Ah, silver! The gleaming metal that has tempted mankind since time immemorial, now poised to embark upon a journey of such historical magnitude that it might just crack the elusive barrier of $100 per ounce next year. Our dear economist and self-proclaimed oracle, Peter Schiff, asserts that the confluence of macroeconomic stress, burgeoning deficits, and the relentless tightening of supply is crafting an explosive narrative for this precious metal-a narrative that could forever alter its perceived value in the annals of financial history.

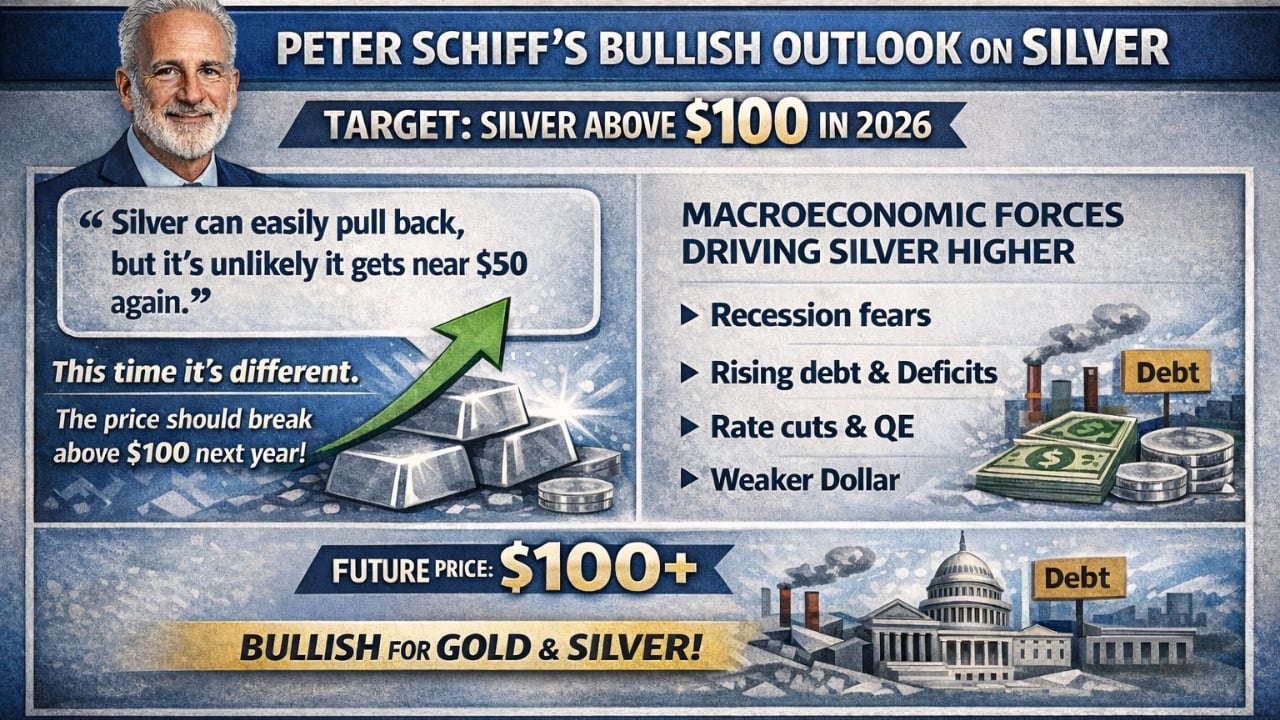

Silver Set to Clear $100 Next Year Despite Macro Volatility, Peter Schiff Claims

On the digital town square known as social media, our intrepid prophet, Peter Schiff, took to his soapbox on December 27th, proclaiming with fervor a remarkably bullish outlook on silver. He argues, with all the conviction of a man who has witnessed more market cycles than he cares to recall, that the cosmic forces of macroeconomics are aligning-much like the stars in a fated constellation-for a meteoric rise beyond $100 next year, even if the ascent is marred by the inevitable sharp and temporary pullbacks along the way. Ah, the sweet agony of investment!

In his infinite wisdom, Schiff declared: “Though silver may indeed retreat, I find it improbable that it shall ever again grace the vicinity of $50.” With a flourish befitting a bard, he added:

“Despite any potential corrections, the price shall surely break above $100 next year. This time, dear friends, it is different!”

These proclamations came amidst a chorus of skepticism from a certain Finance Guy, who cautioned-perhaps with a hint of sarcasm-that silver’s rally could ultimately culminate in a sharp reversal. A voice of caution, indeed! This skeptic opined, “I can certainly envision silver soaring past $100 only to plummet back down to $50. While I agree it’s unlikely to dip lower than that, I’d rather tether my hopes to gold or bitcoin for the long haul than gamble on silver at this juncture.” Such is the life of an investor! 🎩

Schiff, undeterred by the naysayers, reinforced his bullish thesis in yet another impassioned post, linking silver’s potential ascent to the deteriorating conditions of our macroeconomic landscape. He expounded:

“Recession, dear comrades, is a veritable friend to both gold and silver, as it begets larger federal budget deficits, interest rate reductions, expanded quantitative easing-which translates to heightened inflation-and inevitably, a weaker dollar.”

Schiff’s perspective resonates with a broader narrative-the tale of rising government debt, persistent fiscal shortfalls, and declining real interest rates, all of which have historically favored hard assets like silver. Advocates of this thesis also point to chronic silver supply deficits, the tepid responsiveness of mines, and the insatiable industrial demand from solar energy, electric vehicles, electronics, and infrastructure. Meanwhile, the skeptics remind us, with a knowing nod, that silver’s notorious volatility, driven by speculation, and its historical propensity for deep corrections underscore the perilous nature of investing in this shiny metal, making it alluring for the long-term yet fraught with risks in the short term. Oh, the irony! ⚖️

FAQ 🧭

- Why does Peter Schiff believe silver can surpass $100 next year?

Peter Schiff contends that escalating fiscal deficits, potential recession-driven stimulus, interest rate cuts, and ongoing silver supply shortages create a macro environment ripe for propelling silver beyond $100, despite the ever-present specter of volatility. - What macroeconomic factors are most bullish for silver investors?

According to Schiff, recessions typically expand governmental deficits, trigger quantitative easing, weaken the dollar, and elevate inflation expectations, all of which historically support higher silver prices. - How does silver’s supply-demand dynamic bolster the bull case?

Chronic supply deficits, limited mine output growth, and robust industrial demand from solar energy, electric vehicles, electronics, and infrastructure suggest that long-term silver prices may be structurally higher. - What risks should investors consider despite the $100 silver thesis?

Silver remains highly volatile, with a history of sharp corrections, speculation fueled by leverage, and sensitivity to macroeconomic shifts, rendering it attractive for long-term holders but treacherous over shorter horizons.

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

2025-12-29 01:08