In an unexpected plot twist that sends shivers down the spines of the crypto-watching populace, analysts over at X (that’s not a party invitation, by the way) have picked up their crystal balls and proclaimed that the SEI token is gearing up for a rather jolly jaunt towards the magical land of $1.57. Yes, you read that correctly. 🤑

Macro-Chart Signals Trend Reversal as Analysts Confirm Accumulation Phase

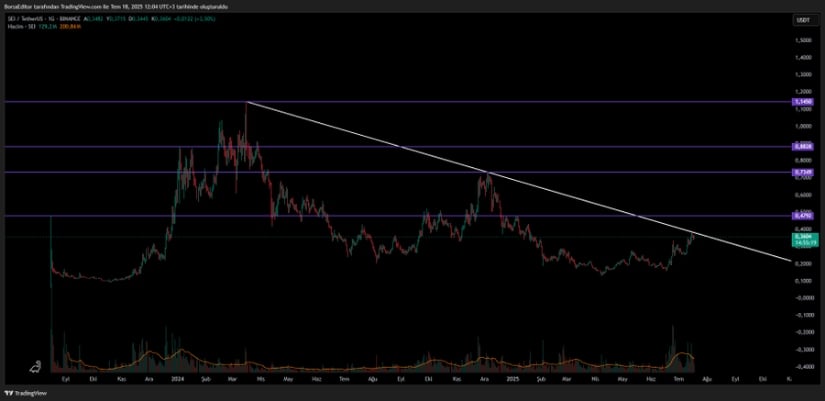

Strap in, folks! According to our dear friend Solberg Invest, the weekly SEI/USDT macro-chart has quite the tale to tell. It shows a breakout so sharp from its descending trendline that it could slice through a lemon. After languishing in the dumps for over a year—trapped beneath a trendline tighter than a Roman gladiator’s tunic—the token is now happily strutting its stuff from the $0.12–$0.22 “How Low Can You Go?” accumulation zone, which has taken on the role of a rather resilient support system. 🏋️♂️

If the chart could talk, it would be shouting, “Look at me!” as it hints at a possible multistep hike towards more respectable trading levels like $0.70, $1.00, and oh, the dreams of $1.57. The price is already frolicking over 150% higher than when the analyst barely lifted a finger to suggest it should buy one ethically produced cup of tea. 🎉 This price prediction rides on the wings of historical crypto cycles like a bird on a very, very full stomach.

Now, enter @KriptoEditoru—our time-traveling analyst who specializes in shorter time frames, which is fancy talk for “now-ish.” They’ve pointed a finger at the $0.40 resistance level, declaring it the price ceiling that could very well cause a dramatic and theatrical gasping scene if prices fail to leap above it. Think of it as the door at a highbrow club; if you can’t get through, you’re stuck pouting outside with last season’s crypto. 🙄

Breaking through this level could unleash the mystical forces leading us to $0.629 and beyond, but failure? That’s just a one-way ticket back down to lower support zones. And nobody wants that kind of trip, thank you very much.

With a recent breakout strutting its stuff, analysts are buzzing about SEI’s exit from downtrend territory and possible entrance into the land of the trend continuation. That’s the place where momentum gathers like overly enthusiastic tourists during peak season.

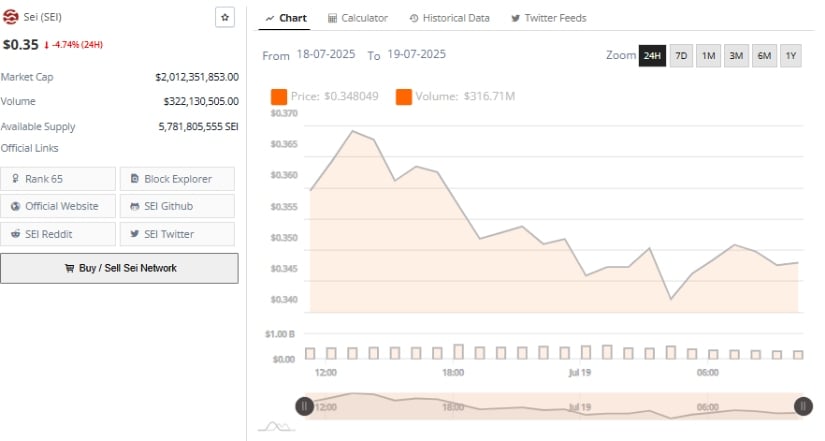

SEI Price Prediction: 24-Hour Data Shows Weakened Momentum Near Resistance

According to BraveNewCoin’s latest 24-hour data (which we assume was obtained after a vigorous tea-drinking session), SEI has decided to take a breather and has pulled back a casual 4.74%, as it lounges around the $0.35 neighbourhood. Meanwhile, a tidy volume of USDT 322 million whizzed by—a tad lower than the party levels we saw during the recent breakout. 🍵

This cautious retreat suggests a pause in buying momentum, much like one halting to catch their breath after an exhilarating dance party. This moment of introspection happens right as we approach critical resistance at $0.38–$0.40. No one likes to be the person tripping at the finish line! 😬

The price seems to have encountered a slight struggle with maintaining higher highs, having flirted with $0.3903 earlier. Relative volatility has chosen this exact moment to be a bit shy, indicating hesitation among short-term buyers, similar to that friend who always takes a moment longer at the buffet. Market sentiment? Well, it’s cautiously bullish but hasn’t had its morning coffee yet, suggesting we might need a bit more consolidation before planning our next breakout rave. 🐌

But don’t lose heart! The broader market structure remains intact. Our analysts, those daring fortune tellers, do muse that maintaining a position above $0.3030 is imperative if we want to keep our upward momentum dancing at the ball.

At the Time of Writing, Bollinger Bands Indicate a Pullback Is Healthy

At the moment of this literary escapade, SEI is trading near $0.3544 after daring itself to test intraday highs of $0.3903. The daily TradingView chart shows SEI is having a bit of a chill after reaching the upper Bollinger Band—as though it finally settled down after a manic episode of excitement. The price is comfy up above the midline Bollinger Band at $0.3033, which is now doing its best impersonation of a supportive couch. 🛋️

Our dear Bollinger Band Power (BBPower) indicator seems to be playing the role of a pessimistic friend, indicating less volatility than those wild parties seen in early July. However, the fact that SEI holds above the mid-band suggests that our bullish plot is far from over. If it decides to give it another whirl at the $0.38–$0.40 zone, we might greet renewed momentum, leading us that much closer to the elusive $0.629 and, eventually, the mythical $1.57.

How the price behaves around this $0.40 barrier will likely determine whether SEI can continue its trend or find itself drawn into the more playful realm of consolidation. Time for some popcorn and speculation! 🍿

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Trump’s Tariff Tango with China: Drama, Markets, and a Lot of Eye-Rolls 🌍💸

- The Davos Drama: Crypto, Banks, and Brian Armstrong’s High-Stakes Tea Party

2025-07-19 21:09