The Shocking Truth About XRP’s Price Plummet (And It’s Not What You Think!)

On that mysterious land called X, Morgan declared, “The biggest, baddest reason XRP’s price jiggles is because it’s caught in Bitcoin’s wild up-and-down tango.”

On that mysterious land called X, Morgan declared, “The biggest, baddest reason XRP’s price jiggles is because it’s caught in Bitcoin’s wild up-and-down tango.”

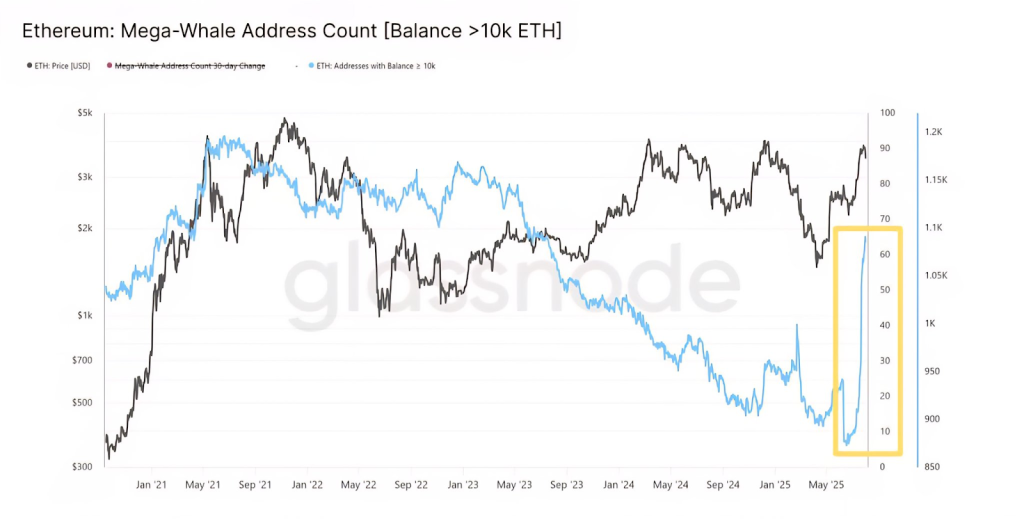

The on-chain evidence is both startling and suspicious: Ethereum exchange reserves are dwindling to their lowest levels not witnessed since records began. Here we see those fabled experts boil over with talk of a so-called “supply shock.” With a dearth of coins making their way to the exchanges and the incessant buying pressure exerted by these titanic whales and their ilk, the market tightropes on a tightrope of scarcity.

On Thursday, Bloomberg-ever the diligent chronicler of political melodramas-reported that the Trump administration, in its infinite wisdom, is allegedly considering other candidates for the CFTC throne. Sources, who presumably whispered this while hiding behind potted ferns, suggest Quintenz’s confirmation delay has sparked a delightful scramble.

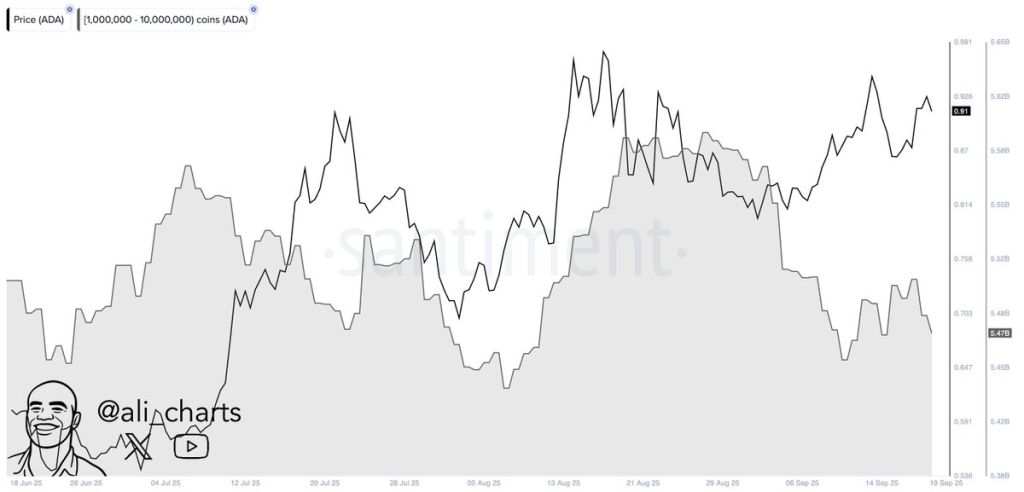

Whales, those digital leviathans, have been busy lately. Not swimming with the current, no-unloading their cargo. Santiment’s data, polished by the oracle Ali, tells a tale: as ADA inch-ticks toward $1, the big boys (holders of 1-10 million ADA) are shedding their stash. Right now, they hoard 5.47 billion ADA, a mountain of coins ready to avalanche if they sneeze. It’s a dance of profit-taking and panic, folks. Price climbs, whales retreat-like a parade where the float’s moving forward but the parade goers are walking backward. 🐚

Enter NBA star Kevin Durant, who recently resurrected a Coinbase account that had been lounging in the digital graveyard for about ten years. Apparently, the account was created after a dinner in 2016 where Bitcoin was the topic of endless speculation. Fast forward to now, and it was *finally* unlocked, thanks to the magic of modern tech, or perhaps just some really good tech support. (A big shout-out to Coinbase CEO Brian Armstrong, who confirmed the recovery on X-because, why not, social media is now the official channel for important news? 📱)

The question, my friends, is whether Algorand can withstand this onslaught. Can it hold its ground? The answer, as always, is a shrug and a mumbled, “Perhaps.” If, and I use the word with the utmost caution, if those valiant retail buyers (bless their stubborn hearts) can staunch the bleeding at $0.2200 and somehow, against all odds, surge beyond $0.2607, then perhaps, just perhaps, we might see a climb towards a glorious $0.2993. A veritable mountain, that.

Apparently, the $XRPR ETF managed a rather impressive $37.7 million in volume on its first day, beating out $IVES (who, frankly, should know better). It seems to be the biggest first-day natural trading volume of any ETF launched in 2025. Dogecoin’s new offering, $DOJE, wasn’t far behind at $17 million – which just proves one thing: people still have money to burn. 🔥 Out of 710 launches this year, yes, quite a feat.

“Markets are underpricing the likelihood of rapid rate cuts,” sighed Economist Timothy Peterson, as if the Fed were a mischievous child with a penchant for chaos. 🤡

The learned scholars of technical analysis have declared this ascent was carefully plotted beforehand, like a well-scripted play. Upon meeting their intended targets, the more sensible traders, not unlike prudent ladies and gentlemen at a soirée, swiftly gathered their gains. Presently, all indications whisper of waning enthusiasm and an uptick in sellers, who, inevitably, disrupt the harmony of the market dance.

The brilliant minds behind Pi Network have, at long last, bestowed upon us the Fast Track KYC – an ingenious little update that leverages the ever-growing powers of AI. The feature promises to allow Pioneers (yes, even those who have not yet seen the light of Pi) to complete KYC and enter the Mainnet ecosystem at lightning speed.