Bitcoin, that ever-fluctuating jewel of the digital realm, finds itself in a curious state of rest, perhaps not unlike a horse preparing to gallop after a long, weary journey. Following the dramatic crash of October 10, the market has resumed its chaotic dance, with the bulls-those optimistic creatures-nudging the price back above the sacred resistance levels. It is as though the spirit of the market has been reignited, its former glory revived as it approaches the mystical $115K region. The close of the month looms, and traders whisper amongst themselves of potential momentum shifts, as though they’ve been gifted a glimpse of the future.

Ah, but dear reader, is this not always the case? The calm before the storm, the lull in the air before the tempest of change-such patterns have preceded many grand moves before. Data points and liquidity indicators, like quiet sentinels in the dark, suggest that capital, abundant and idle, sits patiently on the sidelines, awaiting the signal to spring into action. And so, we wait-holding our breath for the inevitable rise.

Indeed, if Bitcoin-blessed creature that it is-manages to surge past its previous all-time high, many analysts predict a new surge, an impulsive rise akin to those glorious upward movements seen after past bull cycles. The funding rates, as serene as a summer morning, suggest that leverage remains moderate-ah, the quiet before the storm! It is a sign that any rally we may see could, just might, be a steady and sustainable one.

As we continue to watch this marvel unfold, the liquidity near key resistance zones signals a swift reaction should the breakout occur. With volatility compressing and the market recovering from recent turmoil, Bitcoin readies itself for the next grand move. A bull market may well be waiting in the wings, its magnificent arrival heralded by the readiness of liquidity and sentiment. All it takes is the right moment-and the right catalyst.

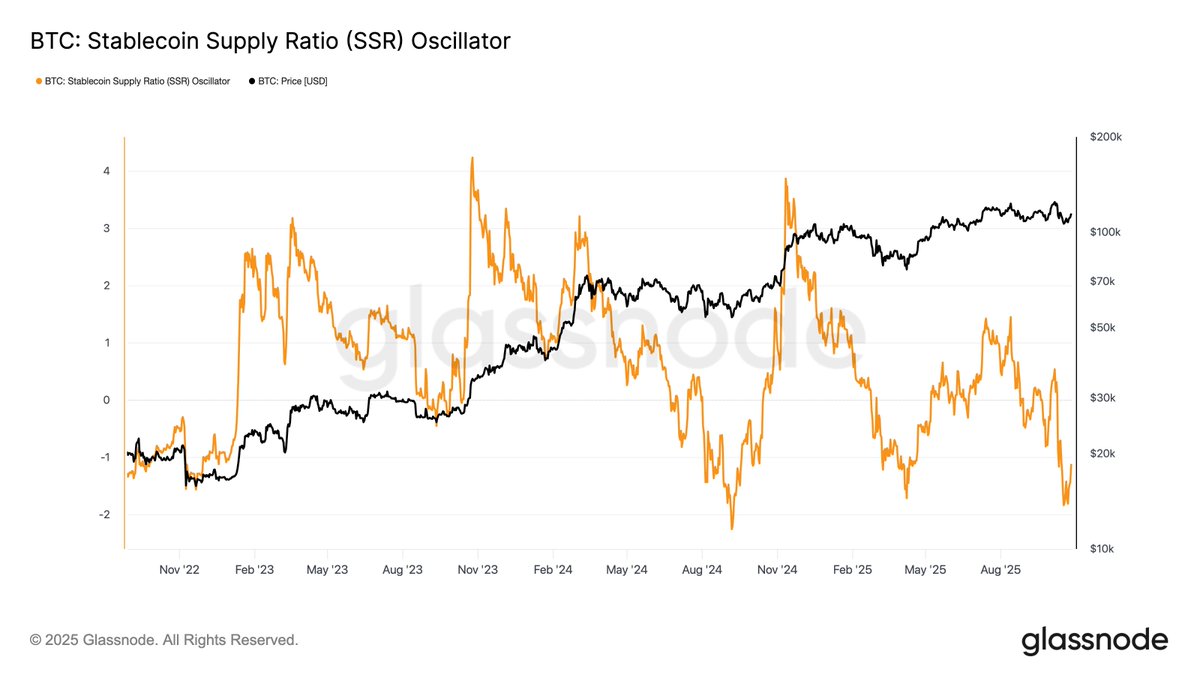

Bitcoin Liquidity Builds as Stablecoin Supply Ratio Hits Cycle Lows

Let us turn, dear reader, to the ever-so-intriguing Stablecoin Supply Ratio (SSR) Oscillator, which has found itself near its cycle lows. What does this mean, you ask? Well, in layman’s terms, there exists a bounty of stablecoin liquidity just waiting to re-enter the market and propel Bitcoin into new heights. Picture, if you will, a vault full of treasure-waiting for the opportune moment to be unlocked and scattered across the marketplace.

In times past, this condition has often signaled a coming bull run-stablecoins, those silent sentinels of digital wealth, simply waiting for the market to regain its confidence. Once the storm passes and trust returns, these reserves typically flood back into risk assets, such as Bitcoin and Ethereum, sparking a wave of momentum that carries the market upward. The current state of affairs may well be a sign of things to come.

Bitcoin, at this very moment, is trading just above the $115K mark, still recovering from the October 10 chaos that left the market gasping for breath. Yet, the underlying structure remains healthy. Stablecoins, now a significant portion of crypto liquidity, stand ready to push Bitcoin higher once conviction returns. It is as though the stage has been set, the actors waiting in the wings, and we-oh, how we wait-for the curtain to rise.

Analysts, those ever-curious souls, see this as a latent bullish signal, a whisper of what may come-a macro setup reminiscent of past expansions. Should Bitcoin stabilize and rise, the ample liquidity in stablecoins may well act as the match that ignites the next big rally. History, it seems, is about to repeat itself. But perhaps this time, the storm will be a bit more exciting, and a bit more profitable.

BTC Retests Resistance as Bulls Regain Control

And so it is that Bitcoin, ever the resilient creature, continues its recovery, now trading around the $115,300 mark. A strong rebound from the $108K region earlier this month has given the bulls reason to hope. The 12-hour chart, that sacred document of the market’s soul, reveals a clear upward structure-one that hints at higher levels ahead. The $117,500 resistance level looms large, like a forbidding mountain pass, challenging the bulls to prove their mettle.

Bitcoin, for the moment, rests comfortably above both the 50-day and 100-day moving averages-a sure sign that short-term strength is returning. The 200-day moving average, that ever-watchful guardian, has turned into a solid support base around $113K. Should Bitcoin break above $117.5K, a surge to $120K-$123K could be on the horizon-an impulse move, driven by renewed investor confidence. But alas, volatility is always lurking just around the corner. A rejection at this level could see a return to the $111K range, keeping the consolidation alive.

Nevertheless, the technical structure is constructively bullish. If Bitcoin manages to close above $117.5K with strong volume, we may well be witnessing the end of the post-crash stagnation-a new leg higher, driven by improving liquidity and sentiment. And so, dear reader, we wait, as the market readies itself for what could be a most spectacular show.

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-10-28 04:26