In the grand theater of finance, where fortunes are made and lost with the flick of a pen, Microstrategy’s stock has taken flight, soaring above the mere value of its bitcoin holdings. Investors, like moths to a flame, are drawn to the explosive potential that Michael Saylor, the ever-enthusiastic executive chairman, so passionately elucidates. It is a tale of structural advantages that elude the common man, those who cling to their direct bitcoin like a child to a security blanket.

Michael Saylor’s Revelations: 4 Factors Behind MSTR’s Premium Over Bitcoin NAV

Ah, Microstrategy (Nasdaq: MSTR), a name that now dances upon the lips of investors, has found itself trading at a premium to the value of its underlying bitcoin. This curious phenomenon reflects not merely the whims of the market but rather a series of structural advantages that are as elusive as a shadow in the night. The premium, dear reader, is measured against the company’s net asset value (NAV), which, if one dares to ponder, represents the worth of its bitcoin holdings after the inevitable toll of liabilities has been accounted for. On the fateful day of August 13, Saylor took to the social media platform X, proclaiming:

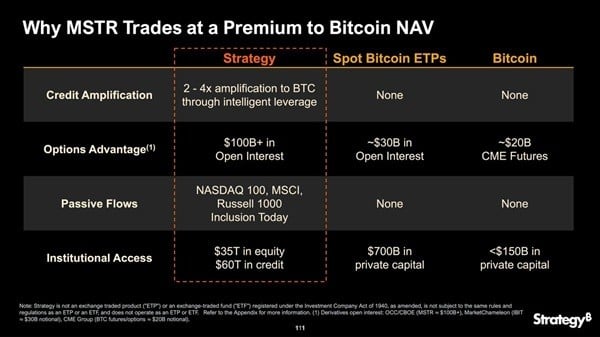

MSTR trades at a premium to bitcoin NAV due to Credit Amplification, an Options Advantage, Passive Flows, and superior Institutional Access that equity and credit instruments provide compared to commodities.

These elements, like a well-orchestrated symphony, bestow upon Microstrategy a leverage and liquidity that bitcoin itself, in its solitary existence, cannot hope to possess.

Consider, if you will, the company’s audacious ability to apply leverage of 2x to 4x to its bitcoin through the alchemy of equity-based financing. Saylor, with a twinkle in his eye, refers to this as “credit amplification,” a performance enhancer during the bullish phases of the market. In stark contrast, the humble spot bitcoin ETPs and direct bitcoin holdings languish, bereft of such leverage capabilities. Furthermore, Microstrategy revels in the bounty of over $100 billion in open interest within the traditional options markets, a staggering figure that dwarfs the paltry $30 billion for spot bitcoin ETPs and a mere $20 billion for CME bitcoin futures.

Moreover, as a proud member of esteemed indices such as the Nasdaq 100, MSCI, and Russell 1000, Microstrategy captures the passive investment flows that, alas, do not extend to bitcoin or its spot-based ETPs. It is as if the universe conspired to favor the clever over the simple.

Institutional reach, dear reader, is yet another distinguishing feature. The equity markets, with their vast expanse, offer potential access to a staggering $35 trillion in equity and $60 trillion in credit, a veritable ocean compared to the mere puddle of $700 billion in private capital available to spot bitcoin ETPs and the less than $150 billion for direct bitcoin. Critics may scoff at the valuation gap, deeming it excessive, yet proponents argue with fervor that these market dynamics justify the premium, allowing Microstrategy to amplify returns and expand its investor base beyond the confines of commodity-based bitcoin exposure.

Since the year of our Lord 2020, the company has embarked on a quest to acquire bitcoin, adopting it as a primary treasury asset. With the cunning of a fox, it funds its purchases through debt and equity offerings, thus becoming the largest corporate holder of bitcoin and a de facto proxy for investors. As of its latest public filing, Strategy holds approximately 628,946 BTC. One can only imagine the conversations at dinner parties!

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR JPY PREDICTION

- EUR NZD PREDICTION

- Bitcoin Ghosts, Rogue Bankers & The Not-So-Smart Crypto Circus: This Week’s Recap Will Make You Regret Not HODLing

- Meme Coin Mania: A $500 Million Frenzy 🤑

- 📉 SUI’s Price Plummets Below $4: Is It Time to Panic or Party? 🎉

2025-08-14 06:29