♀️

These fees, of course, trickle down to those who hold the keys – the validators and stakers. A delightful incentive, wouldn’t you agree? And the SEC, ever vigilant, has approved staking for crypto ETFs. Institutions circling, sniffing for a piece of the $87 million pie. One can almost smell the money. 🤑

Solana on top 🔥

— SOL Strategies (@solstrategies_) August 1, 2025

SOL Strategies, a firm with a substantial SOL treasury, applauds. Such endorsements are, shall we say, commonplace. Will others follow? Will the capital flow? One can only observe, with a detached amusement. It’s all a game, after all.

SOL Price Alert: $160—A Line in the Sand?

Technically speaking, Solana’s recent stumble has taken it below the 20-day EMA ($179.41). A break in momentum, they say. The Bollinger Bands, stretching between $157.43 and $201.39, look on with indifferent precision. And the MACD? Shifting, crossing… a complex dance of indicators.

Solana price forecast | SOLUSD 24H | TradingView, August 1, 2025. More lines. More colors. More attempts to predict the unpredictable.

The $160 level is the current bulwark. If it falls, $150 looms. A rather serious drop. But perhaps… perhaps there will be a rebound. Sentiment stabilising, equities finding their footing. A familiar story. A cycle of hope and disappointment.

In short, Solana’s long-term promise remains, obscured by the immediacy of market fluctuations. Hold $160, they advise. A simple directive in a world of infinite complexity. A world, it seems, desperately seeking order in chaos. 🧐

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-08-02 03:45