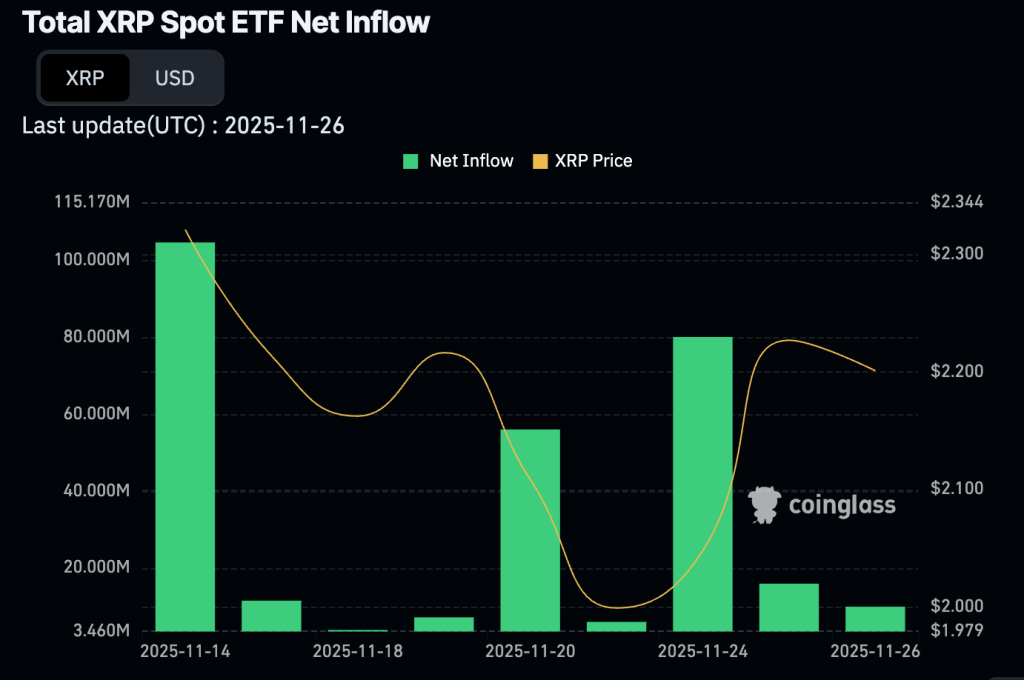

The launch of XRP exchange-traded funds (ETFs) descends upon the crypto market like a storm, leaving analysts squinting at screens as if the numbers might bite. Institutional interest creeps forward, promising to bend both XRP prices and fund behaviors in ways that feel suspiciously theatrical.

ETF Demand is Exploding

Eight trading days-barely enough time to brew a proper cup of tea-and XRP ETFs have amassed over $644 million. Canary Capital, Bitwise, Grayscale, and Franklin Templeton are gobbling tokens like a buffet you shouldn’t be allowed to attend.

Canary Capital’s XRPC ETF launched with $245 million, now puffed up to $329 million. Bitwise collected $168 million. Grayscale and Franklin Templeton each bagged roughly $150 million in just two days. One wonders if their wallets come with elastic seams. 🤨

As more ETFs tiptoe into the market, early guesses suggest seven XRP funds might haul in $7-$10 billion per year. Yes, you read that right. Billions. With a B. And yet, the common folk sip tea quietly, as if nothing happened.

XRP Price Forecast

Chad Steingraber, bravely staring into the institutional abyss, calculates how ETF demand shapes XRP’s price. In a scenario where institutions inject $33.6 billion yearly, higher prices ironically slow ETF consumption. It’s like watching a cat hesitate at the edge of a bathtub: amusing but inevitable.

At $11.25, funds might snag 3 billion XRP annually. At $22.50, 1.49 billion. $45 brings 746 million. $90-373 million. $135-248 million. $225-149 million. Patience is apparently the ultimate investment tool, along with irony. 🤷♂️

ETF entry pressures XRP’s price upward, a curious strategy to restrain asset managers from hoarding too quickly. Who knew economics could be so theatrical?

Despite this, XRP trudges along quietly at $2. Early ETF purchases sneak through OTC desks, leaving public exchanges blissfully unaware, like a cat burglar tiptoeing past sleeping guards. With Bitcoin correcting below $100,000, XRP remains in a calm, suspiciously smug state.

Steingraber warns: this peace is fragile. If ETF inflows continue while XRP supply constricts, prices could leap like startled hares, offering brave investors fresh opportunities-or new headaches. 🐇

What Happens If XRP Supply Tightens?

ETF accumulation could squeeze available XRP. Should scarcity bite, managers may resort to share splits-financial magic tricks worthy of a circus ringmaster.

Example: one share with 10 XRP might split 2-to-1, giving you 2 shares of 5 XRP each. Repeat, escalate to 10-to-1 or even 50-to-1. Investors keep their “value” while the actual tokens shrink like a sweater in the wash. 🧦

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and more. Or just enjoy the show-it’s free entertainment. 🎭

FAQs

Why are XRP ETFs attracting so much demand?

Institutions crave regulated, easy access to XRP without wrestling with crypto themselves. Who needs that kind of stress? 😅

How do XRP ETF inflows affect XRP’s price?

More inflows tighten supply, nudging the price up as funds play tug-of-war over limited tokens.

How much money could XRP ETFs attract each year?

Early estimates suggest multiple ETFs could haul $7-$10 billion annually. Meanwhile, regular humans continue scrolling memes. 💸

Read More

- Gold Rate Forecast

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Silver Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Brent Oil Forecast

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2025-11-27 14:02