The Rise (and Slight Decline) of AI and HPC in Mining

In the year of our Lord 2025, the industrious miners, those brave souls who chase the fleeting ghost of Bitcoin, found their valuations buoyed by the siren song of High Performance Computing and Artificial Intelligence. Ah, but beware-what once was a simple tale of mining for gold is now a saga of ideological separation. Execution and storytelling, like two brothers at odds, diverge their paths-how delightful it is to watch fortunes re-rate themselves amidst this chaos.

Over recent weeks, as if awakening from a long slumber, we have observed a change in the marketplace’s fickle favor. The old days, when Bitcoin miners were judged solely by the size of their coin sacks, gave way to a new paradigm-credible HPC/AI exposure. Investors, with a keen eye and a skeptical brow, now see through the smoke and mirrors, valuing those with real commitments over mere promises.

It was not a fevered dream, but a swift march of progress-less a sentiment, more an execution. In the distant days of 2024, only Core Scientific had lashed itself to a hyperscaler ship. But by 2025, five valiant companies had joined that flotilla. What was once among diversifications is now the backbone of their balance sheets, pipelines, and strategies-transforming mere hobbyhorses into the main steed of corporate ambition.

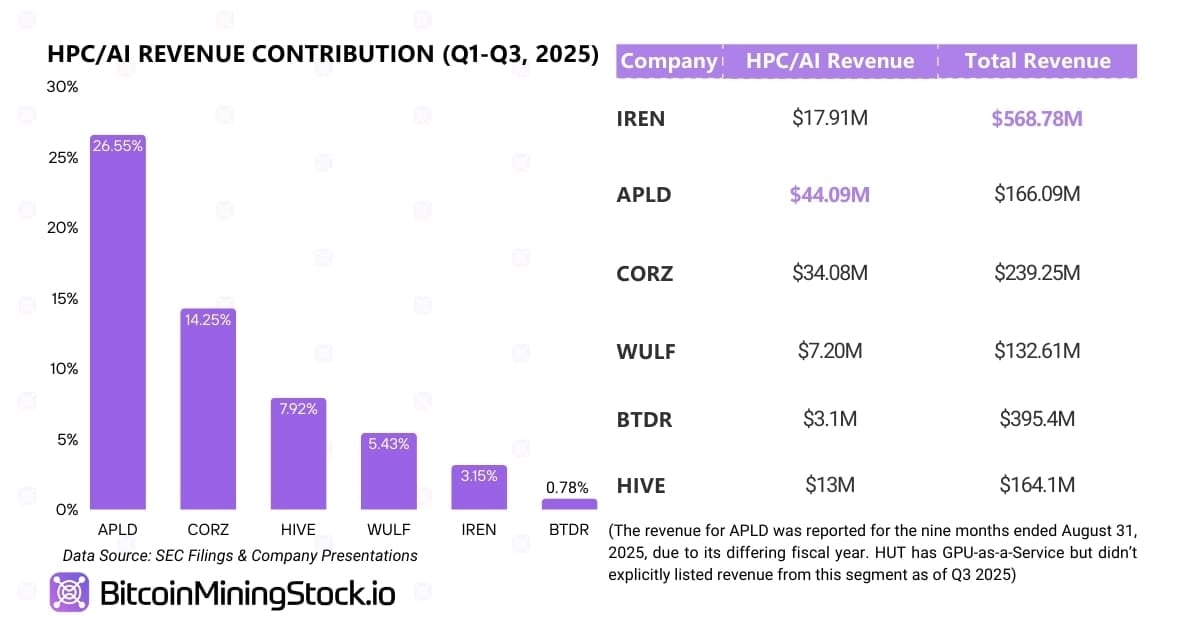

Revenues Whisper, but Their Voice Grows Louder

Though the coffers have yet to overflow, the eyes of those in the know see beyond the horizon. Revenue, like a shy maiden, remains modest-yet visibility is increasing. Hyperscalers, those giants of infrastructure, deal in long-term agreements, building their kingdoms brick by brick, stage by stage. Soon, in 2026 and beyond, the sweet symphony of income shall crescendo, filling the coffers more robustly than before.

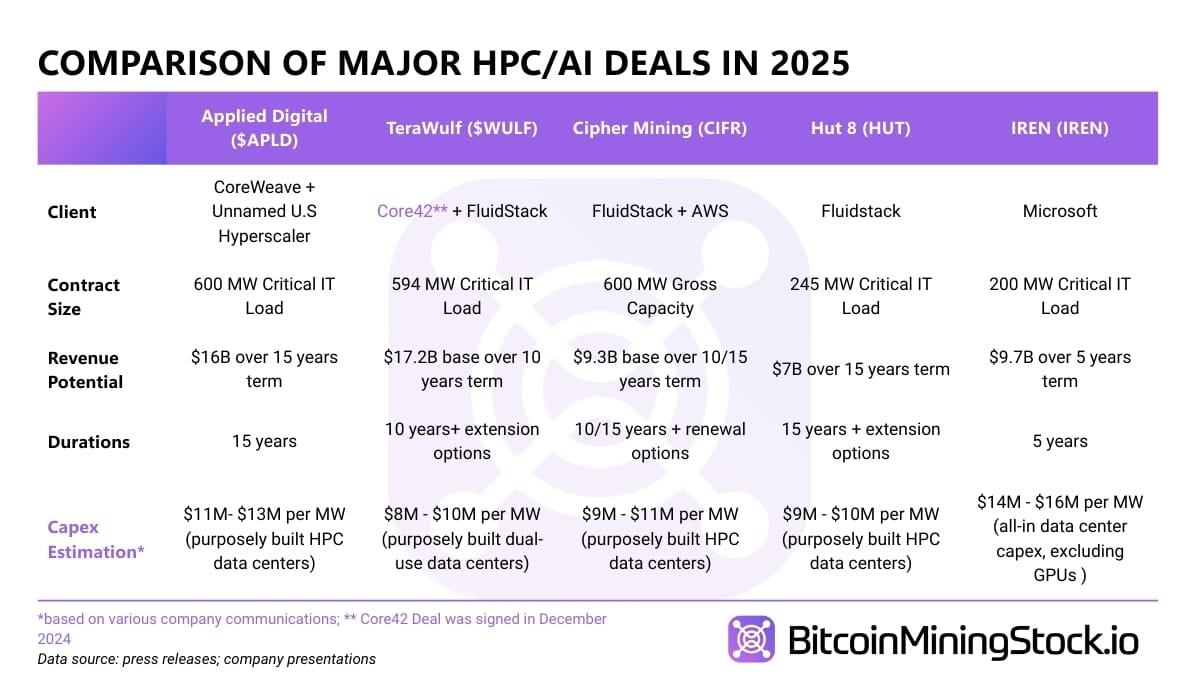

Comparison of Deals: A Game of Contrasts

Not all deals are cut from the same cloth. Some miners fancy themselves as HPC infrastructure providers-think of them as the landlords of the digital age-rather than AI cloud lords. They offer power, cooling, shelter-nature’s splendid hotel service, but for GPUs rather than guests. The nuances matter; for whose wallet the coin falls is decided by whether they deal in hosting or direct AI services.

This distinction is no trivial matter. For, despite similar headlines, the economic fate of a contract depends on whether the miner is harnessing GPUs for their own grand designs or merely playing host. Capex, margins, and execution-these are the trifles that determine victory or folly.

HPC-A New Dawn, or Just a Bold Facade?

For some miners, HPC was once a side show, a minor distraction. Now, it is the main act-a veritable fountain of future capital. Companies like IREN and TeraWulf have cast their lot, signaling a shift from the Old Mines to the New Mines-those carved in silicon and heat rather than just rock and static electricity. Bitfarms, ever the cautious, hint that perhaps mining itself may fade into background noise with time.

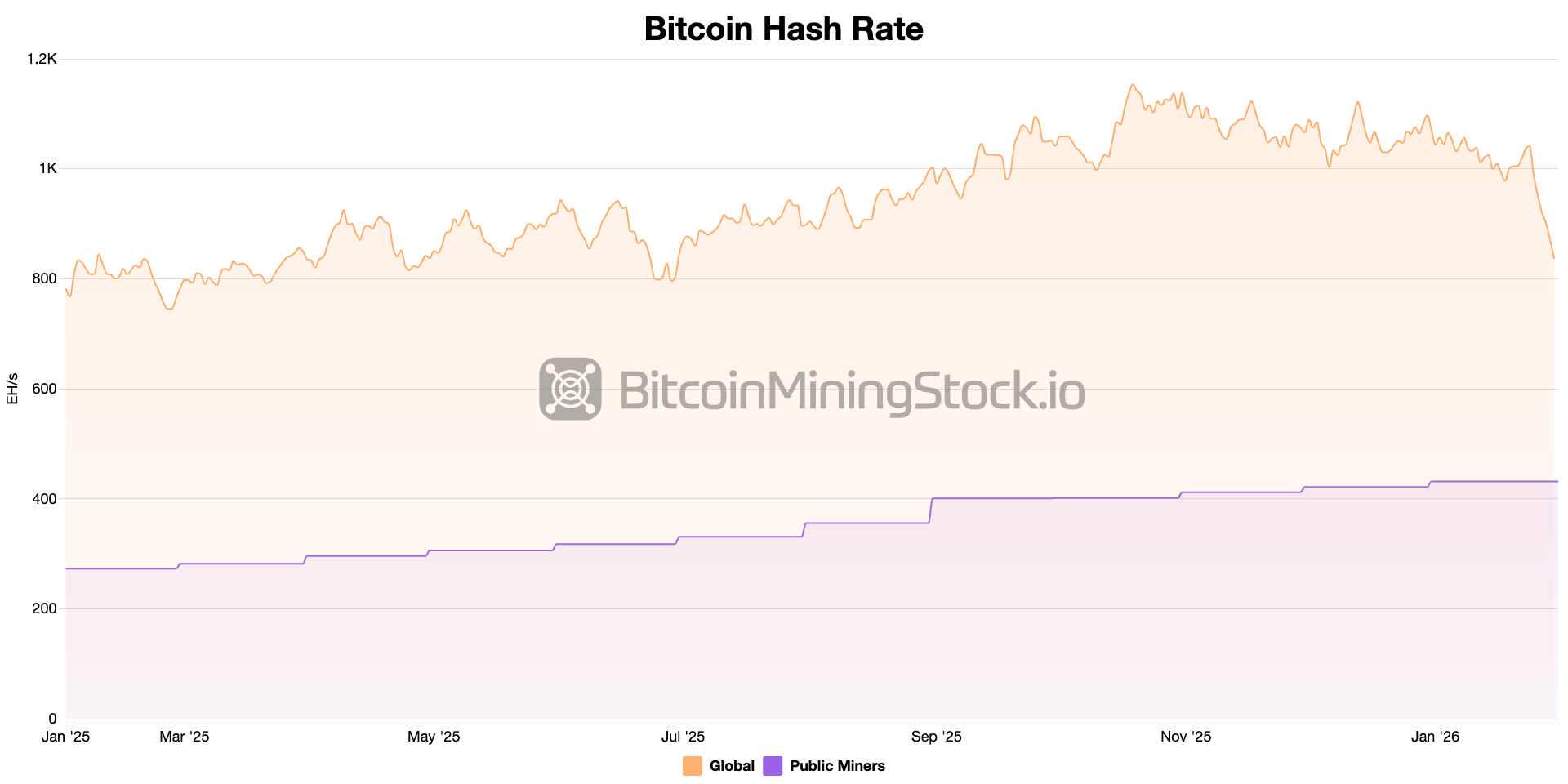

But such shifts have secondary consequences-less Bitcoin hash rate growth from public miners, perhaps even a plateau or decline. An unintended consequence of ambition, but what is progress without a little chaos?

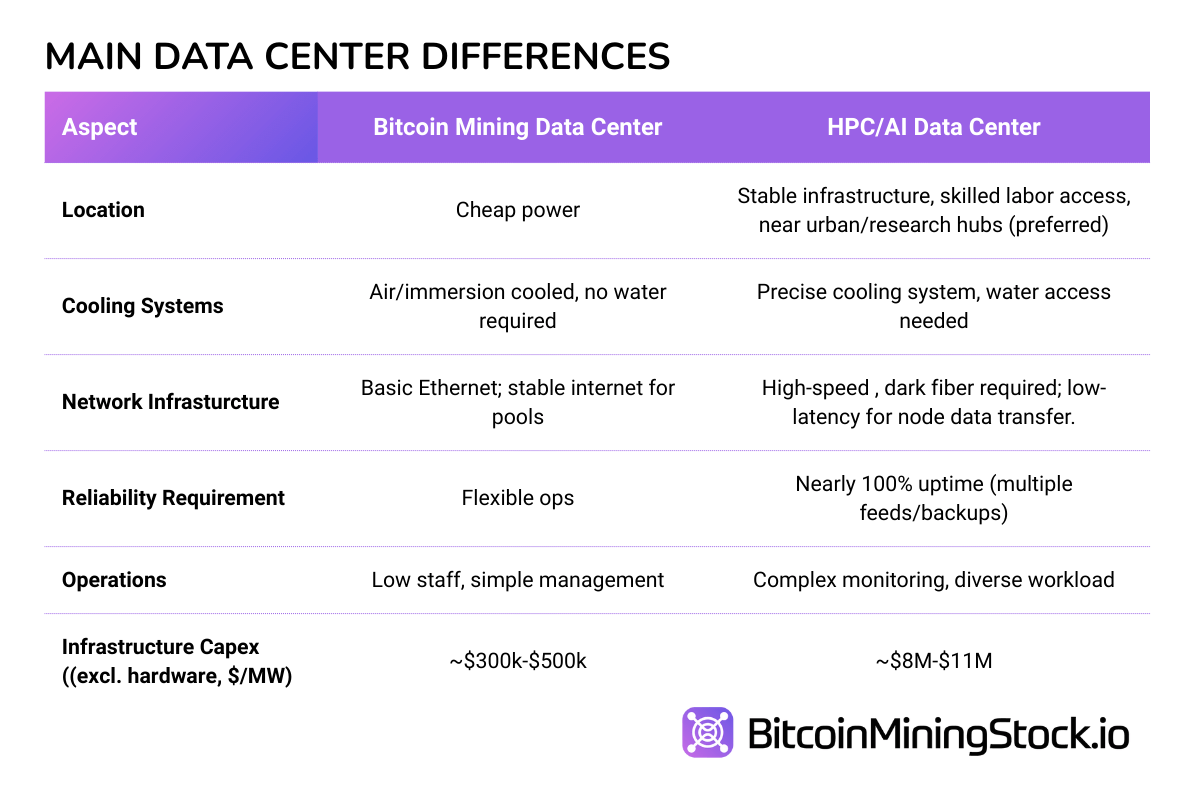

Not Everyone Can Jump on the HPC Bandwagon

Ah, but let us not be naive. Transitioning to HPC is not a matter of simply flipping a switch. Most mining sites, designed for speed and flexibility, faltered at the gate-like trying to fit a square peg into a round hole. Adaptation, at best, costs millions per megawatt-no small change, my friends-and requires expertise quite foreign to seasoned miners of yore who merely bought ASICs and prayed for luck.

If capital and skill are the true barriers, then many will be left stranded, watching the HPC train pass by while they count their losses. The time to build these beasts is long, costly, and riddled with risks-a lesson for the impatient and the foolhardy.

2026 and Beyond: A New Market Reality

The drumbeat of hyperscaler deals shall continue into next year, but the market’s gaze has sharpened. No longer are megawatt claims enough-investors probe deeper: who finances what? When does the revenue drip in? What of the risks if the client dodges? The age of blind faith is waning; now, they seek assurance, griping about risk and reward, about who truly bears the burden.

Not every HPC deal will re-rate a stock alike. The future belongs to those who can de-risk their ventures and operate with finesse-not just throw money into immense dark holes and hope for the best.

And What of Bitcoin Mining? A Twist in the Tale

Some say that the march of HPC marks the end of traditional Bitcoin mining. But I raise my eyebrow-with due respect to skeptics-as if it were a new dawn rather than a darkening cloud. When miners retreat or scale down, their resources go elsewhere-scattered across lands, ignited by the promise of new opportunities. Think of it as a redistribution, a Great Migration of hardware and energy, seeking more suitable pastures.

New domains emerge-regions with stranded energy, flare gas, and off-grid power-tough terrains, but perfect for small, modular ventures that contribute without massive overheads. The old giant in Texas may become a handful of sleek containers in Paraguay or Scandinavia, a delightful regional tale of resilience and adaptation.

Meanwhile, Bitcoin mining strains to keep pace. Unlike AI workloads, it cares little for uptime or redundancy. Instead, it offers flexibility-absorbing excess power, lowering costs, and acting as a humble servant to the broader energy infrastructure. As a result, the old model-buy ASICs, wait, and hope-becomes an artifact of the past, replaced by a more complicated, yet clever, dance involving grid services, heat reuse, and closer ties to the power gods.

This evolution is neither guaranteed nor easy, but it is certain: Bitcoin mining will change. The question remains-will it survive or evolve?

And just to satisfy the curious-if you desire a deeper dive into contracts, locations, or their complex riddles-visit the original report, where those details dwell, waiting for brave explorers.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Silver Rate Forecast

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

2026-02-02 10:02