Ah, the illustrious Ed Yardeni, he of Wall Street’s sell-side arena, now dons his prophet’s cap and gazes into the murky depths of market trends. With an air of nonchalance, he observes a delightful phenomenon-a broadening bull market, as if it were a chubby little cherub spreading its wings amidst a cacophony of small and mid-cap stocks. How quaint!

He posits, with the utmost confidence befitting a man with a crystal ball, that the ratio of the S&P 100 to the S&P 500 may have reached its zenith by year-end. One might chuckle at the thought-dare we hope for a more egalitarian distribution of market prowess?

“If so,” he muses, “then the odds of a bubble bursting now are much lower than they were back then, when the stock market was much more concentrated in tech names than it is now, according to this ratio.” Oh, how delightfully optimistic! Instead of the melodrama of popping bubbles, we might be treated to the genteel unfolding of a bull market, tiptoeing through the daisies.

Last month, our protagonist Yardeni took a bold stance-underweighting the so-called Magnificent Seven. These tech titans, once untouchable sovereigns in their fortified realms, now find themselves embroiled in a “Game of Thrones” scenario, each vying for supremacy in a kingdom divided. After fifteen years of favoring their reign, the firm has finally decided to hedge its bets-how deliciously dramatic!

In his latest analysis, Yardeni claims, with all the gravitas of a sage, that this new thesis seems to be bearing fruit, or perhaps just a few overripe berries.

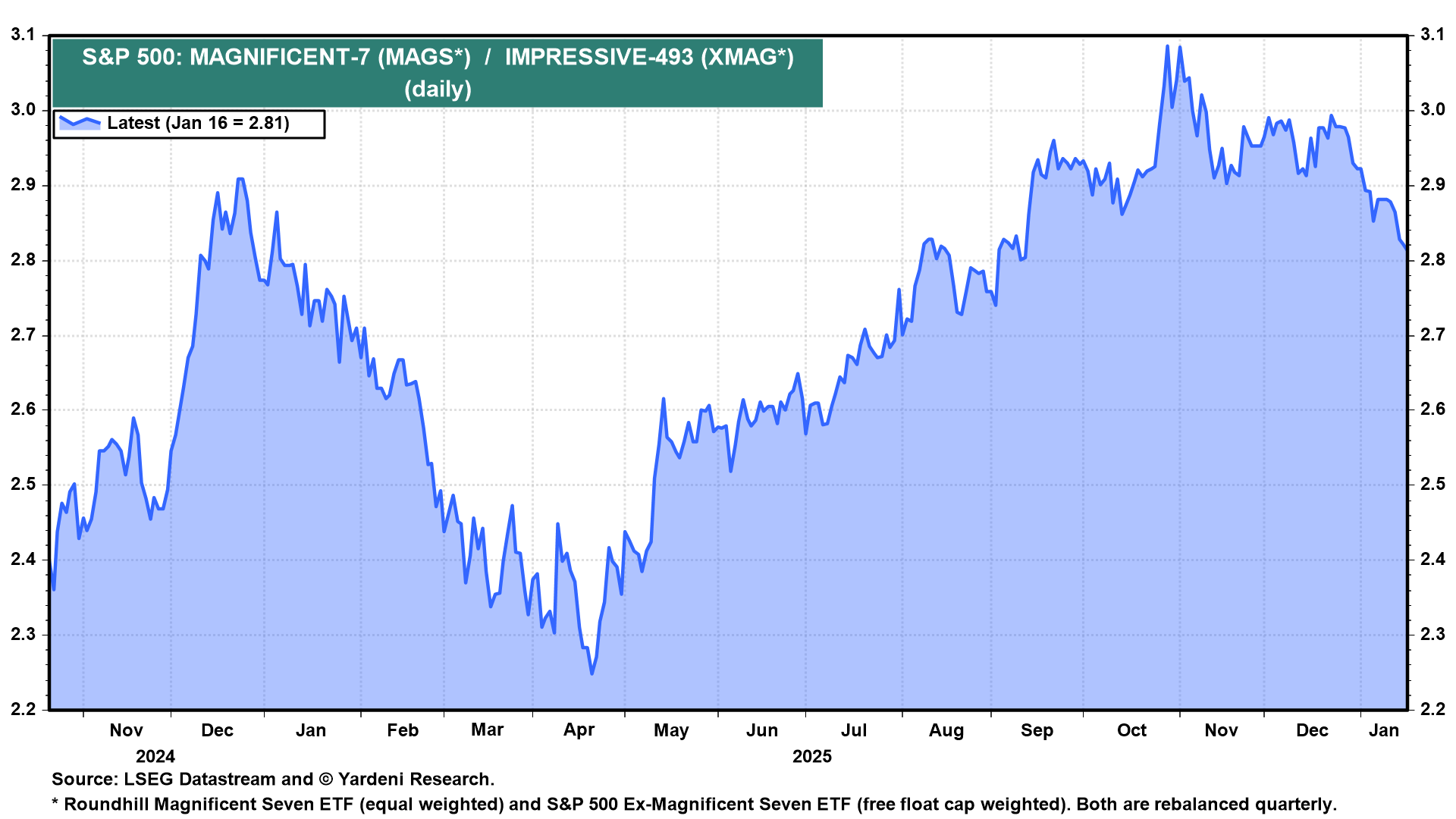

“Until late last year, the Magnificent-7 operated as seven independent kingdoms protected by large moats. Each prospered with its own unique monopoly. However, the AI arms race has upended that peaceful coexistence by greatly increasing competition among them.” Ah, the sweet scent of rivalry in the air! The S&P 500 MAGS to XMAG ETFs ratio peaked after Michael Burry’s fateful tweet on October 31, 2025-“Sometimes, we see bubbles. Sometimes, there is something to do about it.” A prophetic warning indeed!

But lo, the venerable Yardeni notes, with a twinkle of doubt in his eye, that while SMID stocks have outperformed their larger counterparts, one must remain vigilant, for this performance could very well be a head fake-a mischievous little trickster lurking in the shadows of the stock market.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Binance’s Futures Freeze: Oopsie or Oops-We’re-Fucked? 🧊💸

- EU’s Crypto Crackdown: Can Regulations Keep Up with the Wild West?

2026-01-20 19:36