What to know:

By Omkar Godbole 🕵️♂️ (All times ET unless stated otherwise. Yes, even if you wish they weren’t.)

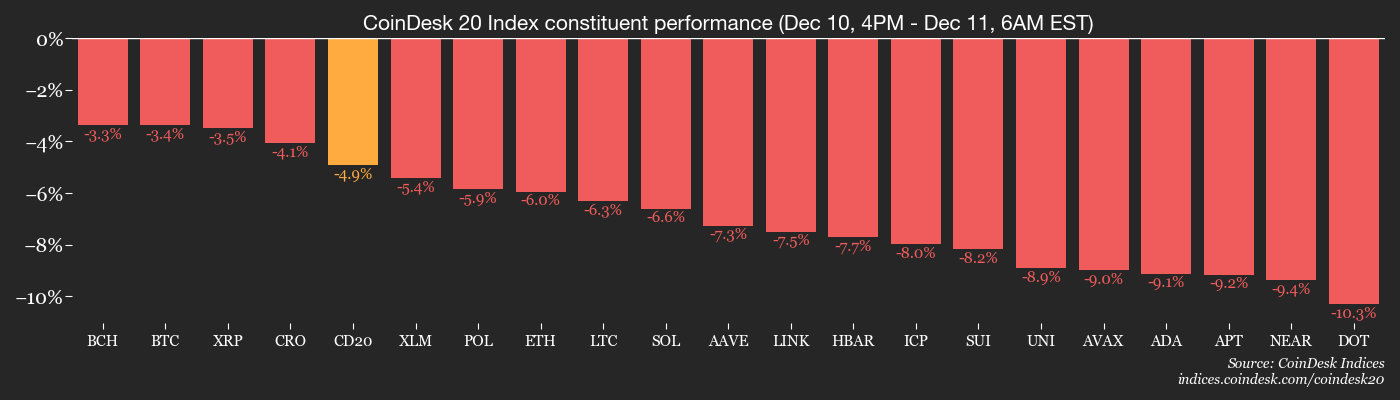

Bitcoin has plummeted to $90,000 because, apparently, the universe decided it’s time to remind everyone that “volatility” isn’t just a buzzword. 🌌 The CoinDesk 20 and 80 indices are down over 3.5% each-like a bad hair day, but for crypto.

The market’s mood is worse than a soggy crumpet. 🧪 Nasdaq futures are sulking thanks to Oracle’s earnings miss, and the Fed’s 25-bps rate cut felt like a hug from a cactus. Traders grumbled that the “hawkish forward guidance” (read: cryptic riddles from policymakers) made risk assets flee faster than a cat in a room full of rocking chairs. 🐾

Analysts are now pondering if we’ll see a year-end rally. Spoiler: They’re not sure. Volatility’s taking a nap, and ETF flows don’t need to sprint to spark a surge. But here’s the kicker: Since Nov. 11, we’ve had zero days with $500M+ in spot ETF inflows. The last time? October 7. November-December 2024? Those ETFs were guzzling $500M like it was water at a tech bro’s detox retreat. 💧

In other words, flows are the king, queen, and court jester right now. Whether they’ll recover in time for New Year’s fireworks? TBD. 🎇

Cheer up! Large Bitcoin holders (wallets with 10-10k BTC) have stockpiled 42,565 BTC since Dec. 1. It’s like finding a goldmine in your neighbor’s backyard while everyone else is selling their shovels. 🏴⛏️ Meanwhile, short-term holders and retail investors are trimming positions like overgrown hedges. 🌿

Ethereum’s Vitalik Buterin endorsed Fileverse, a decentralized Google Docs alternative. Because why trust docs that don’t run on blockchain? He claims it’s “stable enough for secure collaboration.” Translation: “We fixed the bugs that made your spreadsheets cry.” 📄🤖

In traditional markets, the 10-year Treasury yield is clinging to 4.14% like a toddler on a trampoline. ING analysts say it’ll rally “sustainably.” Sure, Jan. 🚀

What to Watch

Need a roadmap? Read CoinDesk’s “Crypto Week Ahead.” It’s like a treasure map, but with fewer pirates and more spreadsheets. 🗺️

Token Events

Same as above. We’re not lazy, we’re “efficiently meta.”

Conferences

Check CoinDesk’s guide! Or just go for the free coffee. ☕

- Day 4 of 4: Abu Dhabi Finance Week 2025 (Abu Dhabi) – Where money talks… and occasionally yells.

- Day 2 of 2: Indonesia Blockchain Week 2025 (Jakarta) – “Blockchain” and “Jakarta” in the same sentence? Bold.

- Day 1 of 3: Solana Breakpoint 2025 (Abu Dhabi) – Solana: the comeback kid with a caffeine addiction. ☕⚡

Market Movements

- BTC down 2.3% at $90,263.13 (24hrs: -2.24%) – Still more drama than a soap opera.

- ETH down 4.25% at $3,199.17 (24hrs: -3.71%) – Ethereum’s having an identity crisis.

- CoinDesk 20 down 3.25% at 2,871.54 (24hrs: -3.85%) – The index is tired. Let it rest.

- Ether CESR Staking Rate down 1 bps at 2.8% – A 1-bps drop walks into a bar…

- BTC funding rate: 0.0026% on Binance – Cheaper than a gym membership.

- DXY down 0.2% at 98.59 – The dollar’s taking a nap.

- Gold futures up 0.47% at $4,244.40 – Shiny and still relevant.

- Silver futures up 2.53% at $62.58 – The underdog strikes gold.

- Nikkei 225 down 0.90% at 50,148.82 – Japan’s stock market: moody.

- Hang Seng down 0.04% at 25,530.51 – Hong Kong’s like, “Meh.”

- FTSE up 0.11% at 9,666.02 – The UK’s playing it safe.

- Euro Stoxx 50 up 0.19% at 5,718.99 – Europe’s shrug emoji.

- DJIA up 1.05% at 48,057.75 – The Dow’s having a good hair day.

- S&P 500 up 0.67% at 6,886.68 – Wall Street’s favorite child.

- Nasdaq Composite up 0.33% at 23,654.16 – Tech’s still breathing.

- S&P/TSX Composite up 0.79% at 31,490.85 – Canada’s polite rally.

- S&P 40 Latin America down 0.2% at 3,129.59 – Latin America’s midday slump.

- U.S. 10-Year Treasury rate down 1.9 bps at 4.145% – Bonds are confused.

- E-mini S&P 500 futures down 0.54% at 6,854.50 – Futures: the cautious optimist.

- E-mini Nasdaq-100 futures down 0.77% at 25,599.75 – Tech’s cold shower.

- E-mini Dow futures down 0.18% at 48,019.00 – The Dow’s tiny hiccup.

Bitcoin Stats

- BTC Dominance: 59.26% (0.27%) – The king still wears the crown, but it’s dusty.

- Ether-bitcoin ratio: 0.03539 (-2.04%) – ETH:BTC’s awkward dance continues.

- Hashrate (7-day avg): 1,066 EH/s – Bitcoin’s heartbeat, slightly offbeat.

- Hashprice (spot): $38.52 – Miners: “At least we’re not losing money… today.”

- Total fees: 2.69 BTC / $248,636 – Transaction fees: the universe’s way of saying “thanks for the spam.”

- CME Futures Open Interest: 126,970 BTC – Gamblers, assemble!

- BTC priced in gold: 21.4 oz. – A Bitcoin weighs more than your average necklace.

- BTC vs gold market cap: 6.05% – Gold’s still the 900-pound gorilla. Bitcoin’s the hyperactive squirrel.

Technical Analysis

- BTC’s daily price chart since September: a candlestick masterpiece of chaos.

- Wednesday’s Fed cut did nothing. BTC’s stuck in a “counter-trend rising channel” (read: it’s lost and won’t ask for directions).

- Breakout above the channel? Bullish. Breakdown below? Bearish. This is thrilling. 🎢

Crypto Equities

- Coinbase ($275.09, -0.82%) – Pre-market down 2%: “We’re fine. No, really.”

- Circle ($88.41, +2.78%) – Pre-market down 2.3%: “We’re fine. No, really.”

- Galaxy Digital ($29.52, +0.24%) – Pre-market down 2.1%: “We’re fine. No, really.”

- Bullish ($46.13, +0.04%) – Pre-market down 2.28%: “We’re fine. No, really.”

- MARA ($11.92, -2.69%) – Pre-market down 2.18%: “We’re fine. No, really.”

- Riot ($15.57, +0.39%) – Pre-market down 1.93%: “We’re fine. No, really.”

- Core Scientific ($17.33, -0.91%) – Pre-market down 1.27%: “We’re fine. No, really.”

- CleanSpark ($14.53, -2.15%) – Pre-market down 2.89%: “We’re fine. No, really.”

- WGMI ETF ($45.91, -3.20%) – Pre-market down 2.16%: “We’re fine. No, really.”

- Exodus ($15.73, +2.95%) – “We’re the only ones not panicking. You’re welcome.”

Crypto Treasury Companies

- MSTR ($184.64, -2.3%) – “We’re still buying BTC. Or is that a typo?”

- Semler ($20.35, -0.1%) – “We exist. Trust us.”

- SharpLink ($12.02, +3.62%) – Pre-market down 3.14%: “Pi-ty the fool who buys this.”

- Upexi ($2.45, -4.3%) – “We’re not MicroStrategy. Sorry.”

- Lite Strategy ($1.84, +0.55%) – “Lite. Not right.”

ETF Flows

Spot BTC ETFs

- Daily net flow: $223.5M – “Halfway to $500M! Wait, no…”

- Cumulative net flows: $57.91B – “It’s a start.”

- Total BTC holdings ~1.30M – “We’re halfway to the moon!”

Spot ETH ETFs

- Daily net flow: $57.6M – “ETH’s little brother.”

- Cumulative net flows: $13.17B – “ETH’s tiny brother.”

- Total ETH holdings ~6.31M – “More than your grandma’s savings.”

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD IDR PREDICTION

- CNY RUB PREDICTION

- Bitcoin Takes a Nosedive: Will It Bounce Back or Just Splash? 😂💸

- India’s IT Department Takes a Bite Out of Crypto: Can You Handle the Heat? 🔥💰

- Solana’s Price Lags Despite Institutional Surge 📉💸

2025-12-11 15:35