Amidst weeks of monotonous wandering, the XRP price today finds itself squeezed within an ever-narrowing corridor. The air is thick with whispers of a looming breakout towards the magical figure of $5, fueled by both technical formations and the latest whispers from Ripple’s corridors of power.

XRP Price Holds Steady as Triangle Tightens Its Grip

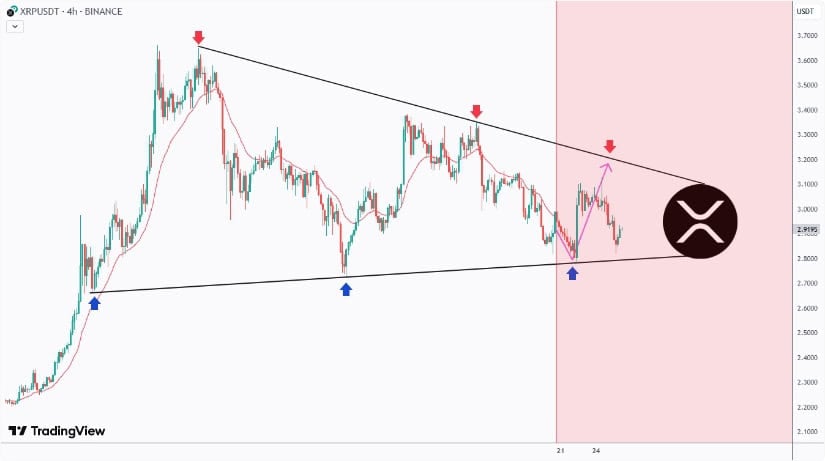

On August 25, XRP clung to a precarious perch near $2.92, just above the crucial support levels of $2.86-$2.88. The ceiling, however, remained stubbornly fixed around $3.05-$3.12, creating a symmetrical triangle on the four-hour chart that seemed to mock the patience of traders. Analysts, with their usual blend of caution and optimism, noted that this compression was a delicate dance between bulls at the base and bears lurking overhead.

Data from the market revealed a curious phenomenon: exchange outflows totaling $12.7 million. This silent exodus suggested that investors might be quietly amassing XRP during the pullback-a move that, historically, tends to ease the immediate selling pressure and set the stage for a bullish surge if momentum picks up.

Technical indicators, ever the barometers of market sentiment, reflected the prevailing indecision. The Relative Strength Index (RSI), hovering in the low 40s, hinted at waning momentum but stopped short of signaling an oversold condition. A rebound above 45-50 could breathe new life into the bulls, while a dip below 40 might spell trouble for the optimists.

Rare Bullish Patterns Herald Potential Upside

Beyond the short-term consolidation, XRP’s technical charts were a treasure trove of bullish omens. The daily chart revealed three rare and tantalizing patterns: a golden cross, a bullish flag, and a cup-and-handle formation. Each one seemed to whisper promises of significant gains:

- The golden cross, a harbinger of long-term bullishness, materialized in July when the 50-day moving average surged above the 200-day line.

- The bullish flag, a sign of ongoing accumulation, followed a robust upward trend earlier in the summer.

- The cup-and-handle pattern, with its characteristic U-shape and handle-like pullback, hinted that the current lull could be the prelude to a powerful breakout.

Collectively, these patterns painted a picture of a market poised for a significant move. Analysts predicted that a decisive breach of the year-to-date high of $3.65 could usher in the next leg of the bull run, with targets reaching as high as $5-a gain of nearly 70% from current levels.

Ripple Fundamentals Add Fuel to the Fire

While the technical setup provided a compelling case, Ripple Labs continued to fortify XRP’s foundations. The company’s dollar-backed stablecoin, RLUSD, had grown to over $686 million in assets, with trading volumes surpassing $2 billion in the past month. This surge positioned Ripple as a formidable player in the stablecoin arena, challenging the dominance of established rivals in cross-border payments.

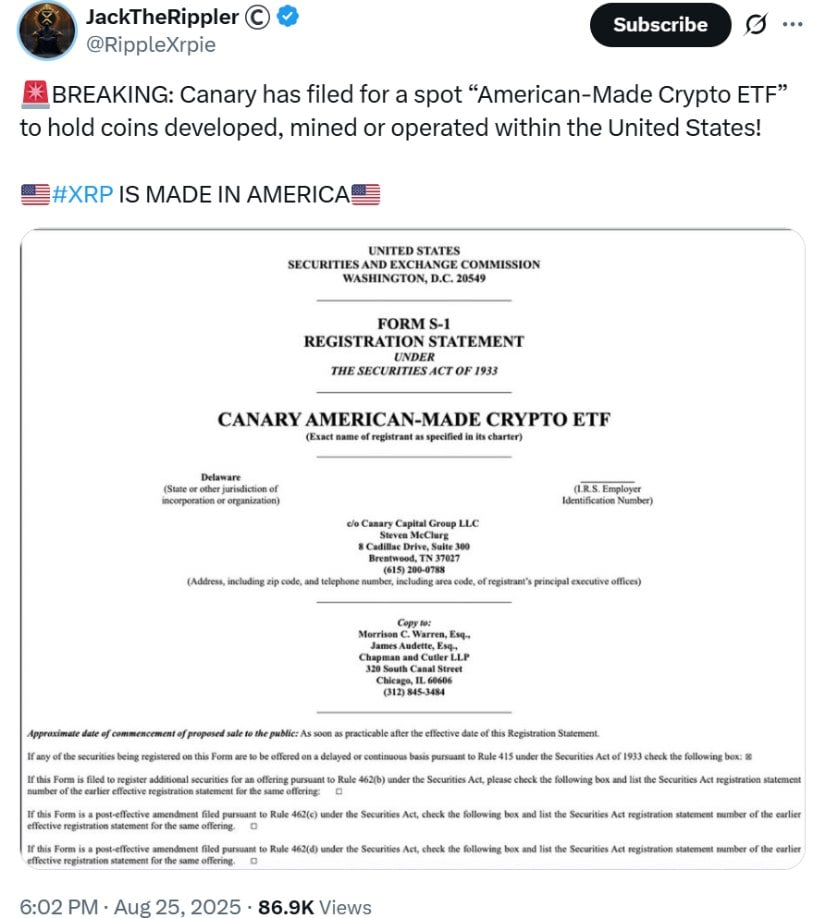

Institutional adoption could further stoke the flames of the next rally. The SEC’s pending decision on spot XRP ETFs, expected later this year, loomed large on the horizon. Bitcoin and Ethereum ETFs had already attracted billions in investments, accounting for over 5% of their respective market caps. If XRP followed suit, it could draw in close to $10 billion in assets in its early years.

Ripple’s ambitious goal to challenge SWIFT in global settlements added another layer of strength to the XRP narrative. Coupled with whale accumulation and rising open interest, the sentiment surrounding XRP predictions for 2025 and beyond remained decidedly optimistic.

XRP Short-Term Outlook: A Delicate Balance

For the moment, XRP’s price remains ensnared between the support of $2.86 and the resistance of $3.12. Bulls will need to reclaim the $3.05-$3.12 zone to aim for $3.25, and eventually $3.34-$3.50. A daily close above $3.65 would confirm the breakout, setting the stage for a rally toward $5.

Conversely, a breach below $2.80 could unravel the bullish structure, potentially sending XRP tumbling to $2.74 or lower. Until the triangle resolves, traders will remain on edge, but the growing array of technical and fundamental signals suggests that XRP might be on the cusp of a decisive move into September. 📈✨

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- 🚀 Ethereum’s Grand Farce: Developers Flock, Bitcoin Yawns, Solana Whirls! 🎭

- EUR HUF PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Crypto Chaos: Ripple’s Legal Boss Warns of an Endless Puzzle of Regulatory Nonsense

2025-08-26 18:07