The liquidity game in South Korea’s crypto world ain’t no walk in the park-it’s a dance with dragons, and folks better bring a sword.

South Korea’s Crypto Liquidity Is Complicated-Kaiko Research Explains Why

Kaiko Research, with all their fancy charts and graphs, decided to take a peek under the hood of Korean crypto liquidity. Spoiler: It’s not just about who’s shouting the loudest on the trading floor. Real liquidity, they say, is about pulling off a big trade without making the market throw a tantrum. Simple? No. But hey, nothing worth doing ever was. 😅

According to the analysts, you can’t judge liquidity by volume alone-unless you’re trying to get a paper cut from data. Kaiko’s crew insists you’ve got to look at time, market mood swings, and whether your order slips like butter or gets stuck to the ceiling. They mix in volume, bid-ask spreads, market depth, and slippage to paint a picture that even a retail investor could hang on their wall (if they had one).

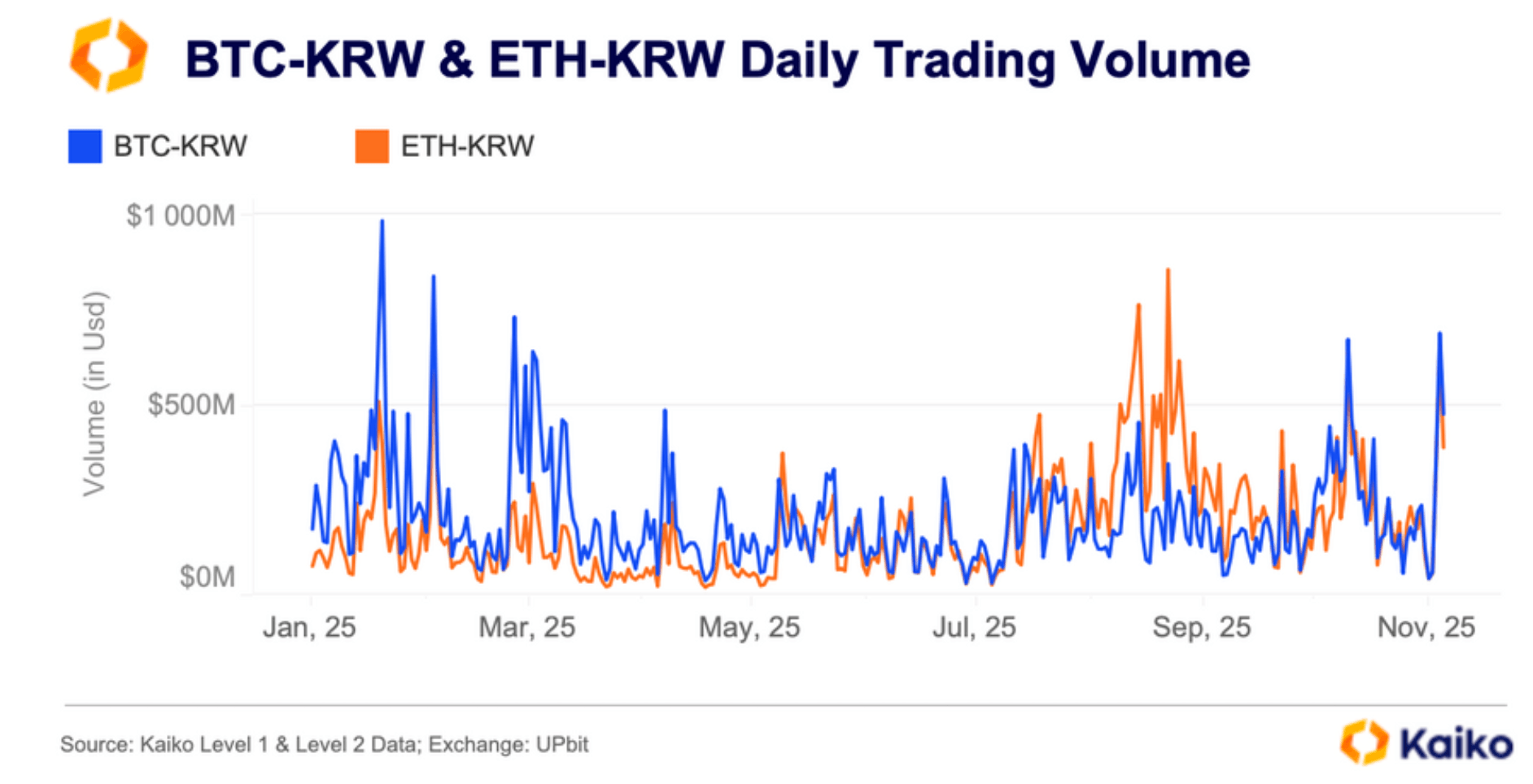

Volume? Useful, sure. But when the market’s in a panic (hello, Oct. 10, 2025!), it’s like trying to pour water into a sieve. Spreads, on the other hand, are the silent tax on your trades. Narrow ones mean you’re in and out like a whisper. Wide ones? You’re paying rent to the market gods. And let’s not forget volatility-it’s the party crasher that makes everyone’s spreads balloon like overinflated balloons at a toddler’s birthday.

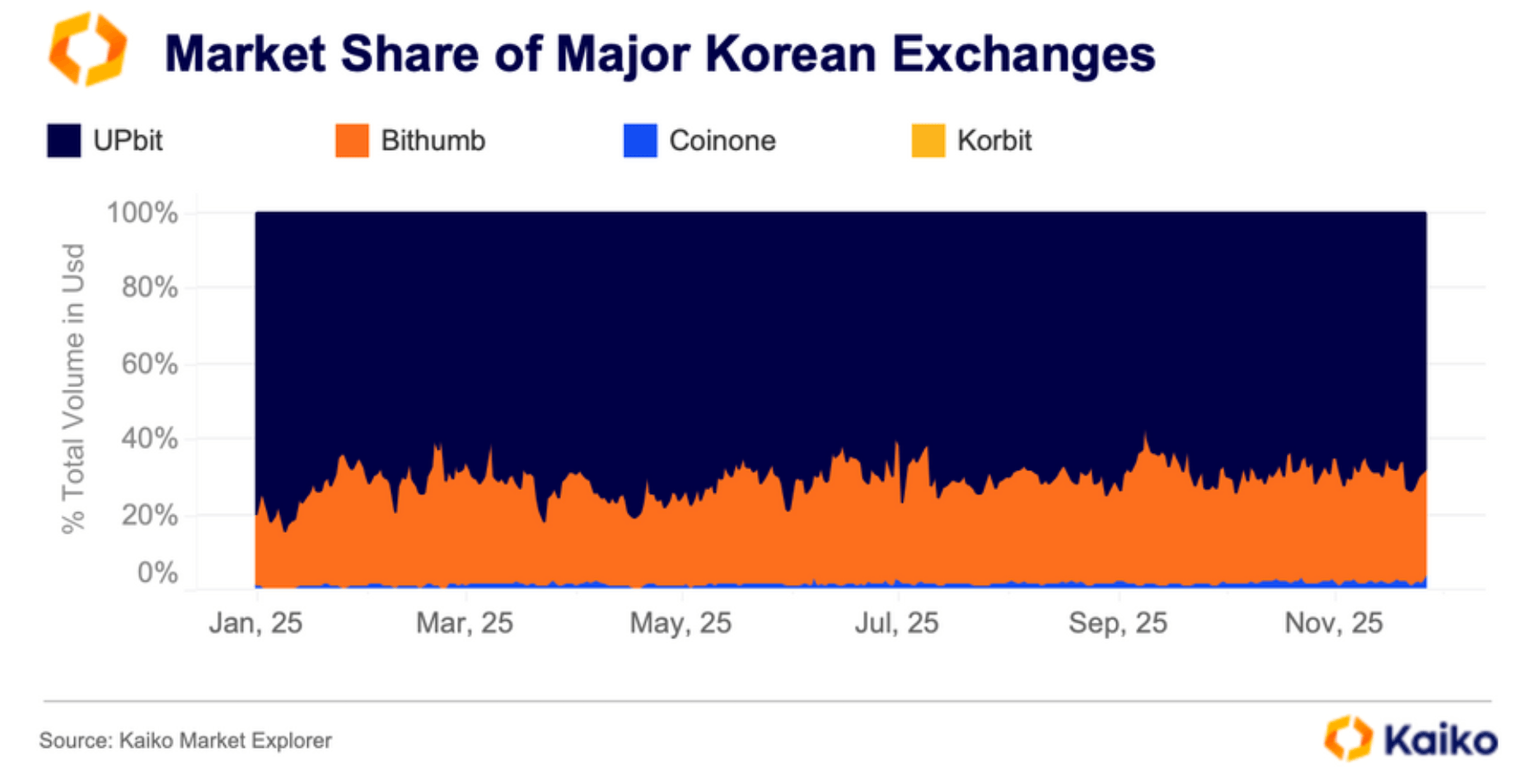

Kaiko’s researchers also note that tick sizes in Korea aren’t just numbers-they’re rules of the game. Big ticks mean stable prices but wider spreads. It’s like choosing between a sturdy bridge and a tightrope. Exchanges like Upbit and Bithumb play it safe, favoring readability over micromanaging prices. Call it the “Korean way” of keeping things simple-or maybe they just don’t want to confuse the grandparents.

Market depth? Think of it as the number of people holding hands in the order book. But don’t trust what you see-some folks are ghosting their orders faster than a bad ex leaves a voicemail. Iceberg orders? Those are the sneaky ones hiding in the dark, leaving you high and dry. Slippage, though, is the real deal. It’s the gap between what you think you’ll pay and what you actually do. And let’s be honest, it’s rarely in your favor. 💸

Even then, slippage’s mood changes with the time of day, the exchange, and the asset you’re trading. But here’s the kicker: Upbit’s got 70% of the liquidity pie, making rivals look like they’re trading in a sandbox. Their order books are deeper than a gold miner’s pockets, and their execution? Smoother than a jazz saxophone solo. Bithumb, Coinone, and Korbit? They’re playing second fiddle while Upbit’s conducting the orchestra.

Zero-fee models? Kaiko says they’re a trap. Removing fees is like taking the bait-market makers just pass the cost to you via wider spreads. It’s a game of musical chairs, and the chairs keep disappearing. And then there’s the Kimchi premium, where Korean prices flirt with global benchmarks before getting back in line. Capital controls and regulations? They’re the gatekeepers, keeping liquidity fragmented like a family feud.

Macro shocks? They hit like a wrecking ball. Remember December 2024’s martial law chaos? Volume spiked, but depth vanished. It’s the crypto equivalent of a fire drill at a bakery-everyone’s running, but no one’s bringing the bread. Bull markets, though, are the opposite. Fresh capital flows in like it’s Black Friday at the stock market, compressing spreads and making traders feel like kings. But don’t get too comfortable-liquidity’s a fickle mistress.

At the end of the day, liquidity’s not a number-it’s a system. And if you don’t treat it like one, you’ll end up with more questions than answers. Kaiko’s report? It’s a roadmap for anyone brave enough to navigate the wilds of Korean crypto. Just don’t forget to pack a compass… and maybe a lawyer.

FAQ 🇰🇷

- What does Kaiko Research mean by liquidity in crypto markets?

Kaiko Research defines liquidity as the ability to execute large trades quickly and near market prices without significant price impact. It’s less about volume and more about whether your order survives the gauntlet. 🛡️ - Why is volume alone misleading when assessing liquidity?

According to Kaiko Research, volume often spikes during stress events when execution quality worsens, making it an incomplete indicator. It’s like judging a storm by the size of the puddle. 🌧️ - Which Korean exchange has the deepest liquidity?

Kaiko Research finds that UPbit dominates Korean crypto liquidity, accounting for about 70% of total trading volume in 2025. The others? They’re just playing tag. 🏃♂️ - How do tick sizes affect liquidity on Korean exchanges?

Kaiko Research explains that larger tick sizes improve stability and visible depth but increase minimum spreads and execution costs. It’s the crypto version of choosing between a luxury car and a go-kart. 🏎️

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Poker Goes Wild! 🎰 Meet the Creator Squad That’s Flipping the Table!

- Binance’s Compliance Crisis: A Tale of Woe and Warnings! 💸

- Dogecoin’s Dramatic Dance: Surges, Secrets & a Fed-Fueled Frenzy! 🚀🐶

2026-01-19 02:29