Well, I reckon Curve and Yieldbasis have cooked up a fine collaboration that’s turned the world of decentralized governance on its head, like a drunken squirrel on a rollercoaster, igniting a whirlwind of DAO proposals, liquidity explosions, and cash streams fancier than a one-legged rooster at a square dance-all centered on the growth of crvUSD.

Curve and Yieldbasis: A Union of Grand Schemes

Now, let me tell ya, this partnership ‘twixt Curve and Yieldbasis is strutting out of the gate faster than a cat on a hot tin roof, with mutual incentive pedestrians hand-in-hand under a shared liquidity umbrella, as noted in Curve’s latest analysis; a raucous affair, truly.

In case you’re wondering, Yieldbasis has set its sights on kicking impermanent loss (or as I like to call it, that pesky IL) out the door in automated market makers (AMMs), allowing folks to deposit BTC derivatives to keep them busier than a one-armed paperhanger. They are maintaining a spiffy 2x compounding leverage through Curve’s crvUSD credit line. This setup is like a self-playing piano, integrating Curve’s AMM and DAO-approved credit facilities to cook up a liquidity feast.

Now, governance activity has surged recently-yes sir! On the 24th of September, the Curve DAO pulled the lever on Yieldbasis’ initial crvUSD credit line of a hefty 60 million bucks, with pools filling up quicker than a piñata at a birthday bash. Just a few votes later, they expanded that line to a whopping 300 million crvUSD by mid-October, each round being snatched up like hotcakes at a Sunday breakfast. The latest round of voting on October 15 even rolled out YB token emissions and an airdrop for those trusty veCRV holders who cheered for the earlier proposals.

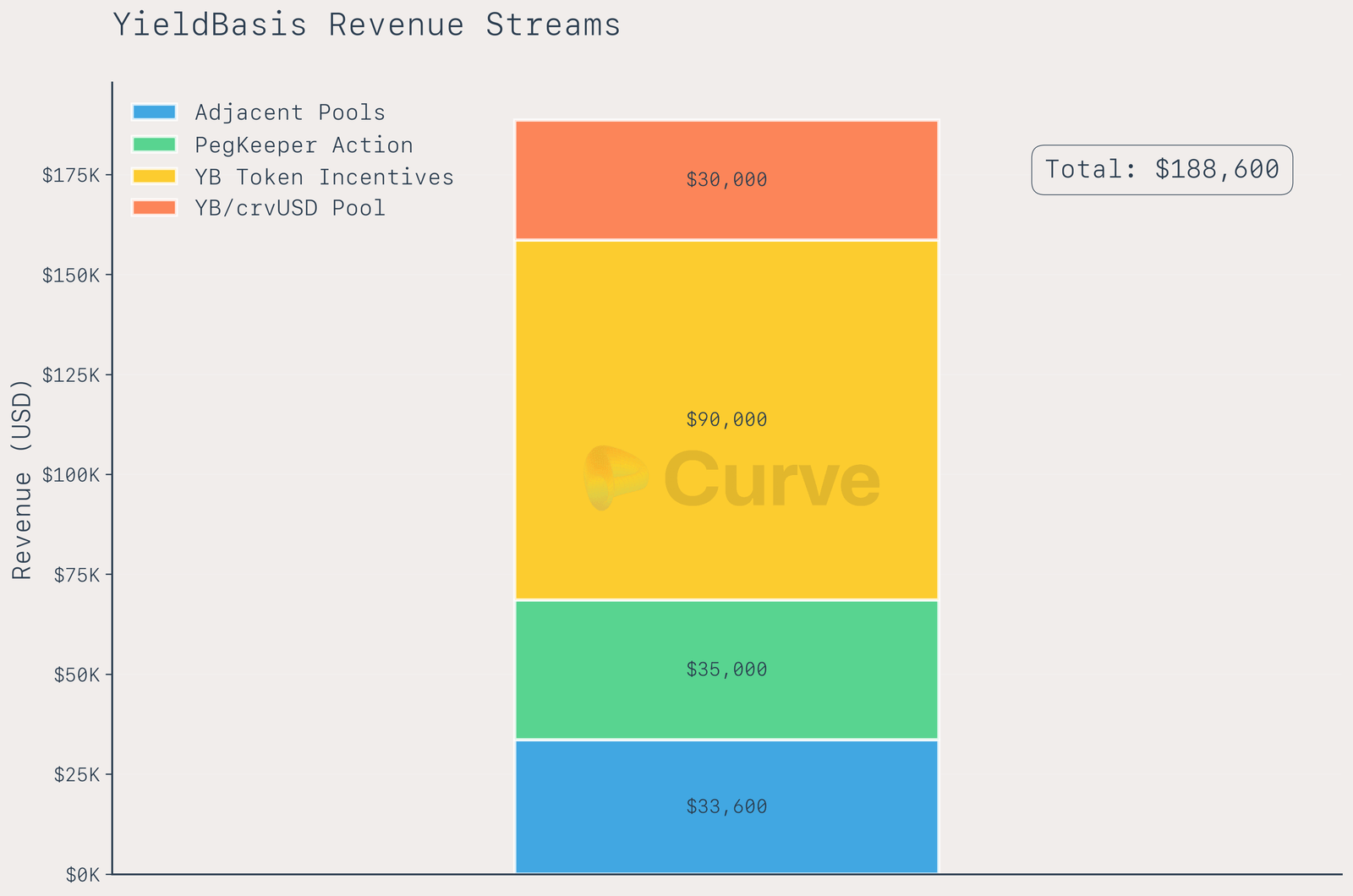

That report goes on to say that every single BTC dollar deposited into Yieldbasis spruces up to $2 in total value locked (TVL) on Curve like magic, pushing that TVL from a meager $6 million to a staggering $300 million. And as if that weren’t enough, trading antics from Yieldbasis threw a shoe into adjacent volume on Curve’s crvUSD-based pools, racking up an astounding $188,000 in revenue thus far. PegKeeper operations even managed to contribute around $35,000 to stabilizing crvUSD’s peg while beefing up DAO profits. Ain’t that a hoot?

Looking down the road, Curve governance is puzzling over proposals to expand Yieldbasis in a way that won’t bring the whole barn down. Proposal #1238 is urging folks to redirect YB emissions into a DepositPlatformDivider contract to fund vote incentives through Votium and VoteMarket, while Proposal #1241 is aiming to triple PegKeeper capacity. These shenanigans are all aimed at enhancing crvUSD liquidity, which remains as critical as a light bulb in a dark barn before any further fox trots with credit line expansions.

Chief honcho Michael Egorov has his proposal package emphasizing slow and steady wins the race-boosting crvUSD stablecoin supply, aligning feeding times for emissions incentives, and setting the stage for a potential $1 billion allocation to Yieldbasis once we’ve got a firm grip on that slippery liquidity. It’s a topic of great debate among DAO participants, who continue to chew over how to maintain a graceful dance between Yieldbasis expansion and Curve stability. It’s like trying to juggle eggs on a unicycle if you ask me!

Yieldbasis has shown it can pump up Curve’s liquidity, volume, and DAO revenue like a prize bull at a county fair. But whether this partnership can keep cruising along without throwing crvUSD’s stability off the rails – well, that’s the $1 million question folks, and a mighty test for Curve’s next chapter in the wild world of decentralized growth.

FAQ

- What is Yieldbasis?

Yieldbasis is a protocol built on Curve that’s like a magic trick for eliminating impermanent loss for BTC liquidity providers via 2x leveraged crvUSD positions. Ain’t that somethin’? - How has Curve benefited from Yieldbasis?

Curve’s reaping TVL growth, new trading revenue, and long-term token emissions like a squirrel after a pile of acorns. It’s been quite the windfall! - What DAO votes shaped the partnership?

Key votes have expanded Yieldbasis’ crvUSD credit line to $300 million and kicked off YB token emissions, proving that democracy can indeed be lucrative! - What’s next for Curve and Yieldbasis?

Governance votes are on the horizon, aimed at pouring more liquidity into crvUSD while making sure Yieldbasis pools expand safely without causing a ruckus.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

- BONK Falls, Pump.fun Reclaims Throne – Can BONK_FUN Fight Back?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

2025-10-22 21:03