Ethereum’s Grand Collapse: $3,200 or Bust! 🚀💸

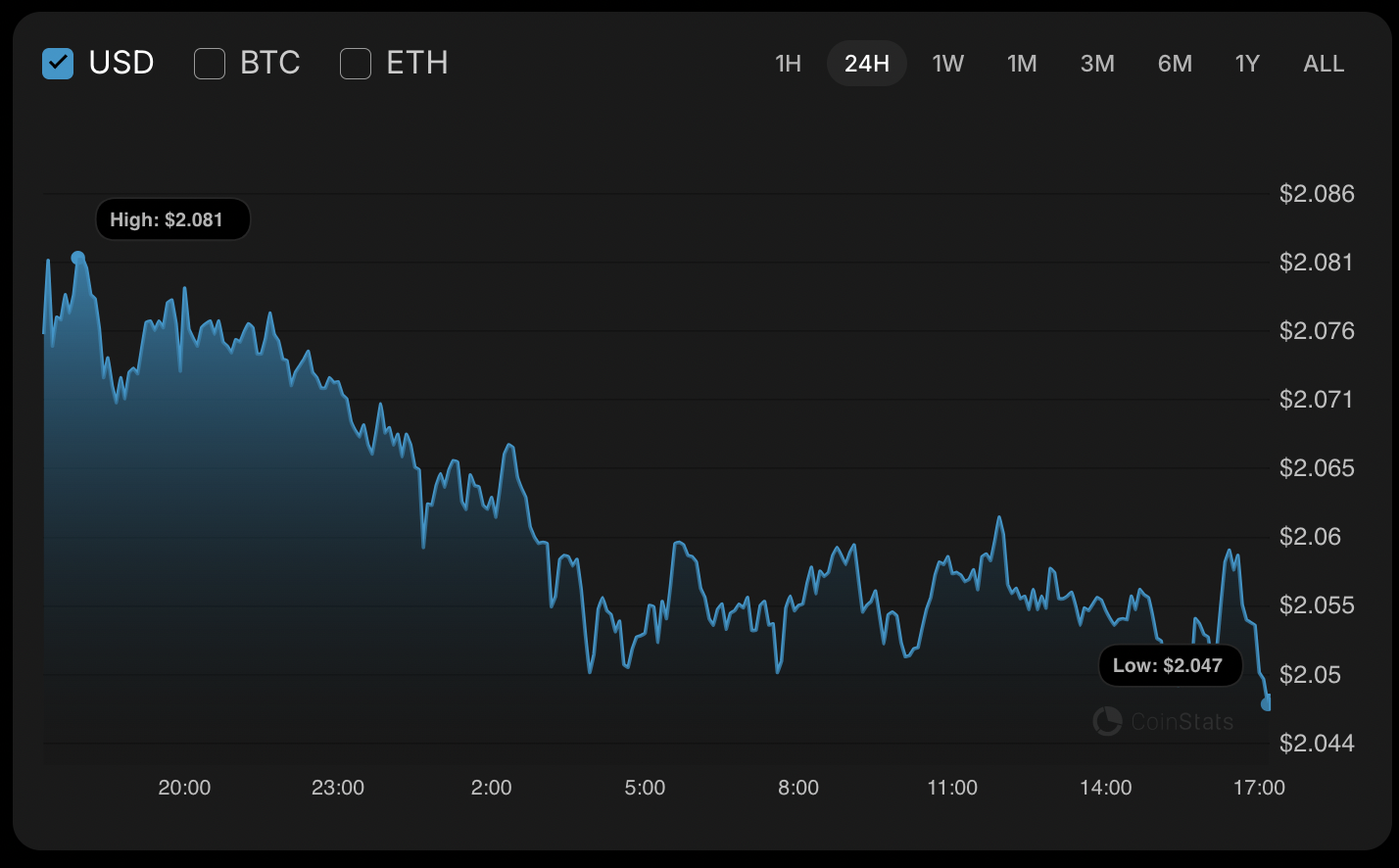

Ethereum’s price, like a Victorian heroine, failed to hold above $3,300 and plunged into the abyss. It descended below $3,280 and $3,250, embracing the bearish zone with the enthusiasm of a man who just realized he’s out of gin.