Behold, the European Union, that venerable institution of diplomacy, deployed troops to Greenland, a land so remote it might as well be a different planet. The POTUS, ever the master of theatricality, declared a new set of tariffs against these noble allies, citing a grand design to “acquire” the island by February 1. A deal? A farce! A comedy of errors penned by a man who thinks “diplomacy” is just a fancy word for “yelling louder.”

The EU, that paragon of unity, responded with the urgency of a man discovering his socks are missing. Meanwhile, the Democrats, ever the diligent guardians of fiscal responsibility, rushed to thwart the President’s tariff proposals, their efforts as futile as trying to catch a shadow with a net. Yet, amidst this chaos, BTC stood tall-calm, unshaken, as if it had already foreseen the entire debacle and decided to ignore it. A saint in a world of sinners, or perhaps a cryptocurrency with a PhD in existential apathy.

Latest Developments

As reported yesterday, the newly announced tariffs against Denmark, Sweden, France, Germany, the UK, the Netherlands, and Finland will be effective from February 1. A 10% tax on all goods, with a potential jump to 25% by June 1. Trump, that modern-day Don Quixote, declared it a “masterstroke,” while the EU muttered about “unilateral aggression” and scheduled an emergency meeting. A symphony of bureaucratic grandeur, no doubt.

Analysts from the Kobeissi Letter, those self-proclaimed sages of trade wars, claim this is the fourth step in the “eternal dance of economic mayhem.” They predict markets will open lower, but Trump, ever the showman, will continue his “hardball” antics. A performance worthy of a Soviet-era opera, if only the libretto were less absurd.

Unlike the US-China tango, the Greenland situation will take time, as acquiring an entire island is no mere matter of signing a contract. The EU, that bastion of resistance, remains “highly opposed” to the idea. A sentiment we can all relate to, especially if the island’s inhabitants are as stubborn as its leaders.

The Democrats, ever the loyal opposition, plan to introduce legislation to block the tariffs. A noble effort, but one that might as well be written in hieroglyphs for all the good it’ll do. The POTUS, after all, is not a man to be swayed by mere legislation.

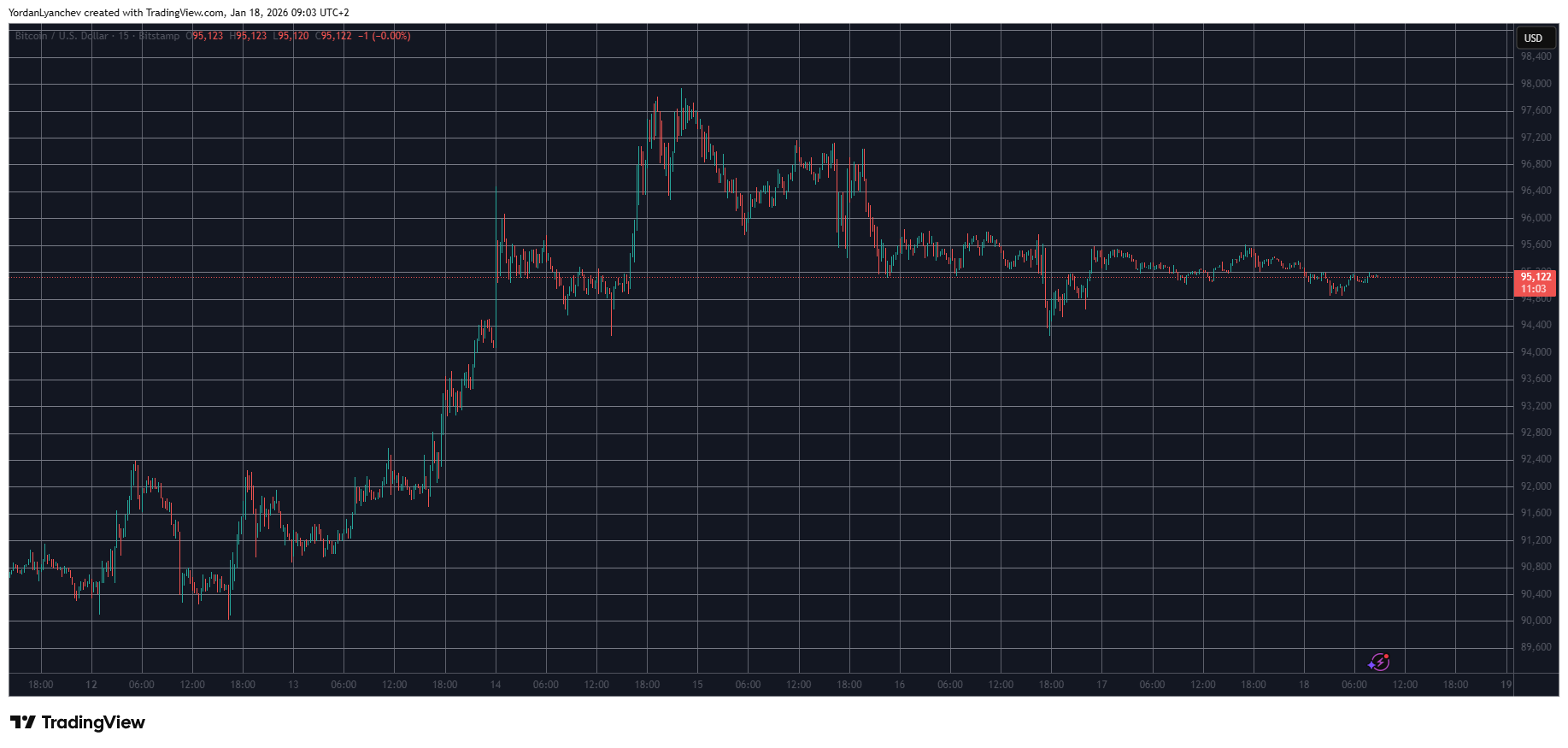

BTC Stands Still

Trade wars have historically sent BTC into a tailspin, like a drunk tourist in a subway station. Yet this time, it remains as composed as a librarian in a library. A $95,000 price tag, unshaken by the chaos around it. A testament to its resilience-or perhaps a sign that it’s simply waiting for the madness to end.

Despite the volatility, BTC’s calm is nothing short of miraculous. While the world scrambles, it sits there, serene and unbothered, as if it’s already won. But fear not, dear reader, for the future holds more fluctuations than a Russian novel. The EU’s meeting, the futures markets, and the inevitable “surprise” announcement-BTC’s journey is far from over.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR ZAR PREDICTION

- Shocking Crypto Caper: Nano Labs Goes Wild with $50M BNB Bonanza! 🚀💰

2026-01-18 10:28