Behold the curious case of SLNH: a modest microcap with aspirations grander than Ivan the Terrible’s beard. 🧔♂️ Boasting a pipeline of over 1 GW, Soluna Holdings whispers sweet nothings to the ears of Bitcoin miners and AI enthusiasts alike. Could this be the birth of the next IREN? Or merely another fleeting comet in the cryptoverse? 🌠

Amidst the cacophony of Bitcoin miners pivoting to AI, Soluna has emerged like a moth drawn to a halogen bulb. 🔍 The argument? A microcap with a pipeline that could power a small nation (> 1 GW), building green data centers, and a $100 million credit facility for Project Kati – their renewable-powered magnum opus. But let us not indulge in speculative theatrics just yet. 🎭

Some see Soluna as the understudy to IREN or CIFR, waiting in the wings for the market to recognize its potential. But let us not be seduced by shallow musings. Does the hype hold water? Or is it merely a mirage in the desert of financial speculation? 🌵

Let us descend into the labyrinth of facts.

Soluna’s Infrastructure: A Colossus in the Making?

Soluna Holdings, a U.S.-based developer of modular green data centers, positions itself as the Prometheus of renewable energy, bringing compute power to the masses. 🔋 Their claim? A clean energy pipeline of 2.8 GW, with 1.023 GW earmarked for near-to-mid-term development. This places them in the same league as Bitfarms – albeit with a market cap that, until recently, was a mere fraction. A David among Goliaths, perhaps? 🐦

Project Kati, Soluna’s pièce de résistance, is a two-phase, 166 MW buildout. The first phase, Kati 1 (83 MW), began construction in September 2025, with 48 MW leased to Galaxy Digital and the remainder reserved for Bitcoin hosting. 🏗️ The second phase, Kati 2, aims to cater to AI and high-performance computing workloads – a move that could elevate Soluna to the pantheon of infrastructure providers. 🏛️

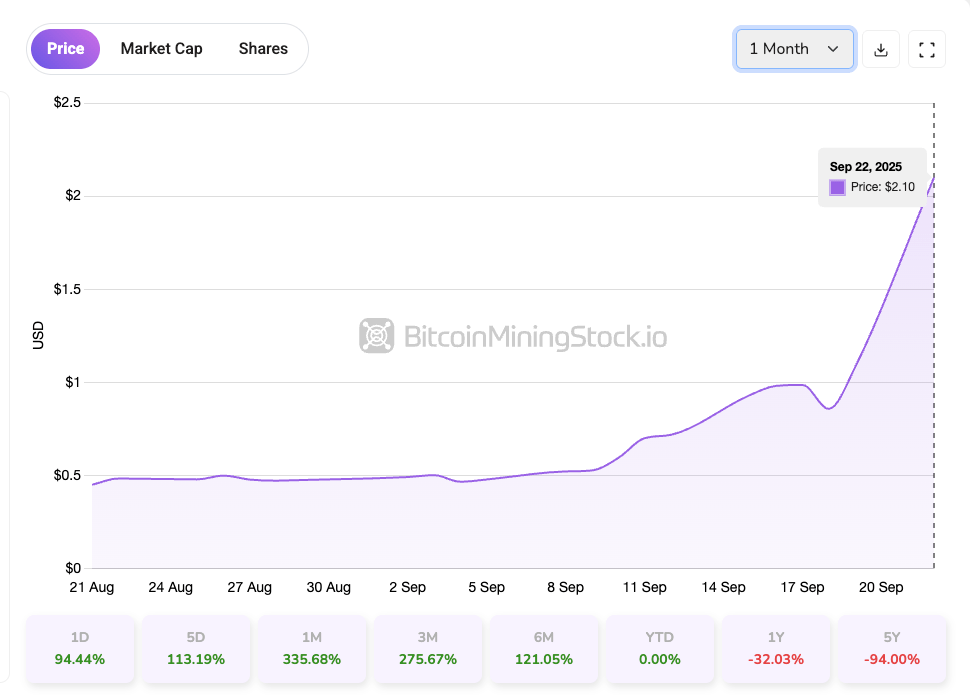

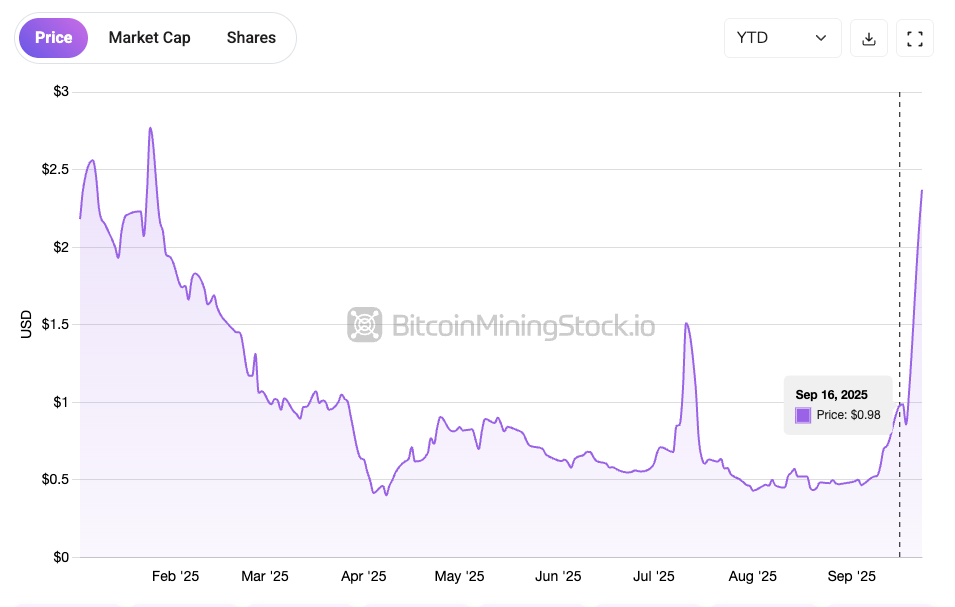

The market, with its fickle heart, has begun to price in Soluna’s ambitions, particularly after the $100 million credit facility announcement. 💰

The $100 Million Credit Facility: A Double-Edged Sword

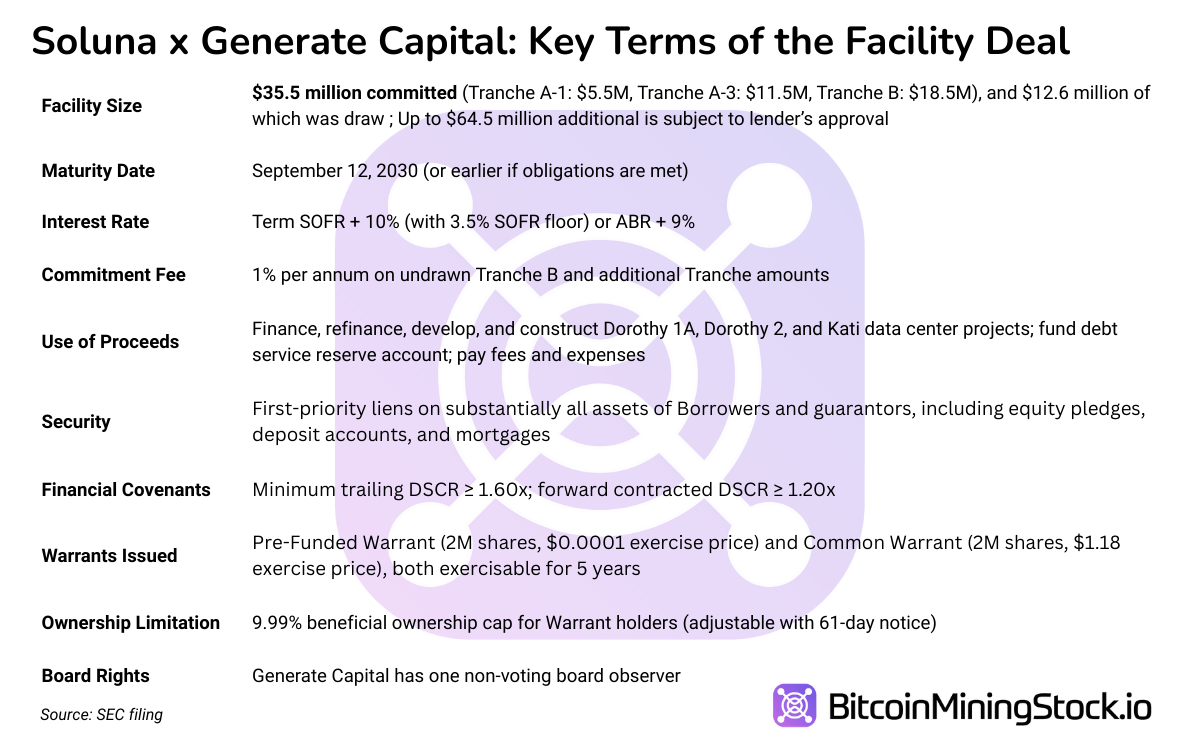

In September 2025, Soluna secured a $100 million credit facility from Generate Capital, a lender with a penchant for sustainable infrastructure. 🌱 For a company with $6.15 million in quarterly revenue and $9.85 million in unrestricted cash, this is akin to a pauper winning the lottery. 🎰 But the devil, as always, is in the details.

Of the total, $35.5 million is currently committed, with the remaining $64.5 million subject to Generate’s discretion. The interest rate? A princely SOFR + 10%, with a minimum SOFR floor of 3.50%. 🏰 On top of that, Soluna pays a 1% annual fee on unused funds. A classic case of “damned if you do, damned if you don’t.” 🤦♂️

The funds are ring-fenced for Dorothy 1A, Dorothy 2, and Project Kati, with Generate holding first claim over the borrowing entities’ equity, assets, cash accounts, and real estate. 🏴☠️ Soluna must also maintain a trailing debt service coverage ratio (DSCR) of at least 1.60x and a forward contracted DSCR of at least 1.20x. A tightrope walk over a financial abyss, no less. 🎪

Generate also received equity-linked incentives in the form of warrants, adding a layer of dilution risk. 📉 In short, this deal is a high-leverage enabler for Soluna, but one misstep could spell disaster. 💀

Final Thoughts

Soluna’s ascent hinges on its ability to execute. Best case: it follows the path of IREN or CORZ, scaling into a legitimate HPC infrastructure player. 🏆 Worst case: tight covenants and high debt costs choke the company before its projects mature. ☠️

Speculation swirls around potential JVs or M&A, with the CEO hinting at inbound interest from hyperscale miners, power plant owners, and infrastructure funds. 🎤 But for now, the 94% spike reflects investor enthusiasm. What comes next will depend on execution. ⏳

Soluna has entered a high-stakes phase. The credit facility buys it time, not certainty. 🕰️

For now, the stage is set. Let the drama unfold. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Silver Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: Will It Hit $120K? 🚀

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- XRP: A Most Lamentable Fall! 📉

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

2025-09-29 07:58