Oh, Kevin Hassett. That name has suddenly become the hottest ticket in town for the next head of the Federal Reserve, and let’s just say the crypto crowd is buzzing like a pack of caffeinated squirrels. Why? Well, according to Bloomberg (which we all know is totally never biased), Hassett is now seen as Trump’s top pick to chair the Fed. This is the same guy who spent years playing nice with Coinbase and probably enjoys a nice, hefty stockpile of COIN. For crypto investors, it’s like someone just opened the candy shop.

How Will Hassett Impact The Crypto Market?

So, what does this mean for crypto? Well, apparently, it’s all sunshine and rainbows. The magic formula here? A dovish macro policy (translation: lower rates) + a guy who owns a big chunk of Coinbase. Sounds like the recipe for a juicy bull run, right? According to Juan Leon at Bitwise (who sounds like the kind of guy who wears socks with sandals but knows his crypto), “If Kevin Hassett becomes Fed Chair, the implications for crypto are strongly bullish.” Bold words, Juan. You’re saying a guy who’s publicly critiqued interest rates and has a stake in a crypto exchange is going to make crypto soar? No pressure, Kev.

But wait, there’s more! Enter stage left: Treasury Secretary Scott Bessent, who’s apparently been stirring the pot and questioning the entire post-crisis framework. The man’s got some big ideas, like calling out the “ample reserves regime,” which is a fancy way of saying, “Hey, maybe all these reserves aren’t doing us any favors.” Talk about shaking the Fed’s tree!

Felix Jauvin, who must have had too much coffee one morning, summarized it nicely: “Bessent wants a Fed chair who’ll ditch the fancy balance sheet tricks and get back to simpler, pre-ample times.” You know, just keep it simple – no QE copium here, folks. But what does this mean for crypto? One Fed policy of slashing rates? Eh, maybe. Full-on quantitative easing that sends liquidity flooding into every risk asset? Well, that’s a different story. It’s not like 2020-2021 all over again, folks. Sorry to burst your bubble.

But don’t get too comfy. Rate cuts may help the risk appetite, but they won’t automatically trigger the all-consuming “everything rally” crypto enthusiasts love to dream about. Sorry, crypto whales, it’s not a free-for-all just because the Fed throws a couple of interest rate reductions into the mix.

And why is Hassett even in the running? Macro commentator EndGame Macro (@onechancefreedm) has the answer: it’s because Hassett isn’t some dry, bookish central banker. Nope. He’s the guy Trump trusts because, well, he’s been defending Trump’s policies for years and even called out the Fed for being too slow and cautious. Markets hear “dovish,” Trump hears “growth,” and crypto folks hear, “Hey, he’s one of us!”

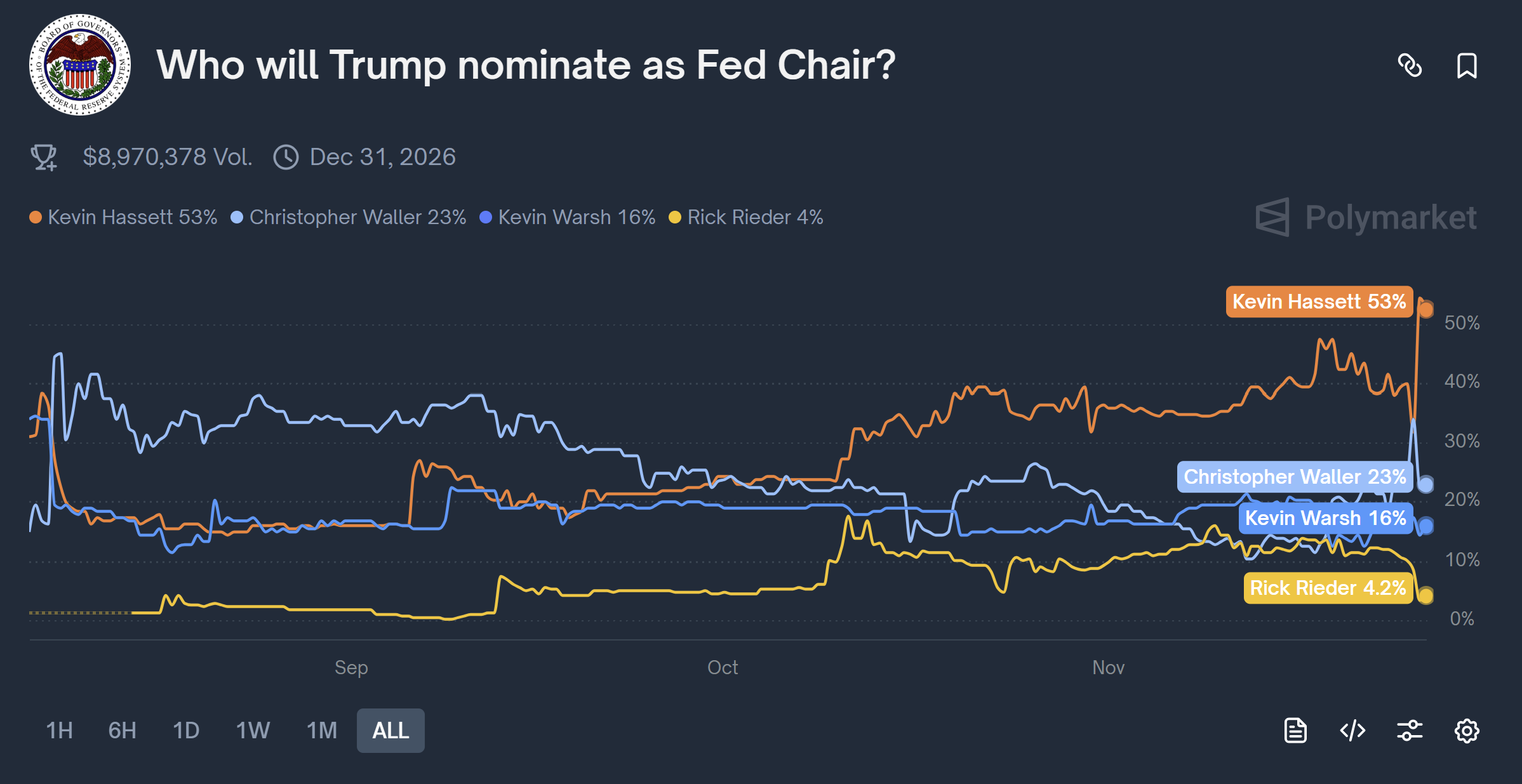

The betting markets seem to agree with this logic. Over on Polymarket, Kevin Hassett is now sitting pretty at around 53%, meaning the tide has shifted from wild speculation to a more reasonable “yeah, this could happen” vibe.

But let’s not get ahead of ourselves. Will crypto really explode? That depends on a few things: How aggressive will a Hassett Fed be? How far will Bessent push to shrink that balance sheet? And, let’s face it, how much will the market freak out about inflation and fiscal risk under a Fed that’s a little more political than before?

The odds market is signaling that crypto might finally be creeping closer to the beating heart of US monetary power. But, honestly, we won’t know until 2026. So, buckle up. The ride might be bumpy, but hey, at least the market cap is still a healthy $2.96 trillion (as of press time).

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

- Why Microstrategy’s Stock is Outpacing Bitcoin: 4 Surprising Reasons Revealed!

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- USD CNY PREDICTION

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

2025-11-27 11:10