Markets

What ho, old sport! Here’s the lowdown:

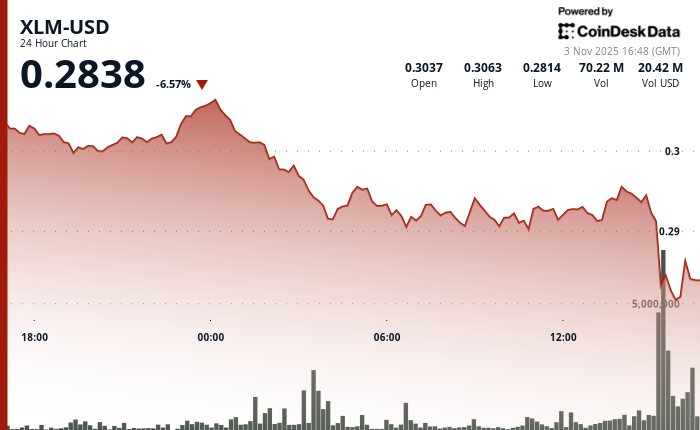

- Stellar, that plucky little number, bounced back from a $0.277 dip after a spot of heavy liquidation, proving it’s as resilient as a Jeeves under fire. 🧢💪

- Volume surged 887% during the kerfuffle, like a chap who’s had one too many at the Drones Club, before settling down. A sign of short-term sanity, what? 🥂📉

- XLM’s facing resistance at $0.3014, mind you, with consolidation near $0.281. It’s all a bit of a balancing act, like Bertie Wooster trying to juggle aunts and amorous intentions. 🎭⚖️

Stellar (XLM), the old bean, sprang back to $0.285 on Tuesday after a bit of a sell-off, with trading volumes 11.18% above the 30-day average. Smart contract activity surged 700%, which is more exciting than finding a forgotten tenner in your trousers. 💼🚀

Despite the rebound, XLM underperformed the broader crypto market by 2.10%, rather like Bertie Wooster at a brain teaser. Network-specific headwinds, old boy, even as sector sentiment perked up. Traders, those clever chaps, pointed to Stellar’s $5.4 billion real-world asset tokenization milestone as proof of its mettle, though the muted relative strength suggests buyers are more cautious than a cat in a room full of rocking chairs. 🐱🪑

A brief capitulation between 15:27 and 15:31 UTC saw XLM plunge 5.5% from $0.293 to $0.277, with volume spiking to 12.8 million shares per minute. Support held firm at $0.277, sparking a sharp rebound toward $0.285 as buyers piled in like hungry chaps at a free buffet. 🍴💥

Technically speaking, Stellar’s facing resistance at $0.3014 after failing to hold $0.2900 support. Current consolidation near $0.281 suggests a delicate balance between bulls and bears, rather like a game of cricket where no one’s quite sure who’s winning. 🏏🤷♂️

Key Technical Levels: A Mixed Bag of Tricks 🎩✨

Support & Resistance

- Support: Critical support at $0.277, as solid as a Jeeves in a crisis. 🛡️

- Resistance: Strong resistance at $0.3014, like Aunt Agatha’s disapproval. 🚫

- Range: Consolidating between $0.281 – $0.285, a bit of a tight spot, eh? 🧵

Volume Analysis

- 24-hour volume 11.18% above the 30-day average, showing some backbone. 📈

- Breakdown phase: Volume spiked to 259.3M shares (+887% vs. SMA), like a sudden rush to the bar at the Drones Club. 🍸

- Stabilization: Volume normalized below 4M shares, indicating reduced volatility-phew! 😌

Chart Patterns

- Decisive break below ascending trendline support during capitulation, rather like losing one’s hat in a stiff breeze. 🧢💨

- 24-hour range: $0.0287 (9.4%) from $0.3038 high to $0.2817 low, a bit of a rollercoaster, what? 🎢

- Stabilization: Price steadying after rebound attempts from $0.277 low, like Bertie Wooster finding his feet after a spot of trouble. 👞

Targets & Risk/Reward

- Immediate resistance: $0.2900 (former support), a bit of a hurdle, old bean. 🏇

- Upside target: $0.3014, contingent on sustained momentum-fingers crossed! 🤞

- Downside risk: Retest of $0.277 support if consolidation fails, like dropping the buttered side down. 🧈

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- AAVE: Oh, the Drama!📉

- Brent Oil Forecast

- EUR HKD PREDICTION

2025-11-03 21:05