Well, it’s happening. Wall Street wants a slice of the blockchain craze, because why not turn your investment portfolio into something that’s shiny, digital, and probably a little more confusing? If all goes well, our beloved, stuffy indexes might soon be hanging out on a blockchain – like a financial version of a very serious Instagram account, but with more numbers and fewer filters. 🎉

Partnership Already Launched

In a move that’s equal parts daring and somewhat reckless, S&P Dow Jones teamed up with Centrifuge – not because they want to spin you around, but to create the first tokenized S&P 500 fund. Think of it as slipping your index into a smart contract, which is as futuristic as it sounds, and probably a little less fun. This “proof-of-index” tech basically takes official S&P 500 data and embeds it into blockchain contracts, because who doesn’t want their stocks managed by what sounds like a robot reading a finance textbook?

The first of these digital funds is called… ah, the Janus Henderson Anemoy S&P 500 Index Fund. Managed by Anemoy Capital with a little help from Janus Henderson (a name that makes it sound like a Greek god of investments), and slated to go live once the regulators give it the thumbs-up. Because nothing says “trust me” like hiding your money on the internet.

What’s cool? Well, you could trade this thing at 3 a.m. from your pajamas, use your tiny slices of the index as collateral for loans, or just feel fancy knowing you own part of the biggest stock index while binge-watching Netflix. Sounds like the future, right? 🌝

Why This Matters for Regular Investors

For the everyday person-imagine being able to buy a tiny piece of the S&P for less than a fancy coffee. No brokers, no market hours, just you and your blockchain. And if you’re European, you could do this at 3 a.m. because apparently, the blockchain is also a night owl.

And here’s the kicker – you can even use your blockchain HODL as collateral, borrowing money to, say, upgrade your avocado toast or fund that goat yoga class. Plus, early results are promising: funds like these have already hit a billion dollars faster than you can say “digital money makes things easier.”

More Indexes Coming Soon

Brace yourself – S&P doesn’t plan to just stop at the S&P 500. No, no – they’re eyeing other giants like the Dow Jones and niche indexes. They’re basically planning to turn Wall Street into a blockchain theme park where every index gets a pixelated makeover, depending on demand, of course. Because if there’s one thing markets love, it’s catering to what investors want-like a fancy buffet but with fewer calories and more data.

With over a trillion dollars traded daily in these indexes, turning them into blockchain might just revolutionize how we all get our money fix. Sure, it sounds complicated, but so does assembling IKEA furniture, and look how well that turned out. 🪑

Growing Market for Digital Assets

The whole tokenization craze is exploding – up 380% in three years, reaching a staggering $24 billion. Major players like BlackRock are already riding the wave, launching their own digital funds. Standard Chartered predicts tokenized assets could hit a jaw-dropping $30 trillion by 2034. So, yeah, this isn’t just a bored tech nerd’s pet project; it’s a big deal.

And it’s not just crypto enthusiasts involved. Younger investors worldwide see blockchain as a cool way to access global markets without needing a secret handshake. Europe, Asia, and Latin America are leading the charge, because apparently, blockchain is the financial equivalent of a passport – it gets you everywhere. Countries like Switzerland and Singapore seem to be leading with rules that let this new digital gold rush happen safely – more or less.

Challenges and Competition

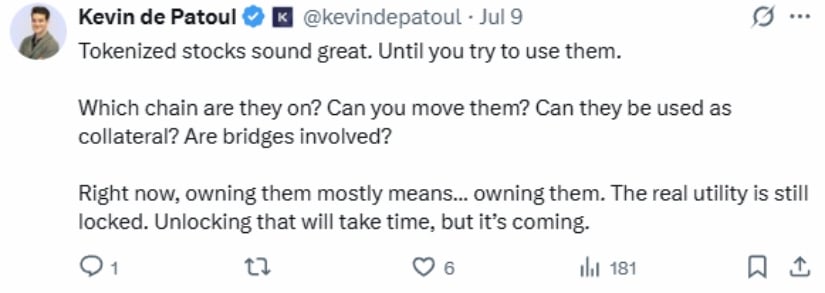

But don’t get too excited just yet. Kevin de Patoul, the CEO of Keyrock, throws a bucket of cold water on the party, warning that tokenization better do something valuable, or it’s just more expensive digital clutter. “If there’s no real benefit,” he says, “it’s just friction and cost.” As if crypto wasn’t already a rollercoaster of confusion.

S&P and friends need to pull off some serious magic tricks if they want their blockchain indexes to stick around. For now, the promise of 24/7 trading, fractional ownership, and DeFi integration sounds promising – but it has to actually work without making investors pull their hair out.

And competition? It’s fierce. Other financial giants are rushing in, eager to claim some digital territory of their own. The race to marry old-school finance with tomorrow’s tech is already heating up, and who knows who will come out on top? Maybe a robo-CEO in a tuxedo? Stay tuned.

What’s Next for Blockchain Finance

Rowton, a market visionary or maybe just an overly optimistic person with a crystal ball, predicts that tokenized indexes will be “pivotal” by 2030. They’ll boost global trading, open new investment roads, and make old finance look even more like a museum exhibit. The idea is to blend traditional and innovative, not to replace grandma’s pension fund (probably).

Already, nearly half of Swiss banks are dabbling in the crypto pool, so this ain’t some fringe thing anymore. As traditional banks dive in, the blurred line between old money and new tech is becoming fuzzier – sort of like that one sweater you keep promising you’ll throw out but never do. 🧥

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- XRP: A Most Lamentable Fall! 📉

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- XRP: Banking, Bonds, and Bonkers Politics – What’s Next?

2025-08-17 02:16