Ah, the ballet of blockchain, where Tether, that enigmatic issuer of the world’s most voluminous stablecoin (USDT), has pirouetted into the spotlight once more. With a flourish worthy of a grand maestro, it has acquired 8,888 Bitcoins-a number so charmingly arbitrary, one suspects it was chosen by a Ouija board rather than a financial strategist. Valued at a cool $1 billion, this transaction is less a mere purchase and more a theatrical declaration of intent, a digital *touche* to the skeptics and a wink to the crypto cognoscenti. 🧐

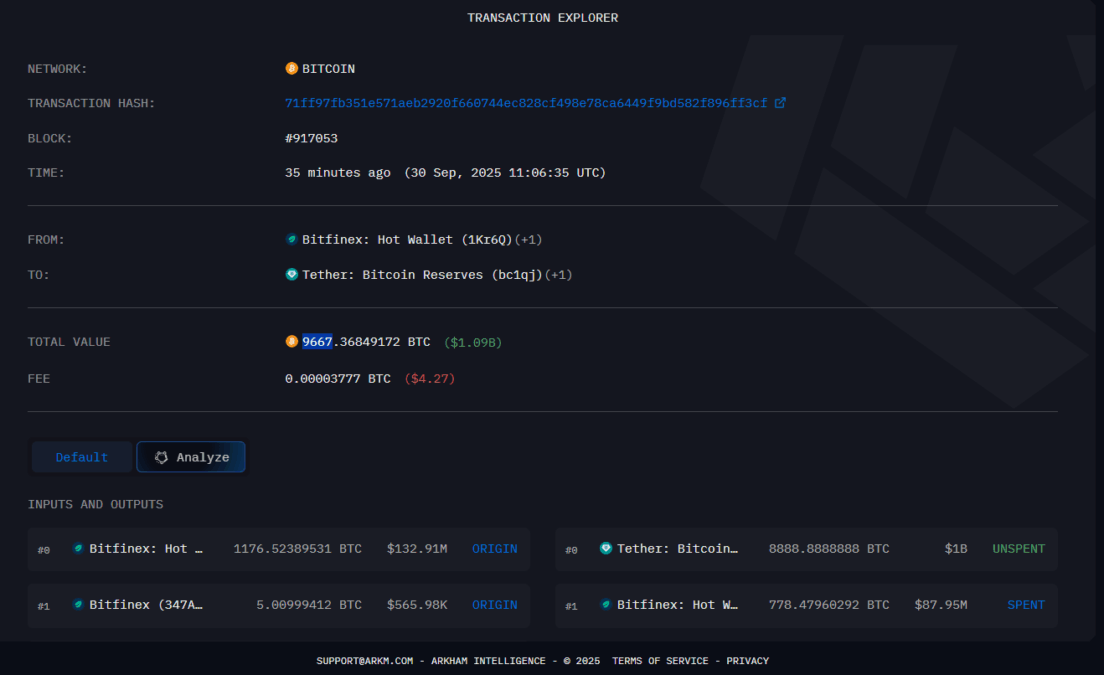

The on-chain transaction, a transparent tapestry of ones and zeros, reveals the coins waltzing from a Bitfinex exchange wallet directly to Tether’s reserve address. A move so audacious, so *public*, it could only be the work of a company that thrives on both opacity and spectacle. Arkham’s blockchain explorer, that modern-day oracle, duly noted the transaction hash, ensuring the world could marvel at this financial pas de deux. 🕵️♂️

This acquisition, my dear reader, is no mere accumulation of digital trinkets. It is a strategic gambit, a chess move by a player who has long mastered the art of the game. Tether, ever the shrewd operator, seeks to bolster its Bitcoin holdings, aligning itself with the growing institutional infatuation with cryptocurrency as a store of value. Or, as the cynics might whisper, a hedge against the inevitable unraveling of fiat folly. 🤡

A Peek into the Vault: Tether’s Reserve Composition

Let us, for a moment, delve into the arcane details of Tether’s reserves, as revealed in its most recent attestation report. A document so dry, it could double as a desert survival guide. 🏜️

- Cash & Cash Equivalents: 79.94% – The bedrock of stability, or so they say.

- Secured Loans: 6.24% – Because who doesn’t love a bit of leverage?

- Bitcoin: 5.49% – A modest flirtation, until now.

- Precious Metals: 5.37% – For when the apocalypse arrives in style.

- Other Investments: 2.96% – The financial equivalent of “miscellaneous.”

With this $1 billion Bitcoin bonanza, Tether’s allocation to the digital gold is set to swell, like a financier’s ego at a gala. The next quarterly report promises to be a page-turner, though one suspects it will be read by fewer people than a Nabokov novel. 📈

This move, my astute observer, is a dual-edged sword. On one side, Tether embraces Bitcoin as both a growth vehicle and an inflation hedge, a nod to the crypto faithful. On the other, it clings to the safety blanket of highly liquid assets like U.S. Treasury Bills, ensuring the USDT peg remains as stable as a Swiss watch-or so the narrative goes. 🛡️

Tether, ever the sphinx, has remained silent on this transaction. The Bitcoin market, meanwhile, has reacted with all the excitement of a cat watching paint dry. No price fireworks, no dramatic swings-just the steady hum of business as usual. Or is it? Perhaps the real drama lies in the silence, the unspoken questions, the *why* behind the *what*. 🧪

In the end, Tether’s billion-dollar Bitcoin binge is less a financial transaction and more a Rorschach test for the crypto world. What do you see? A visionary move, a reckless gamble, or merely a company playing the long game in a short-attention-span world? The blockchain, ever impartial, records it all. The rest, as they say, is interpretation. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- How Tether’s USDT Cashed $149M This Week & Left Circle Eating Crypto Dust 😲💸

- Why Did 90% of Solana Traders Vanish? 🤔 The Twisted Truth Unveiled!

- Philippine Senator’s Bold Move: Budget on Blockchain? You Won’t Believe This! 😲

- Ethereum’s Wallet’s Leaking-Here’s How to Profit! 💸🚀

- SOL to $500?! 🤪 It’s Possible!

- SEC’s High-Stakes Dance with Blockchain: ‘It’s All About Efficiency, Right? 😂💸

- USD IDR PREDICTION

- 🦋 Altcoin Woes: A Prequel to 2026’s Grand Finale? 🚀

2025-09-30 15:48