Markets

What to know:

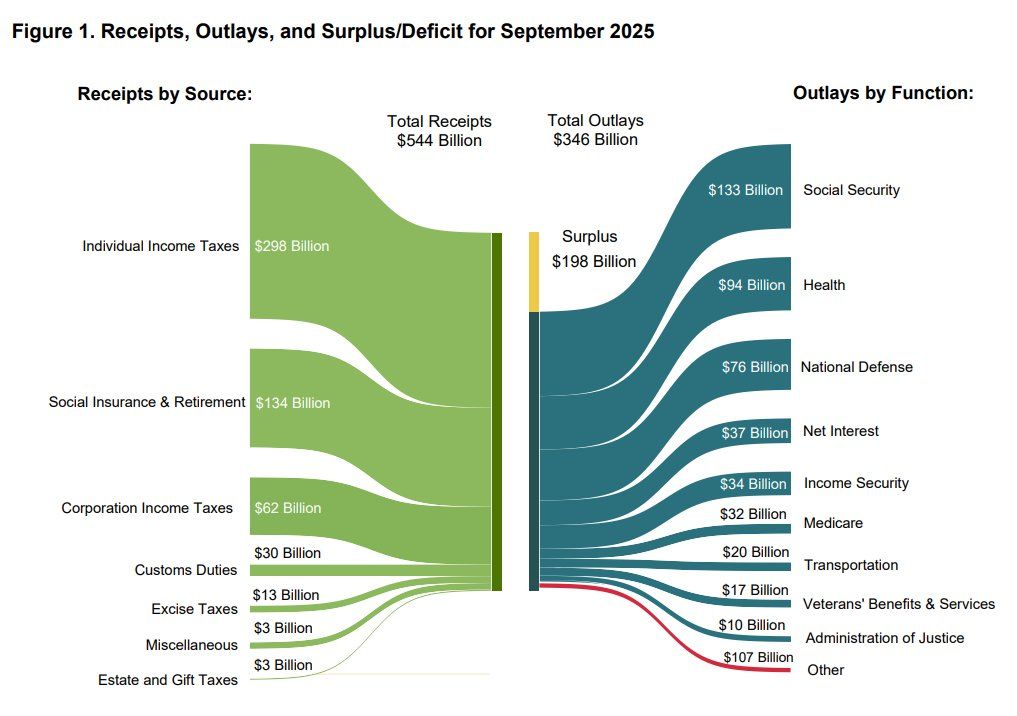

- A $198 billion surplus in September highlights revenue growth, driven by import tariffs.

- Net interest payments was the fourth highest outflow for September, outpaced by Social Security, healthcare, and defense.

Ah, wretched Bitcoin, you pitiful creature of the digital abyss, lingering like a forsaken soul around a mere $105,000, what depths of despair have you sunk! Yet behold the grotesque spectacle of our nation’s fiscal soul, illuminated in a sepulchral September surplus, a twisted jest from the gods of coin and commerce. 💸

According to the venerable CNBC, that pillar of worldly wisdom, the U.S. Treasury hath recorded a $198 billion surplus in September 2025, the most prodigious in history for such a month-a veritable triumph amid the cacophony of deficit’s eternal howl, slashing the fiscal 2025 wound to $1.78 trillion, a paltry $41 billion reduction from 2024. Sarcasm drips like mercury: is this salvation or mere mockery? 😂

While September doth typically bask in surplus sunlight, courtesy of taxpayers’ sacrificial tithes, lo, this time an aberrant demon stirs-those import duties, those tariffs summoned by President Donald Trump in April, like some demonic pact. They hath spewed forth $30 billion in revenue that very month, nigh half the foretold bounty for the fiscal year entire. Oh, the irony of protectionism’s shackles!

These ill-gotten gains, wrought from the sweat of global wrangles, doth shield against the monstrous interest upon our $38 trillion debt-a torrent exceeding $1.2 trillion annually. In September, net interest, that vampire of the treasury, claimed $37 billion, ranking fourth among federal expenditures, trailing the noble woes of Social Security ($133 billion), the ceaseless plague of health ($94 billion), and the martial thunder of defense ($76 billion). What farce, this budgetary waltz with fate! 🤡

The unexpected effulgence from Trump’s tariffs portends his unwavering devotion to this trade crusade, undeterred by market maelstroms. Investors, those fickle wraiths, may flee risk’s abyss for sanctuaries in bonds and gold, echoing the April “tariff tantrum”-a name so delightfully absurd, evoking toddlers in ties. 😜

Yet, perchance, these tensions ignite inflation’s pyre, but the Fed, that sage soothsayer, deemeth such flames ephemeral, thus persisting in rate descents from 4.00% to 4.25%. The CME Fed Watch Tool foretells 50bps of cuts for 2025, plummeting to 3.50-3.75%. Will this balm soothe assets’ aching souls, or shall we descend into deeper existential turmoil? Only the heart of the miser knows. 🙄

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Silver Rate Forecast

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- XRP’s 2026 Forecast Collapses-Banks Wave Goodbye to Crypto Dreams!

- Brent Oil Forecast

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

2025-10-17 12:57