When Bunnies Go Boom: $8.4M Vanishes in DeFi Debacle 🐇💸

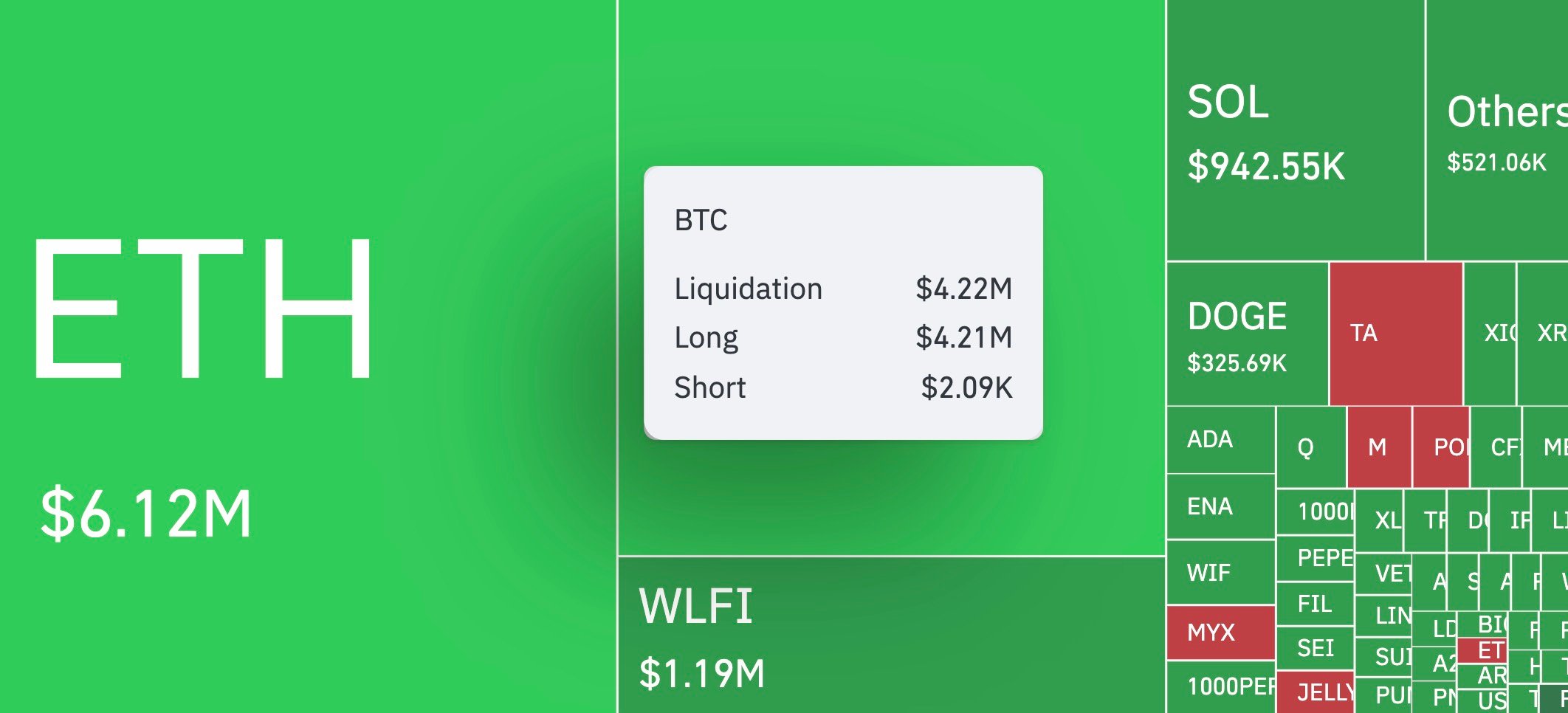

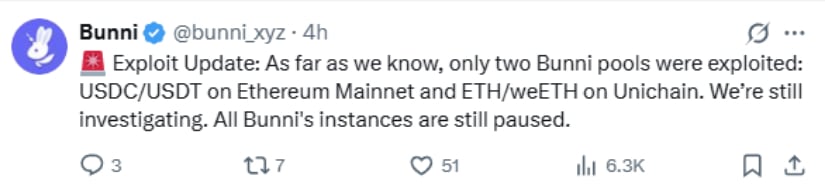

Picture this: a hacker, armed not with brute force but with mathematical precision, exploited Bunni’s custom LDF system. This mechanism, designed to shower liquidity providers with returns, was tricked into miscalculating ownership stakes. Victor Tran, co-founder of KyberNetwork, spilled the beans on social media: the attacker executed trades with amounts so specific they could make a mathematician blush. 😳 Repeating this process like a magician pulling endless rabbits from a hat, the hacker siphoned off tokens worth $2.4 million from Ethereum and $6 million from Unichain. And just like that, poof! The funds vanished into Ethereum via the Across Protocol. 🪄💰