What You Need to Know (but probably won’t admit to understanding):

- Vanguard, the financial equivalent of that uncle who always said “stay away from Bitcoin,” is suddenly a fan of spot Bitcoin ETFs, adding yet another gatekeeper to the $BTC entrance line.

- Bitcoin is now considered a fancy “macro asset” that everyone can get into without the need for complicated explanations. Meanwhile, traders are zooming toward riskier plays, like ecosystem tokens and infrastructure projects (because who doesn’t love a good gamble?).

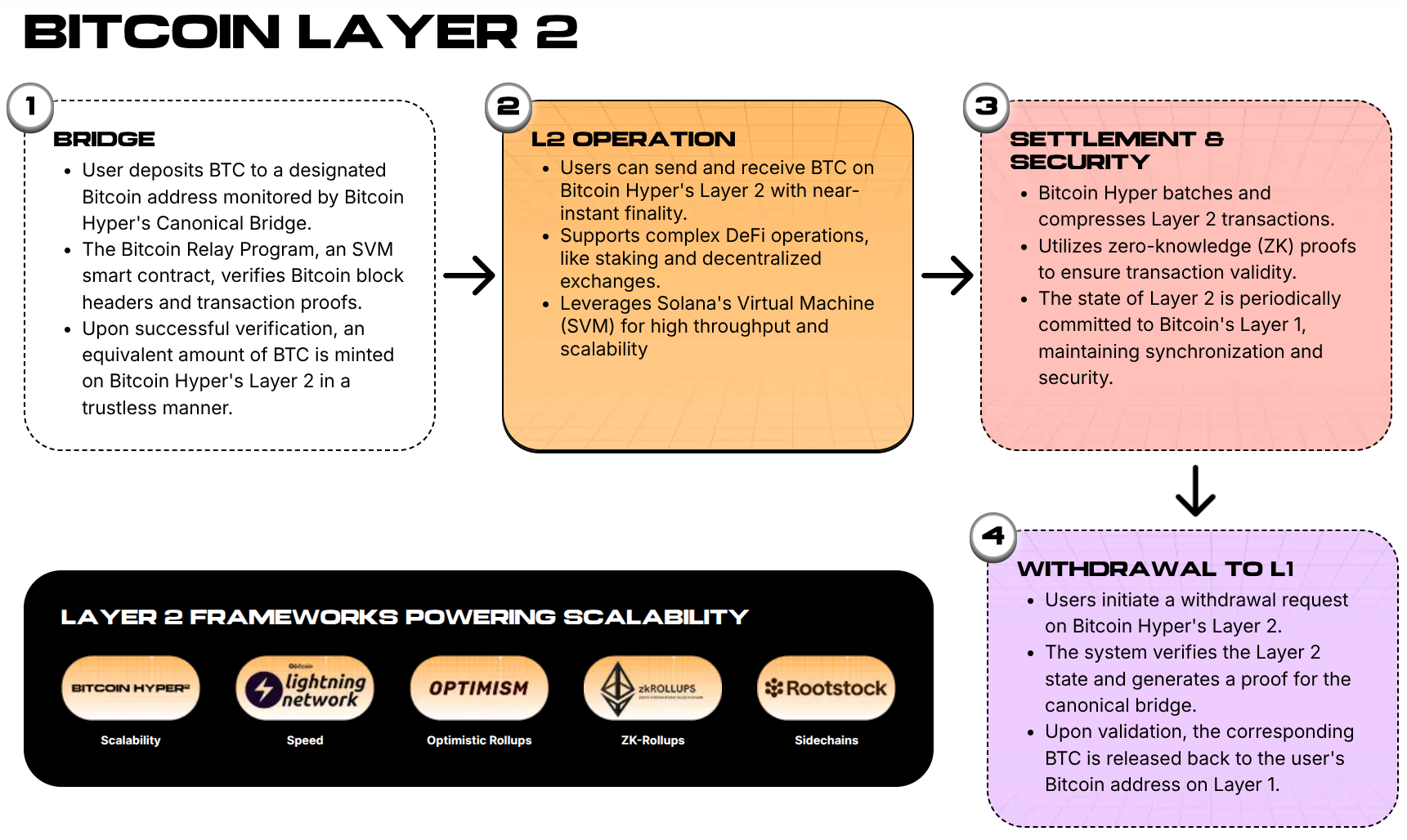

- Bitcoin Hyper ($HYPER) is making a bold move to tackle Bitcoin’s many flaws: slow speeds, high fees, and the sad lack of programmability. They’re fixing it all with some fancy SVM magic.

- The race for the Bitcoin Layer 2 crown is on, and projects are scrambling to support DeFi, gaming, and other things Bitcoin wasn’t designed to handle. And for some reason, they all think they can beat the odds.

For years, Vanguard was that grumpy old man on the porch, shouting at clouds, insisting that Bitcoin was a bad idea. But now? Well, now they’re in the game. And it matters. Because when a $9+ trillion retirement giant decides to let people put $BTC in their 401(k)s, things get real. So real, in fact, that Bitcoin rallied back to $92K from a dismal dip below $86K on Tuesday. It’s like watching your awkward cousin suddenly become the prom king.

Now, along with BlackRock and Fidelity, Vanguard is helping flood retirement portfolios and brokerage accounts with the magic of Bitcoin. This not only pumps up Bitcoin’s market cap, but it also changes the way traditional investors view crypto risk. It’s not a wild speculation anymore; it’s “digital gold.” And who doesn’t love gold?

For traders, this is a revelation. Bitcoin is now “safe,” so where can you go to get real gains? Oh, that’s right, risky ecosystem plays and infrastructure tokens. The kind of stuff you tell your friends you’re into to sound edgy.

Bitcoin Hyper ($HYPER) is swooping in, positioning itself as the cool new kid in class-basically, it’s like Solana with a Bitcoin twist. But way cooler.

As mainstream capital pours into spot BTC via the traditional financial system, the question isn’t ‘Should I own Bitcoin?’ anymore. It’s more like ‘Where can I get in on Bitcoin’s growth without having to use actual leverage?’ The answer? Ecosystem plays, of course. Like Bitcoin Hyper (HYPER), which promises to fix all the problems while you’re too busy basking in its glory.

Why Wall Street’s Latest Obsession Means More Attention on Layer 2

Wall Street’s sudden love for Bitcoin ETFs may seem like a step forward, but here’s the thing: it doesn’t actually solve Bitcoin’s major issues. The base layer can only handle about 7 transactions per second. Seven. That’s less than your average traffic light during rush hour. And don’t even get me started on the confirmation times, which feel like waiting for a snail to cross the street, and the fees? They’ll make you wish you just bought a few pizza slices instead.

For the “store-of-value” crowd, this is fine. But for those wanting DeFi, gaming, or basically anything fun, it’s like trying to throw a party in a house with no Wi-Fi.

That’s why a whole bunch of projects are now rushing to layer smart contracts and high throughput onto Bitcoin. They’re like that kid who can’t stop trying to fit in with the cool crowd by wearing a leather jacket-only this jacket is built on a bunch of fancy new tech.

These projects include everything from Ordinals tools to sidechains like Rootstock to experimental rollups. But among them, Bitcoin Hyper ($HYPER) is carving its own path, differentiating itself by integrating Solana’s Virtual Machine (SVM). And yes, it’s just as fancy as it sounds.

buy $HYPER for just $0.013365

Bitcoin Hyper’s Bet: Solana Speed Meets Bitcoin’s Security

Let’s zoom in for a second. Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin Layer 2 with SVM integration. The idea? It promises performance that could make Solana look like it’s stuck in traffic.

Anchored by a secure bridge to Bitcoin’s Layer 1 (don’t worry, it’s still solid), Bitcoin Hyper uses a high-speed Layer 2 to process transactions faster than you can say “Why didn’t I invest earlier?” And yes, this isn’t a pipe dream; there’s actual tech behind it.

And guess what? People are noticing. The presale for Bitcoin Hyper has already raised over $28.8M. Big money is getting in, with some wallets dropping half a million bucks like it’s pocket change.

Our experts predict that by the end of 2026, the price could hit $0.08625. If you buy now, you could be looking at a 545% return. Not too shabby, right?

If you think Vanguard and its friends are going to keep feeding capital into spot Bitcoin, then Layer 2s like $HYPER offer a different angle. It’s not just about the price of Bitcoin anymore; it’s about whether Bitcoin can finally host real applications. And if it can, well, get ready for the ride.

Join the $HYPER presale.

Disclaimer: This isn’t financial advice, but seriously, you should do your research before jumping into anything. Just saying.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- DOGE ETF: Because Who Needs Bitcoin Anyway? 🚀

- 🚨 IRS Goes on Vacation: Crypto Taxes in Chaos! 🚨

- DeFi Drama: Hacker’s Dance with $4.2M and Curve Pools 🕺💰

- CC’s 13% Surge: Leverage or Genius?

2025-12-03 16:57