Recent price action, volume trends, and the broader accumulation structures have conspired to paint a picture of cautious optimism among traders, much like a debutante nervously eyeing the dance floor, as the market balances within a clearly defined range, poised for a possible breakout. 🎩✨

Consolidation Within Key Trading Range Signals Indecision

Analyst Baykus, with the sagacity of a seasoned fortune teller, highlights Worldcoin’s (WLD) clear range-bound price structure, trading between the approximate supports and resistances of $0.90 and $1.15, respectively. This consolidation, akin to a chess match where every move is scrutinized, indicates a profound indecision, where buyers and sellers are locked in a stalemate, causing the price to oscillate without a clear trend. The repeated tests of these boundaries suggest that liquidity is as stubbornly concentrated at these levels as a mule on a hot summer day, making them critical zones to monitor for potential breakouts or breakdowns. 🐴🔥

The $1.00 mark acts as a crucial pivot point within this range, with the price frequently reverting to this midpoint after testing both the upper and lower limits, much like a pendulum swinging between the whims of fate. Traders often use these zones to enter mean-reversion trades, going long near the lower boundary and short near the upper one, a strategy as predictable as the sunrise, which explains why the asset has remained confined within this sideways pattern. Volume and momentum will be key factors to observe in future attempts to breach these levels, much like a general preparing for battle. 🌅⚔️

Looking ahead, a decisive close above $1.15 could expand the trading range and push the token toward the lofty heights of $1.20 or even $1.25. Conversely, breaking below $0.90 risks a quick decline toward the more modest $0.86 or $0.80, as liquidity below support becomes as vulnerable as a house of cards. This setup suggests that heightened volatility may ensue once the range finally resolves, making patient, disciplined trading essential in the interim, much like waiting for the right moment to propose marriage. 💍⏳

Intraday Performance Flags Momentum Loss but Shows Resilience

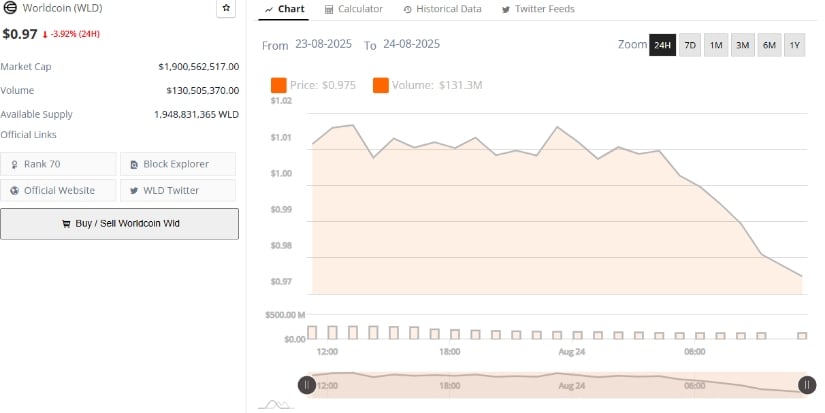

Additionally, BraveNewCoin’s 24-hour chart reveals a gradual decline from $1.01 toward intraday lows near $0.97, followed by a sharper pullback in the final hours, a performance as graceful as a swan but as tumultuous as a stormy sea. This steady weakening in price action points to an imbalance between buyers and sellers, signaling cautious market sentiment as demand diminishes near local highs. 🌊🕊️

Volume analysis complements this view, showing approximately $131 million traded, but with declining volume as the price fell, a phenomenon as subtle as a whisper in a crowded room. Thinning liquidity during downswings suggests that small sell orders could impact prices disproportionately, increasing volatility risks. Given the reduced trading activity, entering positions at recent lows requires caution to avoid getting caught in sudden moves, much like stepping into quicksand. 🌋🚫

Still, WLD maintains a sizable market cap of around $1.90 billion, with nearly 1.95 billion tokens circulating, a scale that mitigates against the extreme intraday swings typical in smaller-cap tokens. A recovery above the $0.99-$1.00 zone with strengthened volume would signal renewed bullish interest, much like a knight returning to the castle with a dragon’s head. Until this occurs, sideways price action around $0.95 to $0.97 is the most probable near-term scenario, a scene as predictable as a soap opera. 🏰🐉📺

Broader Accumulation Structure Supports Bullish Outlook

A longer-term perspective from TOP GAINER TODAY highlights a series of rising bases for WLD, with the most recent consolidation occurring near $0.90-$1.00, a pattern as methodical as a well-rehearsed ballet. This pattern demonstrates gradual seller absorption, building a foundation for future upward moves, much like laying bricks for a skyscraper. The analyst’s bullish projection targets a journey back to double-digit prices, contingent on sequential breakouts and momentum alignment, a vision as grand as a king’s dream. 🏢👑

Key resistance levels line the path upward, starting with $1.10-$1.15, then $1.30 and $2.00, each a formidable barrier as challenging as scaling a mountain. Surpassing these would pave the way to higher objectives like $4 and $6, eventually making a move toward $12 feasible, a journey as epic as a hero’s quest. Each resistance zone serves as a critical checkpoint, requiring confirmation before advancing further, much like a pilgrim seeking holy relics. 🏔️🔍📜

Risk management remains a priority; a breakdown below the upward-trending support line would challenge the bullish narrative and potentially usher in deeper declines, a scenario as dire as a shipwreck. Traders should utilize stops below recent swing lows while watching for sustained defenses of the $0.90 base. Successfully overcoming resistance levels would validate the bullish roadmap and potentially propel the memecoin into a more pronounced medium-term uptrend, a triumph as glorious as a knight’s victory in a tournament. 🛥️🛡️🏆

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: Ripple’s Legal Boss Warns of an Endless Puzzle of Regulatory Nonsense

- XRP: A Most Lamentable Fall! 📉

- TRON’s Stablecoin Chaos: Whales Wobble, Binance Falls! 🐉💸

- EUR HUF PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- XRP Stands at $2.96-Is it the Final Battle or Just a Whimper? 🚨

2025-08-24 21:44