Yes, comrade, the wheel of fortune spins at the edge of a Siberian arctic wind: crypto mining stocks, given the right nudge, diverge and collapse across timelines, while Bitmine, like a sly fox in the henhouse, emerges amid the rubble as star of the absurd, improbable spectacle. 🪓💸

Crypto Mining: Where Results Look Like the Family Soup, Never the Recipe

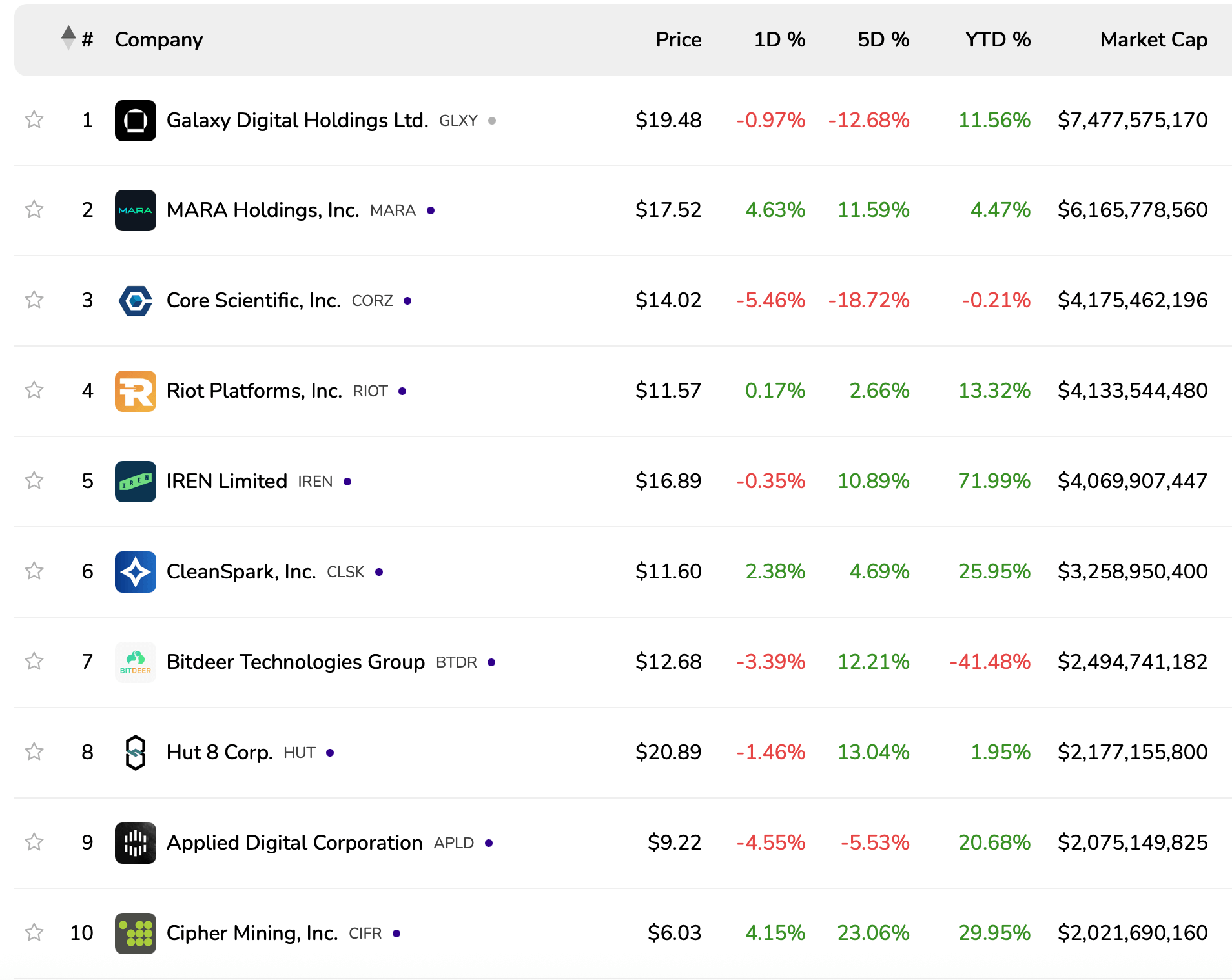

The crypto mining industry, 2025: as calm as a Moscow traffic jam and twice as predictable. July: the month when the stats were made to be laughed at (or perhaps wept over). Galaxy Digital Holdings Ltd. reigns heavy with its $7.48 billion cap—though recently, its value has drifted like a government-issued ration card, down 0.97% for the day, 12.68% over just five despair-filled evenings. Next door, MARA Holdings discovers the cheat code, leaping 4.63% daily and 11.59% weekly; meanwhile, Core Scientific, Inc. drops like the thermometers in February: -5.46% and -18.72% for day and week. Ah, market capitalism—always dangling a carrot that proves to be a potato.

The giants among miners, sweating like prisoners in a coal car, find themselves at odds with the numbers. Riot Platforms ekes out a laughable daily increase (0.17%) and a 2.66% weekly gain—enough to buy a bowl of soup, perhaps. IREN Limited, possessed by some strange fortune or possibly witchcraft, boasts a 71.99% gain YTD. Cleanspark, Inc. climbs 25.95% YTD—bravo!—while Bitdeer Technologies Group tumbles 41.48%, proof that deer sometimes wander straight into the wolf’s jaws. Cipher Mining, Inc. pens a modest ballad (29.95% YTD up); Bit Digital, Inc., perhaps digitally enhanced, sprints 61.90% weekly—take a breath, friend! 🏃♂️

Yet among these laborers in the digital gulag, one stands ludicrously tall. Bitmine Immersion Technologies—miners of coins, yes, but also of the wallets of eager investors—erupts, bewilderingly, with a 1,329.48% YTD jump. How? With immersion cooling (the miners get a bath, at least), green mining with the subtlety of a Soviet five-year plan, and a dash into power-cheap backwaters; all this, as wall posters declare, is for the Motherland—but mostly NYSE American: BMNR.

In perhaps the second most ambitious plot since building a railway through permafrost, the company flirted with ethereum (ETH) and reeled in $250 million, sending investors running after the scent of profit like bureaucrats after coffee rations. Operations sprawled across Texas, Kentucky, and Trinidad & Tobago, with promises of mining-as-a-service (MaaS)—service with a smile, or at least a straight face. Meanwhile, Bitfufu, Bitfarms, and HIVE Digital—names forgotten quicker than last week’s bread—stumbled and declined. Sad violin solo, please.

To close the litany of unknowns: Northern Data AG sinks 45.13%, Canaan, Inc. vanishes 65.10%—the equivalent of losing both your hat and your boots in a snowstorm. Neptune Digital Assets Corp. ends the accounting with a $129 million market cap and a 43.66% YTD gain, somewhere between ironic and tragic. As for the miners themselves? Good tidings—as long as you can parse the sacred math of hashprice (earnings per PH/s) growing 11.67% over 30 days. Even under late capitalism, you might strike something—if only a vein of irony. 🌌🔨

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Silver Rate Forecast

2025-07-09 19:07