A tale of ceaseless peaks and troughs unfolds in the cryptic world of Bitcoin. In a week marked by the kind of volatility that could unsettle even the most hardened trader, this digital coin ascended to a dizzying high of $123,731, only to retreat, now languishing at $119,937-a fall of some 4% from its touching apex.

Amidst this tumultuous backdrop, it seems a caricature of fortitude prevails among Bitcoin’s short-term holders (STHs). Their stance-a peculiar blend of stoicism and strategy-might just be the hidden hand guiding the next surge.

Short-Term Holders: The Enigmatic Catalysts of Future Triumphs?

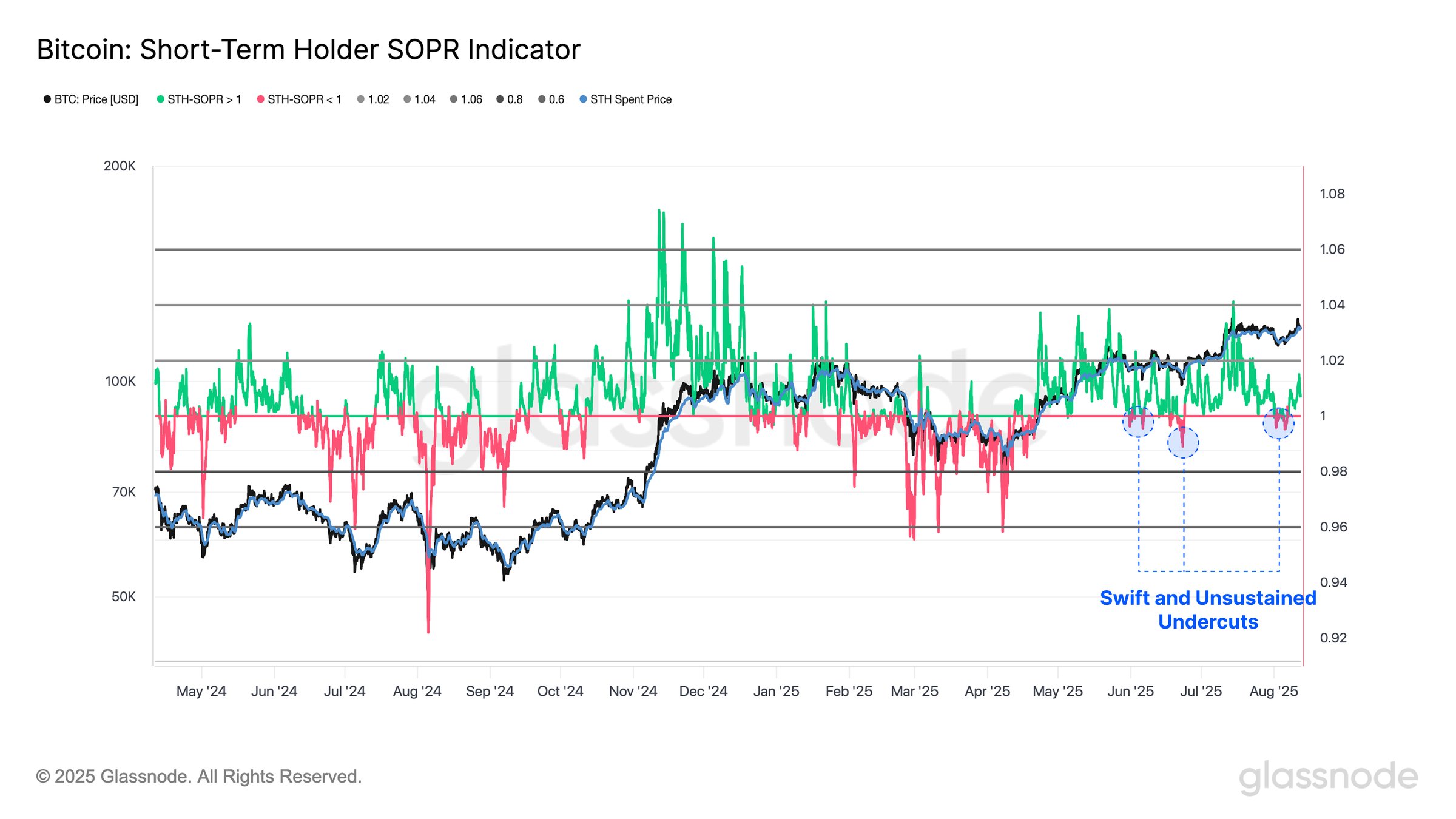

BTC STHs-those who clutch their cryptocurrency for no more than 155 days-have curiously diminished their offloading, settling into an unforeseen pattern of accumulation. Such behavior is mirrored in the STH Spent Output Profit Ratio (STH-SOPR), which, albeit briefly betraying weakness by sliding below the cherished neutral line, has made a commendable return, as confirmed by the estimable Glassnode.

The STH-SOPR-a mysterious cipher-offers insight into whether these short-timers dispatch their holdings with profit or loss. Above the neutral one, indicative of selling with profit, it reveals the bullish spirit; below, it suggests a capitulation of spirits. That this index should recover is a sign of profound significance, for these short-term holders are both spectator and puppeteer in Bitcoin’s theatre of chance. With their financial destinies dallying near the current market price, they are the harbingers of turmoil or tranquility in this cryptic domain.

The Herculean Task of Bitcoin’s Aggressive Buyers

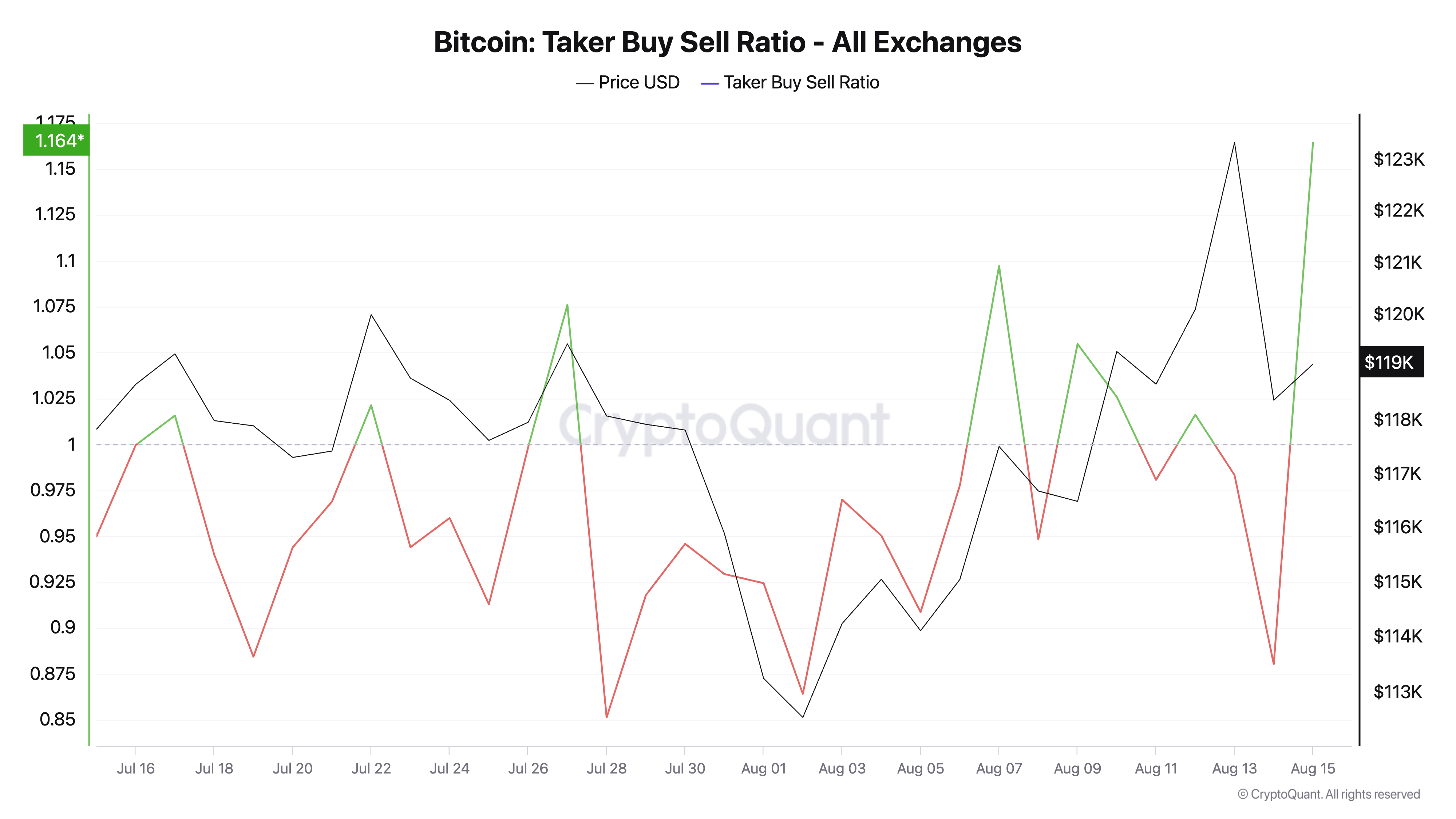

Behold the taker-buy/sell ratio, now reaching the lofty heights of a monthly pinnacle at 1.16, declaring the derivatives market’s bullish slant among the traders. This number-a somewhat devious indicator-compares the fervor of market buys to that of market sells on the futures and perpetual contracts. The fact that it overshadows the mark of one betrays the obstinate zeal of buyers over sellers, an assertion of dominance amidst the ever-ebbing and flowing tides of digital monetary art.

Thus, these zealous buyers are championing liquidity with their enthusiasm, revealing a burning demand which, as the local philosophers might declare, becomes the wind beneath the wings of the next ascent.

Fortune on the Gilded Edge: To $122,000 or Down to Despair?

Should these trends hold steadfast in the storm of speculation, and should the hand of fate not turn, Bitcoin might once again scale the vertiginous $122,000 summit in the forthcoming days. An audacious breakthrough of the $122,190 resistance might well initiate a grand renegotiation of its prior pinnacle of $123,731. But let us not forget, as often in life as in markets, that volatility may rise anew, buckling the sway of bullish conviction and returning the coin to the purgatory of $115,892.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Brent Oil Forecast

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- Bitcoin’s Wild Ride: Will It Hit $120K? 🚀

2025-08-15 10:07