Oh, dear. It seems Kanye West-sorry, Ye-has decided to grace the world with yet another masterpiece: a meme coin called Yeezy Money (YZY). Launched with all the fanfare of a Lancre Morris Dance, it promptly collapsed faster than a poorly constructed Ankh-Morpork bridge. Allegations of insider trading and token hoarding? Well, butter my biscuit, who saw that coming? 🤡💰

Ye’s ‘New Economy’: Where the FAQ Says “Not an Investment” and Everyone Shouts “Hold My Beer” 🍺

Reports from the Discworld-er, the real world-indicate that Ye’s Solana-powered meme token, Yeezy Money (YZY), has officially gone live. Ye’s X account (formerly known as Twitter, because why not rename everything?) broadcast the news to his 33 million followers, declaring “Yeezy Money is here.” Because, clearly, what the world needs is another cryptocurrency. 🌍💸

On Aug. 21, Ye shared the contract address and a link to the YZY Money website, describing it as “A NEW ECONOMY, BUILT ON CHAIN.” The website bills YZY as the currency for a new financial system, complete with Ye Pay (because why not?) and a YZY card for transactions within its ecosystem. Sounds legit. 🤔

According to Coingecko, YZY is trading at approximately $1.02 per token, down 32.8% in 24 hours. The token’s market capitalization is around $132.5 million, with a fully diluted valuation nearing $1.019 billion. The 24-hour trading volume reached $464.35 million, and the circulating supply is listed as nearly 130 million tokens, roughly 13% of the planned 1 billion total supply. Or, as Nanny Ogg would say, “That’s a lot of sausages.” 🌭

Coinmarketcap, which ranks YZY around #160, reported a slightly lower price between $0.98 and $0.99, a market cap of $297 million, and a circulating supply of nearly 300 million tokens. The platform also highlighted a 24-hour volume-to-market-cap ratio of 324%, indicating intense speculative trading. Or, in other words, a lot of people shouting “Buy! Buy! Buy!” while running in circles. 🏃💨

Onchain data from Solscan shows the token address DrZ26cKjDksVRWib3DVVsjo9eeXccc7hKhDjviIYEEZY was first minted on Aug. 17, 2025 – four days before the public launch. The current supply is listed as nearly 1 billion tokens, with over 36,000 holders. Solscan also shows the authority address is enabled, meaning the contract owner can modify metadata, mint new tokens, or alter fees. Because who doesn’t love a bit of flexibility? 🤹♂️

The official YZY Money website outlines “YZYNOMICS,” a distribution plan allocating 20% of tokens to the public, 10% to liquidity, and 70% to Yeazy Investments LLC. The company’s portion is subject to cliff-and-vesting schedules, which sounds about as exciting as a lecture from Lord Vetinari. 📉

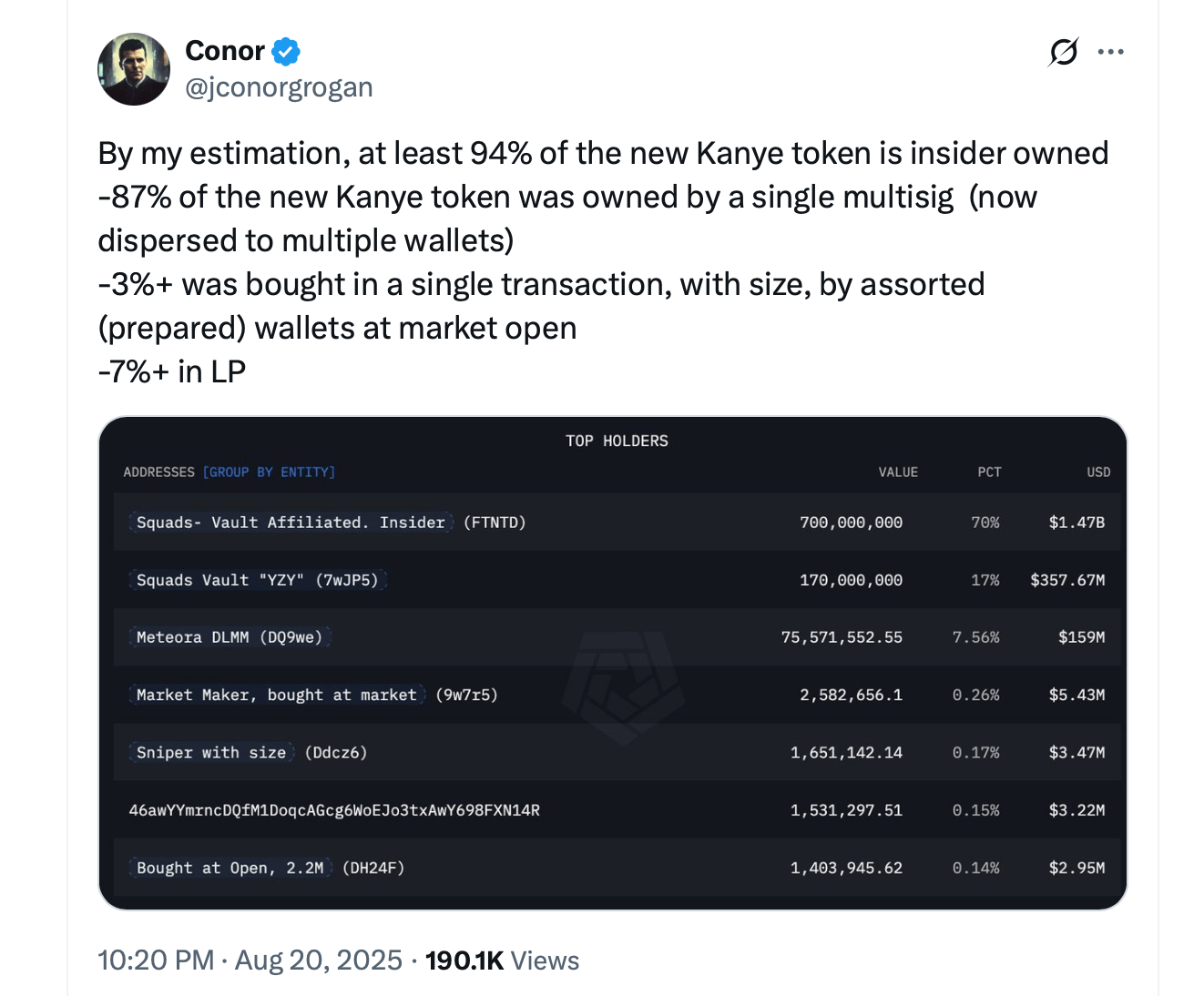

Despite these claims, holder concentration is severely skewed. Solscan data reveals that the top ten wallets control approximately 93% of the supply. The top four wallets alone hold 80%. The largest wallet contains 270 million tokens (27% of supply), followed by three wallets holding 180 million, 180 million, and 170 million tokens, respectively – all believed to be insider addresses. The fifth-largest holder is the Meteora DEX YZY-USDC liquidity pool, which holds 9.5% of tokens. Sounds fair. 🙄

Ye’s X promotion triggered a buying frenzy. The token launched on Meteora with a single-sided liquidity pool containing only YZY tokens, no USDC. This allowed the price to surge arbitrarily, rising from approximately $0.035 to $3.16 within 40 minutes – a gain of 6,800%. At its peak, Nansen analytics estimated the market cap reached $3 billion before collapsing later that day. Because nothing says “stable investment” like a 6,800% spike followed by a crash. 🚀💥

Multiple analytics firms raised insider trading concerns. Lookonchain noted the single-sided pool allowed developers to manipulate liquidity. Coinbase Director Conor Grogan stated that 94% of the supply was held by insiders at launch, with 87% initially in one multisig wallet. He estimated only 3% of tokens were bought at launch and 7% placed in liquidity. Sounds like a totally fair and transparent system. 👌

BitMEX co-founder Arthur Hayes spoke about the token, posting,

“PIs don’t rug me @kanyewest!!! $YZY for the win … cause bull market. Yachtzee.”

Profit-taking and manipulation fears led to a rapid crash. By the morning of Aug. 21, the token traded around $1, and the market cap fell to roughly $345 million. Because nothing says “trust” like a project that loses 90% of its value overnight. 📉💔

YZY joins other celebrity tokens like LIBRA and TRUMP that have faced scrutiny. Given the token’s design and concentration, it operates more as a speculative meme coin than a sustainable financial system, carrying significant pump-and-dump risk. Or, as Rincewind would say, “This is about as stable as a one-legged wizard on a tightrope.” 🧙♂️🪑

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- XRP: A Most Lamentable Fall! 📉

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- XRP: Banking, Bonds, and Bonkers Politics – What’s Next?

2025-08-21 17:28