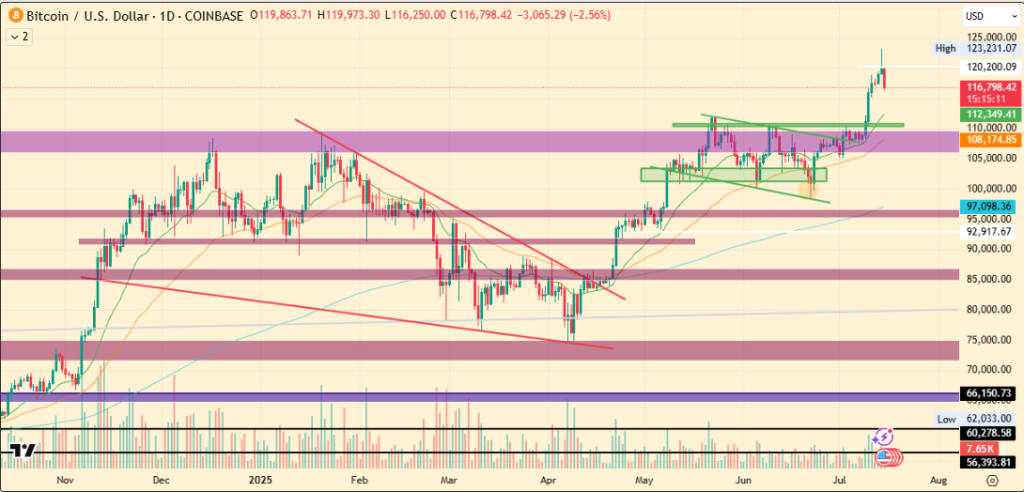

Ah, the Byzantine world of Bitcoin! A fleeting dalliance, one moment frolicking high at a fantastical $123,231, and the next, plummeting over 5% — a drop that could make even a stoic philosopher weep. One can only imagine the investors, with their pockets bulging, hastily locking in their glittering profits at a tantalizing $116,700, as if the heavens themselves were beckoning them to secure their fortunes before they vanished into the ether.

While the market currently wears a cotillion of bullish charm, hints of short-term consolidation waft through the air, like a fragile wisp of perfume at a grand soirée that promises yet another grand entrance.

Profit-Taking: The Thespian Exit of Bitcoin’s Marketplace

As unveiled by the sage scribes at Glassnode, this correction appears most serendipitously correlated with an astonishing surge of realized profits. One could almost hear the clinking of champagne glasses as investors reveled in their bounty.

A staggering $3.5 billion was realized in profits, with illustrious long-term holders (LTHs) pocketing a princely $1.96 billion, whilst the short-term holders (STHs) snatched up a mere $1.54 billion. One might say the LTHs have demonstrated the maturity of seasoned gamblers rather than the rash folly of neophytes.

This wave of profit-taking is akin to an actor gracefully exiting the stage at the pinnacle of applause, with many LTHs viewing the $123K milestone as an opportune cue to detach from the performance momentarily.

In but a single day, #Bitcoin investors realized $3.5B!

Long-term holders claimed $1.96B (~56%)

Short-term holders took $1.54B (~44%)A veritable spectacle of profit realization, chiefly by our venerable long-term holders!

— glassnode (@glassnode) July 15, 2025

The Support of $110K: The Matinee’s Ensuing Act

Despite this playful correction, certain astute analysts remain ever the optimists, like romantics at a darkened theatre. According to the eminent Mister Crypto, this decline may merely be a necessary intermission in the grand opera of Bitcoin.

He proposes that upon a return to the EMA ribbons, hovering near the illustrious $110K mark—an echo of last June’s high—we may yet witness a delightful bounce. Such a scenario could be choreographed to perfection!

Mister Crypto further opines that in a robust bullish conga line, the EMA ribbons often serve as dynamic support, holding firm like the best of leads. Should Bitcoin earnestly test this zenith and hold steadfast, we may soon be tantalized by aspirations of a rousing leap to $135K!

Institutional Holdings: The Long-Distant Serenade of Optimism

Adding to this tapestry of long-term bonhomie, our dear Mister Crypto discourses that Bitcoin Treasury companies—those illustrious patrons of cryptocurrency—now command over half the Bitcoin supply that resides within all ETFs combined. How positively thrilling!

This signals that institutional interest is not merely an ephemeral whim but represents a deeply-rooted ardor for Bitcoin. Such holdings are more akin to a grand strategic maneuver than whimsical speculation, suggesting that our more formidable players still view Bitcoin as a steadfast treasure trove in which to anchor their fortunes.

Bitcoin Treasury Companies now possess more than half the Bitcoin held in all ETFs combined!

Positively bullish for our beloved Bitcoin!

— Mister Crypto (@misterrcrypto) July 15, 2025

Read More

- Gold Rate Forecast

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- USD HKD PREDICTION

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

2025-07-15 11:53