What one must strive to understand:

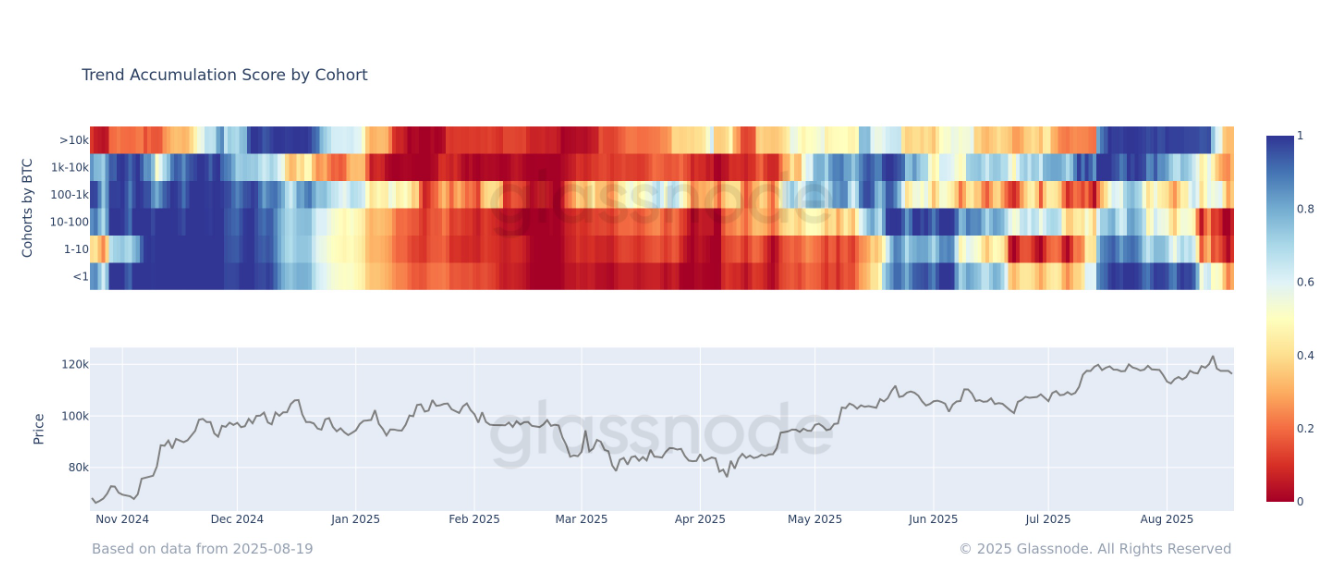

- The Accumulation Trend Score, formerly a proud banner at 1, now skulks in the shadowy recesses of 0.26, never venturing above 0.5 for what feels to a Russian soul like an eternity-unmistakable evidence of widespread distribution. The wallets have become peasants after harvest: dispersing their grain.

- Wallets bearing more than 10,000 BTC and those with less than 1 BTC-yes, even the smallest ruble-hoarders-have abandoned accumulation, now distributing their Bitcoin as if fortune were a fickle mistress threatening to depart at any moment. The market’s verve has cooled, as ice upon a Petersburg morning.

The drama that unfolds in these

BTCBTC$115,441.53 ◢ 0.24%

(If you hold your breath, perhaps it will change by next snowfall. Or not.)

The mood in the cryptographic provinces turns swifter than the feelings of Anna Karenina’s heart. Yesterday all was hope, today all is distribution. According to the watchful clerks at Glassnode, every bitcoin wallet cohort currently enacts a scene of active distribution. The Accumulation Trend Score (ATS)-considered by some to be like measuring the virtue of the Moscow aristocracy-is divided by the size of wallet, and aims to show who is gathering, and who is scattering, their fortunes.

What is this “metric”? Like studying the seriousness of a literary salon based on the quantity of teacups consumed in 15 days, it examines both the mass of the entities and the bitcoin snatched up recently. There is humor in such method, yet it remains relentless.

- Nearer to 1, there is accumulation-like a bear with honey.

- Nearer to 0, distribution-like a peasant who, on payday, races to the tavern.

(Miners, exchanges, and other questionable characters are banished from these calculations. Pavel Ivanovich would approve.)

Now, alas, from the great magnates with their vaults bursting with 10,000 BTC down to the humble laborers with less than 1, all have joined a glorious parade of distribution. Only a week ago, the peasantry and nobility alike were accumulating, their hopes floating higher than bitcoin’s price at $124,000-the kind of peak that would make a czar weep with envy.

This onslaught of distribution is simple: profit-taking, as old as Moscow market day. History has taught us, stern as any grandmother, that bitcoin corrects its course shortly after boisterous new highs. The aggregate Accumulation Trend Score sits, sipping kvass, at 0.26, refusing to budge above 0.5 for days on end.

Bitcoin, that mysterious character of our era, has delivered four months of gains, from April through July-each more festive than a summer’s evening at the estate. But August arrives: the wheat is cut, the traders drowsy, volume thins like winter gruel. In the last three Augusts, corrections have come, swift and merciless, in double-digit percentages. 🍞💸 If history is a stern schoolmaster, August shall again remind us that joy is fleeting and markets are moody as Tolstoy’s philosophical mood swings.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Silver Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Tokenization: The New “Mutual Fund 3.0” You Didn’t Know You Needed

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-19 13:50