Welcome to the US Crypto News Morning Briefing-your essential rundown of the most important developments in crypto for the day ahead. (But let’s be honest, it’s just a fancy way of saying “Here’s what’s happening, and don’t ask too many questions.”) 😏

Grab a coffee, for the markets are debating whether this fresh liquidity is a lifeline or a red herring. (And let’s not forget, the coffee is overpriced, just like everything else.) ☕

Crypto News of the Day: Treasury’s Record Buyback Highlights Liquidity Stress as Markets Await Powell

The US Treasury has carried out one of its largest debt buybacks in history, repurchasing $4 billion worth of government bonds. Analysts say the move injects fresh liquidity into the financial system. (Because nothing says “fresh liquidity” like a government buying back its own debt. How very… Shakespearean.) 🎭

Analyst Kyle Doops highlighted the scale of the Treasury’s move, noting that the $4 billion buyback represented one of the largest in history,

“Bullish fuel for risk assets,” wrote Kyle. (Or as I’d say, “Bullish fuel for those who can afford to take the risk, while the rest of us watch our savings evaporate.”) 🚀

Trader Crypto Rover echoed the sentiment, framing the operation as a rare step highlighting the government’s willingness to add liquidity at a sensitive time for markets. (A rare step? More like a desperate one. The government’s version of “I’ve got this” while the economy squeaks.) 🚢

Yet the size of the sell offers reveals a more troubling dynamic. According to Quinten François, investors lined up to sell $29 billion in debt to the Treasury. Notably, this is far more than the government was willing to buy back. (Ah, the classic “I’m selling, you’re buying” dance. Who’s really in control here?) 💸

“That means investors are desperate for liquidity, lining up to dump debt,” François said. (Desperate? Or just wise? Either way, the Treasury is the only one with a clear head. Or a clear wallet.) 🤔

The analyst added that such a demand imbalance suggests systemic funding stress. He believes the Fed will eventually be forced to step in more aggressively, flooding the system with money. (Flooding? More like a deluge. But who’s counting? The Fed’s version of “We’ll fix it later.”) 🌧️

“When they do, Bitcoin goes vertical,” he argued. (Vertical? More like a rollercoaster. But hey, at least it’s not a straight line.) 🎢

While Treasury’s buyback may have bought time, it has also exposed cracks in bond market liquidity. (Bought time? More like borrowed time. And the interest is steep.) ⏳

Investors are left weighing whether this injection marks the beginning of broader easing, or just a temporary patch before deeper market stress forces the Fed’s hand. (A temporary patch? Like a Band-Aid on a bullet wound. But at least it’s something.) 🩹

The buyback, announced Wednesday, comes as markets brace for Federal Reserve Chair Jerome Powell’s Friday speech at the Jackson Hole economic symposium. Investors hope Powell will clarify the path of interest rates during the meeting. (Brace yourselves, dear readers. The Fed’s speech is the event of the season. Or as I call it, “The Great Rate Guessing Game.”) 🎭

Yields Edge Higher Ahead of Powell’s Jackson Hole Speech

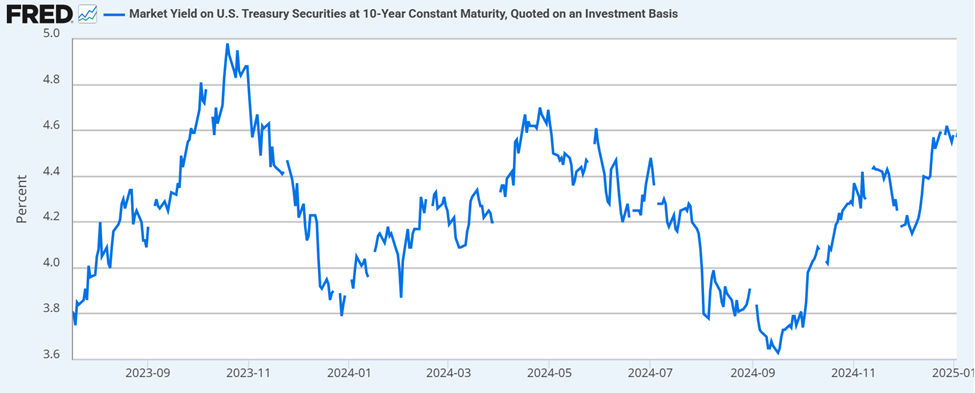

Despite the injection, Treasury yields inched higher on Thursday morning. The benchmark 10-year yield rose slightly to 4.308%, while the 2-year yield climbed to 3.76%. (Yields higher? Because the market is still playing the “I don’t trust the Fed” game. How original.) 📈

Yields and prices move inversely, meaning higher yields reflect lower bond demand. The mismatch suggests that buybacks may not absorb the market’s supply. (So the Treasury is trying to buy its way out of a crisis, but the market isn’t buying. Literally.) 🚫

All eyes now turn to Jackson Hole, where Powell is expected to signal whether the Fed remains committed to keeping rates elevated or is preparing for cuts later this year. (All eyes? More like all fingers crossed. The Fed’s next move is the ultimate mystery. Or as they say in the theater, “The curtain is about to rise.”) 🎭

“Jackson Hole Economic Policy Symposium Meeting Aug 21-23rd (hosting dozens of central bankers, policymakers, academics, and economists worldwide). Jerome Powell is speaking here on August 22 at 10 am EST. This will give us a good outlook for next month’s rate cuts,” wrote CryptoData, a popular account on X. (A good outlook? Or just a good excuse to sell? The market will decide. As always.) 🤝

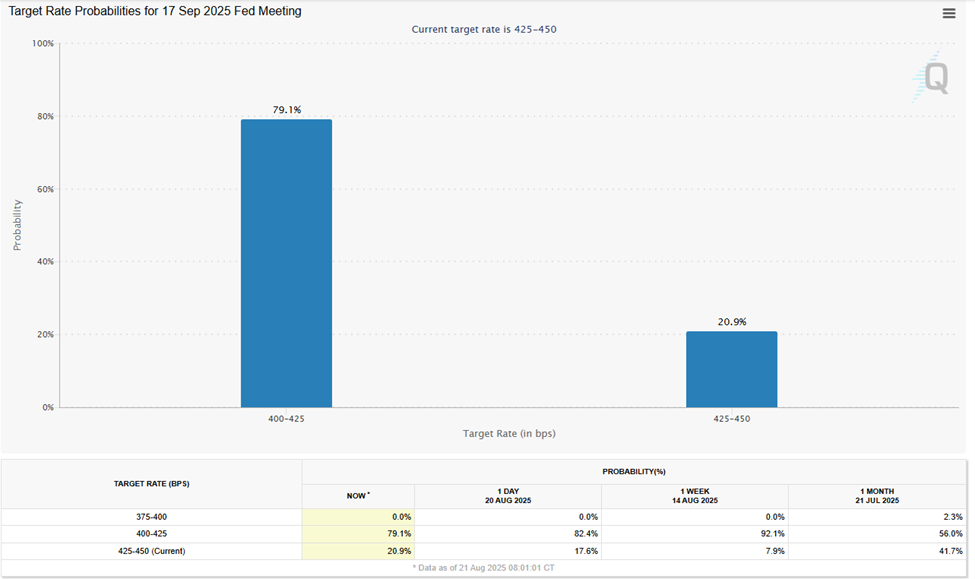

Traders are pricing in nearly an 80% chance of a rate cut at the September meeting, according to CME’s FedWatch tool. (An 80% chance? That’s almost a guarantee. But then again, the Fed is known for its certainty. Or is it just a well-timed guess?) 🎲

However, the latest FOMC minutes showed Fed officials split. While the committee opted to hold rates steady, governors Christopher Waller and Michelle Bowman dissented. This was the first double dissent since 1993. (A double dissent? Like a duet of disagreement. How very… harmonious.) 🎶

Their stance reflected concern that inflation could reaccelerate, especially if Trump’s tariffs and supply chain costs are passed on to consumers. (Tariffs and supply chain costs? It’s like the economy is a game of Jenga. One more block and everything crashes.) 🧱

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of August 20 | Pre-Market Overview |

| Strategy (MSTR) | $344.37 | $340.60 (-1.09%) |

| Coinbase Global (COIN) | $304.39 | $301.53 (-0.94%) |

| Galaxy Digital Holdings (GLXY) | $24.51 | $24.02 (-2.00%) |

| MARA Holdings (MARA) | $15.45 | $15.18 (-1.75%) |

| Riot Platforms (RIOT) | $12.52 | $12.33 (-1.52%) |

| Core Scientific (CORZ) | $14.08 | $13.92 (-1.14%) |

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin’s Big Breakout: Fed Cuts, Crypto Cash, and a Million BTC Heist 🚀

- USD CNY PREDICTION

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

2025-08-21 18:51